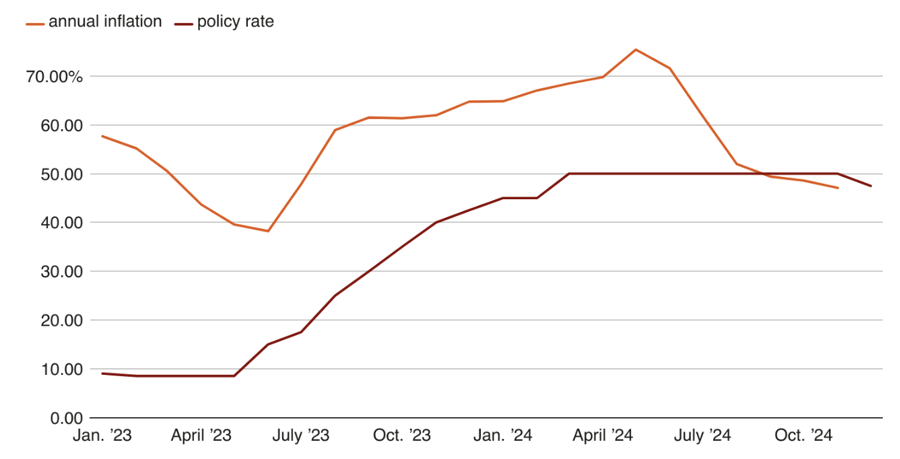

Monetary policymakers in Ankara reduced the benchmark interest rate to 47.5% from the previous 50%, marking the first rate cut since February 2023 – when President Recep Tayyip Erdogan called for lower interest rates to support economic growth in his re-election campaign.

The rate cut by the Central Bank of Turkey on December 26 was larger than the 1.75 percentage point reduction predicted by economists in a Bloomberg survey.

Turkey’s annual inflation rate eased to 47% in November this year, down from a peak of nearly 86% in October 2022. Analysts suggested that the government’s decision last week to raise the minimum wage by 30% next year, a much smaller increase than in previous years, may have given the central bank more leeway to cut rates.

In a statement following the meeting, the Central Bank of Turkey said it had seen some signals of a continued inflation slowdown in December, but affirmed that it had not abandoned its tight monetary policy. “The policy stance will be maintained until a significant fall in the monthly core inflation trend is observed,” the statement read, adding that interest rates would be decided on a meeting-by-meeting basis.

On Wednesday, the Central Bank of Turkey announced that there would be eight meetings to decide on interest rates in 2025, instead of setting interest rates at all 12 regular meetings as usual.

“The Central Bank of Turkey has signaled that they may opt to slow down or pause rate cuts in upcoming meetings,” said Hankan Kara, the former chief economist of the bank, to the Financial Times. He suggested that the smaller-than-expected minimum wage increase had created room for the rate cut.

In a post on social media platform X on Tuesday, President Erdogan announced that the minimum monthly wage for Turkish workers in 2025 would be 22,104 lira ($627). Erdogan’s slower wage increase was well-received by investors as a sign of commitment to curbing consumer demand and inflation. About one-third of Turkish workers earn the minimum wage, and annual adjustments to the minimum wage are used as a benchmark for other wage adjustments.

However, trade unions expressed dissatisfaction with the newly announced wage increase. The leader of the 1.75-million-member Turk-Is union called the increase “unacceptable.”

According to estimates by the Central Bank of Turkey last year, consumer prices in the country rose by 0.07% for every percentage point increase in the minimum wage. Meanwhile, Turk-Is argued that the minimum wage needed to be 20,562 lira for a family of four to escape the hunger threshold.

In the run-up to the 2023 and 2024 elections, Erdogan significantly raised wages and called on the central bank to avoid raising interest rates to gain voter support. But recently, the leader has shifted to more market-friendly policies to attract investors. For many years, foreign investors have been wary of Turkey’s low-interest-rate environment, which goes against traditional economic wisdom in the face of soaring inflation.

The Central Bank of Turkey only began raising interest rates in June 2023 to combat inflation. Until this rate cut, the benchmark rate had increased by a total of 4.15 percentage points.

Analysts suggested that it is now time for the Turkish government to follow through on its promises to cut spending and increase tax revenues to bring down inflation. According to the central bank’s forecasts, the country’s annual inflation rate is expected to fall to 14% next year.

“Essentially, the Central Bank of Turkey is doing its part. Achieving the desired inflation target will only become a reality if fiscal and institutional adjustments continue to be implemented,” said Kara.

Over the past seven years, Turkey’s lira has lost about 90% of its value, falling from 3.8 lira to the dollar to 35.3 lira, severely eroding the income and savings of Turkish citizens.

Low-Interest Rates to Support Production and Holiday Shopping

With the Lunar New Year fast approaching, businesses are bustling with production and inventory preparations to meet the surge in year-end shopping demands. The current low-interest rates offered by lending institutions are expected to further stimulate consumer spending during this peak shopping season.

What Will the Vietnamese Stock Market Look Like in 2025?

The Vietnamese stock market is projected to witness an impressive average liquidity of over 23 trillion VND per session in 2025. Amidst this vibrant liquidity, the VnIndex soared to its highest point, surpassing 1,400 marks, while fluctuating around the 1,341 mark throughout the year.