According to experts at UOB, 2024 has been a challenging year for key global commodities. Brent crude oil peaked at around $90 per barrel in Q2 and has since declined to approximately $75 per barrel. Similarly, copper, another indicator of the global economy’s health, peaked at just under $11,000 per ton in Q2 and fell to $9,000 per ton in December.

BRENT CRUDE OIL AND COPPER PRICES BUFFETED BY GLOBAL ECONOMIC PRESSURES

Heng Koon How, Head of Market Strategy at UOB Singapore’s Group Research and Global Economics, noted that the volatility in Brent crude oil and copper prices signals the increasingly challenging context of the global economy.

For Brent crude oil, the historical correlation between major energy producers has reversed. The Organization of the Petroleum Exporting Countries (OPEC) is finding it increasingly difficult to stabilize oil prices and maintain market share as they cede market share and pricing power to the United States.

UOB’s analysis shows that with a production capacity of approximately 13.5 million barrels per day, the US is now the world’s largest crude oil producer. American energy production surged in the past decade due to initial expansion under the first Trump administration and subsequent expansion under the Biden administration.

“It’s no surprise that the European Central Bank (ECB) has been actively cutting rates, reducing the refinancing rate from 4.5% at the start of 2024 to 3.15% in December. 2025 could be a challenging year for both France and Germany. In particular, the German federal election in February 2025 is likely to cause further economic instability.”

In contrast, Saudi Arabia’s crude oil production is now significantly lower at 9 million barrels per day due to output cut pressures. As a result, the US currently produces roughly 50% more crude oil per day than Saudi Arabia.

With slowing growth from both China and the Eurozone, OPEC has consistently lowered its outlook for global energy demand. Consequently, the threat of oversupply has kept Brent crude oil prices depressed.

“We’ve seen a challenging year for Brent crude oil hovering around the current level of $70 to $75 per barrel. Additionally, we can’t rule out the risk of Brent crude falling below $70 if a second Trump administration significantly increases tariffs on China and the globe in 2025,” predicted Heng Koon How.

Regarding copper prices, UOB experts believe that this commodity has lived up to its nickname, “Dr. Copper,” suggesting that its price movements can predict the health of the global economy. With prices struggling to stay above $9,000 per ton towards the end of 2024, “Dr. Copper” is signaling a continued deterioration in the global economy’s health into 2025.

Notably, copper prices react strongly to concerns about a Chinese economic downturn. As China’s industrial activity remains subdued, copper inventories on major global exchanges have risen. Immediate demand for this commodity also shows signs of weakening.

“Hence, we hold a negative outlook on copper and foresee prices sliding to $7,500 per ton by the end of 2025,” stated Heng Koon How.

In Europe, Heng Koon How pointed out that the growth outlook is becoming increasingly challenging as well. Amid the Russia-Ukraine conflict, countries in the Eurozone now need to spend more to bolster their collective defense capabilities.

“This higher debt situation occurs when the growth of both Germany and France, the twin industrial powerhouses of the Eurozone, is currently near recessionary levels. Specifically, France’s credit rating was recently downgraded due to its worsening political and budgetary crisis,” added Heng Koon How.

GOLD REMAINS A SAFE HAVEN

Despite the bleak short-term outlook for Brent crude oil and copper, UOB experts believe that the mid- to long-term prospects could be entirely different.

For Brent crude oil, future prices are currently stable, and there are no significant signs of abnormal increases, even with ongoing conflicts and geopolitical risks in the Middle East. However, any escalation in the region could reduce crude oil supply and drive prices higher.

Regarding copper, there is a risk of a significant mid-term supply shortage. Reduced output from long-standing copper mines will struggle to meet rising demand, particularly due to the global trend towards green energy and the popularity of electric vehicles.

“Therefore, consumers and businesses related to Brent crude oil and copper may consider taking advantage of the currently low prices to implement a price hedging strategy for future needs,” recommended Heng Koon How.

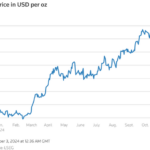

However, one commodity that has benefited significantly from economic and geopolitical instability is gold. In 2024, gold prices surged from $2,000 per ounce in January to approximately $2,600 per ounce currently, an increase of nearly one-third.

In the long term, positive factors remain, including continued accumulation by emerging markets and Asian central banks, along with robust physical and jewelry demand from consumers. The common thread in this increased gold demand is asset diversification to mitigate risks associated with USD instability, especially in light of the volatile economic policies expected in a second Trump term.

“We maintain our optimistic view on gold, as the long-term safe-haven demand will remain robust amid heightened geopolitical and economic risks. We predict gold prices to reach $3,000 per ounce by the end of 2025. In the short term, the strength of the US dollar may cause gold prices to stagnate, but the growth trend will continue into 2025,” concluded the UOB expert.

Is Gold Back on a Bullish Trajectory?

The gold price this morning, December 21st, continued its upward trajectory, buoyed by the downward trend in US Treasury bond yields and the USD exchange rate. The slowdown in inflation in the US has also played a part in this precious metal’s rising value.

The Curious Case of Gold’s Global Price Movement

The gold price hovers tentatively, awaiting a new catalyst to spark action. Investors are cautious ahead of impending U.S. economic data and the Federal Reserve’s interest rate trajectory. With markets holding their breath, all eyes are on the Fed’s next move, as they delicately balance inflation concerns with economic growth. This delicate dance has investors poised, ready to pounce or retreat, depending on the Fed’s forthcoming steps.