Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 590 million shares, equivalent to a value of more than 13.6 trillion VND; HNX-Index reached over 46.9 million shares, equivalent to a value of more than 863 billion VND.

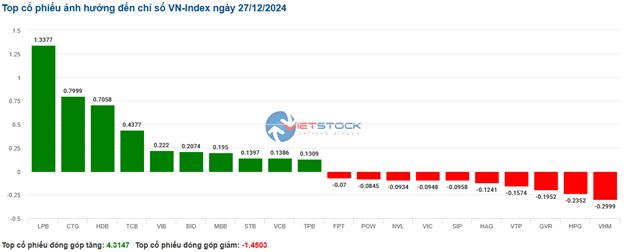

VN-Index continued to fluctuate in the afternoon session, but buyers remained dominant, helping the index stay in the green. In terms of impact, LPB, CTG, HDB, and TCB were the most positive influences on the VN-Index, contributing over 3.2 points. On the other hand, VHM, HPG, GVR, and VTP had the most negative impact, but their influence was not significant.

In contrast, the HNX-Index witnessed a less positive performance, with the index being negatively impacted by VCS (-1.86%), NTP (-1.38%), IDC (-0.53%), and VC7 (-8.4%).

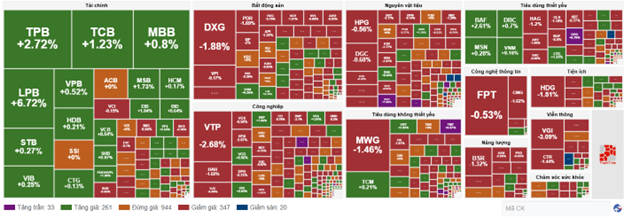

At the close, the market was up 0.18%. The financial sector was the best-performing group, rising 0.76%, led by TPB (+1.21%), VIB (+1.52%), SSI (+0.95%), and MBB (+0.6%). The consumer staples and utilities sectors followed with gains of 0.43% and 0.13%, respectively. On the other hand, the telecommunications sector saw the biggest decline, falling 3.55%, mainly due to VGI (-4.15%), CTR (-1.68%), ELC (-3.41%), and YEG (-6.94%).

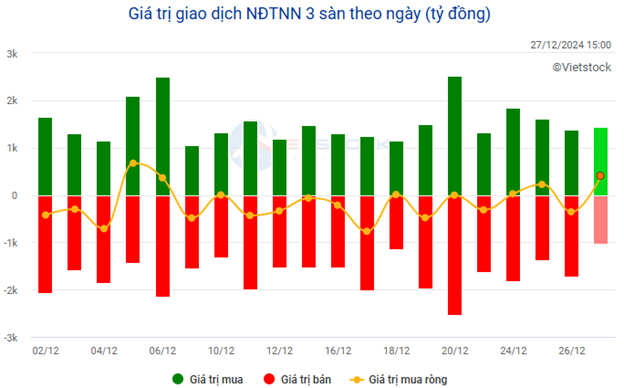

In terms of foreign trading, they net bought over 432 billion VND on the HOSE exchange, focusing on STB (111.45 billion), CTG (87.86 billion), SSI (63.15 billion), and HAX (60.76 billion). On the HNX exchange, foreigners net bought over 36 billion VND, mainly investing in PVS (25.79 billion), MBS (14.61 billion), DHT (13.9 billion), and IDC (3.33 billion).

11:30 AM: Banks maintain the weak green for VN-Index

VN-Index remained in the green throughout the morning session thanks to the “king” stocks, but the picture was less positive elsewhere. From a nearly 5-point gain at the start, the VN-Index rose just 1.25 points at the midday break, settling at 1,274.12. Meanwhile, the HNX-Index fell 0.35% to 229.09. The market breadth was negative, with 401 declining stocks and 261 gainers.

The VN-Index‘s matched volume in the morning session reached nearly 272 million units, equivalent to a value of more than 6.2 trillion VND. The HNX-Index recorded a matched volume of nearly 21 million units, with a value of over 361 billion VND.

The banking group, with its large market capitalization, is supporting the market. 8 out of the 10 most positive influences on the index were from this sector, with LPB, VCB, and BID being the main drivers, contributing about 2 points to the VN-Index. On the other hand, FPT and MWG were the most notable losers, taking away more than half a point from the index.

Most sectors were mixed. Within the financial sector, only banks were in positive territory thanks to strong gains in stocks like LPB (+6.55%), NVB (+2.25%), EIB (+1.82%), TPB (+1.81%), MSB (+1.3%), OCB (+1.38%), and PGB (+1.3%). Meanwhile, insurance and securities stocks traded weakly, with many even experiencing sharp corrections, such as MIG (-1.96%), PVI (-2.35%), PRE (-7.04%), BHI (-8.33%), TCI (-1.79%), and VIG (-1.67%).

On the declining side, telecommunications temporarily “bottomed out,” plunging nearly 3%. This was mainly due to heavy selling in large-cap stocks like VGI (-3.4%), CTR (-1.68%), ELC (-2.87%), VNZ (-1.89%), and FOX (-1.24%). Notably, YEG in this group experienced its second consecutive “limit-down” session. The energy sector also fell over 1% as red dominated, with many stocks trading weakly, such as BSR (-1.76%), PVD (-1.04%), PVB (-2.23%), and AAH (-2.63%).

