Vietnam’s General Department of Taxation reported that in 2024, the state budget revenue exceeded VND 1.7 quadrillion, the highest ever. Several revenue streams surpassed the 2023 figures, including taxes from foreign-invested enterprises, which reached over 109%, taxes from the private sector at 119%, and personal income tax close to 116%.

State budget revenue in 2024 reached a record high of over VND 1.7 quadrillion. Photo: Nhu Y

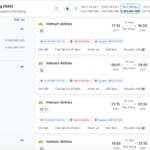

One of the significant growth areas in 2024 was tax revenue from e-commerce, totaling VND 116 trillion, a 20% increase compared to the previous year. So far, 120 foreign suppliers have registered, declared, and paid taxes through the online portal dedicated to foreign suppliers. The tax contribution from these foreign suppliers in 2024 amounted to nearly VND 8.7 trillion, a 26% increase from 2023.

In addition to boosting revenue streams, the tax authorities have been proactive in collecting overdue taxes. In 2024, they recovered over VND 61 trillion in tax arrears, a 33.2% increase compared to the previous year. Notably, the temporary suspension of exit measures resulted in the recovery of nearly VND 4.3 trillion.

Speaking to Tien Phong, Dr. Nguyen Quoc Viet, Vice President of the Institute for Economic and Policy Research, remarked that the state budget revenue of over VND 1.7 quadrillion in 2024 reflects a positive signal for the domestic economy. Dr. Viet was particularly impressed by the increased contribution of various tax sources to the state budget. Notably, the value-added tax (VAT) stood out.

According to Dr. Viet, for three consecutive years, the government reduced the VAT rate by 2% annually, but the contribution of VAT to the total state budget revenue has not decreased but instead increased, especially in 2024. This indicates that domestic consumption has recovered, influenced by factors such as tax postponement, exemption, reduction, and relief policies for individuals and enterprises, which have proven effective. Additionally, sustainable revenue related to corporate income tax has increased significantly. Moreover, revenue from foreign trade, import-export activities, environmental and natural resource taxes, and land-related sources have contributed significantly.

Despite the record-high state budget revenue, the budget expenditure ratio still presents some concerns. Notably, the ratio of recurrent expenditure remains high. Speaking at the recent conference on Tax Work in 2024, Minister of Finance Nguyen Van Thang stated that currently, recurrent expenditure accounts for 70% of the budget, leaving only 30% for development investment, security, and national defense.

Dr. Nguyen Quoc Viet proposed solutions to ensure sustainable revenue and nurture state budget resources. Firstly, authorities must transition the entire informal economy to the formal sector to enable the tax department to ensure fair, accurate, and sufficient tax collection and expand the tax base. Additionally, it is essential to balance tax collection with empowering citizens and businesses.

Furthermore, measures are needed to reduce the burden of personal income tax, harmonizing tax expansion with ensuring accurate and sufficient collection, so that employees can accumulate savings. These savings can then be reinvested in the future, either in assets or through personal income tax, thus creating a sustainable source of revenue.

The Poorest Province Breaks Records in Tourism Revenue, Aiming for Double-Digit GRDP Growth in 2024

The province’s socio-economic development plan for 2024 has yielded numerous positive results, with 16 out of 26 key indicators meeting or exceeding the annual targets. Among these, eight indicators have surpassed their goals. This remarkable performance is a testament to the effective strategies and dedicated efforts that have been driving the province’s progress.

“Beating the Heat, Rain, and Holidays”: Vietnam’s Determined Push for Growth with its 6-Billion-Dollar Expressway and 67-Billion-Dollar Mega Project.

Under Prime Minister Pham Minh Chinh’s leadership, 2024 has been designated as the year to accelerate the development of key transportation projects. This pivotal year will serve as a launching pad for Vietnam’s ascent into an era of prosperity and power.

Unleashing Vietnam’s Potential: Crafting Exceptional Policies for a Regional and Global Financial Hub

The development of a regional and international financial center in Vietnam is of paramount importance and a key political strategy for the new era of national advancement. We must approach this task with a sense of urgency, dedication, and efficiency to ensure the swift establishment of Vietnam as a prominent financial hub on the regional and global stage.