Some stocks with notable trading volume in the morning session across other sectors include DXG (-0.94%), PDR (-0.96%), SZC (-1.63%); VTP (-3.19%), HAH (-1.53%); BAF (+5.41%), DBC (+0.88%), HAG (-2%), VHC (-1.64%), and ANV (-2.72%); MWG (-1.14%), FRT (-1.03%), and VGT (+2.03%), among others.

Foreigners net sold slightly on the HOSE exchange in the morning session, at nearly 27 billion VND. There were no particularly prominent stocks, and HPG and MWG were the two stocks that foreigners net sold the most, but the value was only about 30 billion VND. On the HNX exchange, foreigners net sold nearly 14 billion VND, focusing on selling TNG.

10:30 AM: Profit-taking pressure appears at the 1,275-point mark

Short-term profit-taking pressure emerged, indicating that investors’ sentiment remained cautious, causing the main indices to shift from a strong upward momentum at the opening to fluctuations around the reference level. As of 10:30 AM, the VN-Index rose slightly by 2.48 points, trading around 1,275 points. The HNX-Index fell 0.88 points, trading around 229 points.

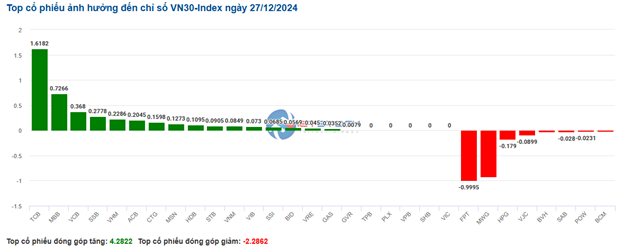

Most stocks in the VN30 basket edged higher as buying pressure prevailed. Specifically, on the buying side, four bank stocks, namely TCB, MBB, VCB, and SSB, contributed 1.61 points, 0.72 points, 0.36 points, and 0.27 points to the index, respectively. Conversely, FPT, MWG, HPG, and VJC faced strong selling pressure, taking away more than two points from the VN30-Index.

Source: VietstockFinance

|

Currently, the financial group remains pivotal in supporting the market’s upward momentum, but the gain is modest at 0.63% due to sector-wide divergence. Within this group, banks continue to attract capital inflows, such as TCB rising 1.44%, MBB up 1.2%, HDB gaining 0.21%, STB climbing 0.27%… The rest of the financial stocks remained flat, including VIB, ACB, HCM, and MSB… while a few names edged slightly lower, like VPB down 0.26%, VCI falling 0.15%, EVF losing 0.31%, and ORS declining 0.35%…

Notably, the LPB stock surged to its daily limit in the morning session of December 27, 2024, with trading volume exceeding its 20-session average, indicating a revival of trading activity. Moreover, the stock successfully broke through the upper boundary of the Rising Wedge pattern, and the MACD indicator signaled a buy opportunity, further reinforcing the upward momentum. If this positive trend persists, the potential price target in the medium term could be the range of 35,000-36,000.

Source: https://stockchart.vietstock.vn/

|

In contrast, the telecommunications group faced substantial selling pressure, posting the most significant decline in the market of 1.58%. Specifically, selling pressure concentrated on large-cap stocks such as VGI falling 3.09%, CTR dropping 1.36%, ELC slipping 1.79%, and MFS decreasing 1.52%…

The YEG stock witnessed another down session. Technically, the strong uptrend in the medium term remains intact for YEG. However, in recent sessions, trading volume has been erratic, reflecting investors’ unstable sentiment in the short term. Additionally, the Stochastic Oscillator indicator has signaled a sell opportunity in the overbought zone. If the indicator falls into this zone in the coming sessions, the risk of a downward correction will increase.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, selling pressure continued to increase, and the market breadth tilted towards the negative side, with 347 declining stocks versus 261 gainers.

Source: VietstockFinance

|

Opening: Financial stocks shine from the beginning

At the start of the December 27 session, as of 9:30 AM, the VN-Index climbed notably by over four points to reach 1,277.65. Meanwhile, the HNX-Index also edged higher, attaining 230 points.

The green temporarily dominated the VN30 basket, with 20 gainers, five losers, and five stocks trading flat. Among them, MBB, TPB, CTG, and TCB were the top-performing stocks. Conversely, BCM, FPT, and MWG led the declining side.

As of 9:30 AM, financial stocks led the market with a 0.79% gain. Notably, stocks like ACB rose 0.39%, TCB climbed 1.44%, MBB advanced 1.41%, LPB jumped 2.24%, and CTG gained 0.79%,…

Following closely was the utilities sector, which rose nearly 0.5%, also contributing to the market’s positive performance. Specifically, prominent stocks in this sector included POW, which increased by 0.41%, GAS up by 0.58%, NT2 climbing 0.24%, and DDG surging 6.67%,…

– 09:30 27/12/2024

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.

The Market Beat: A Tale of Diverging Fortunes

The market closed with the VN-Index down 3.12 points (-0.24%) to 1,272.02, and the HNX-Index fell 0.99 points (-0.43%) to 228.14. The market breadth tilted towards decliners with 436 losers and 274 gainers. Notably, 20 stocks in the VN30 basket ended in negative territory, with 6 advancing and 4 unchanged.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.

The Power of Positive Thinking

The VN-Index surged and retested its old peak in early December 2024 (around the 1,270-1,280 points region). If, in the upcoming sessions, the index surpasses this threshold alongside maintaining trading volume above the 20-day average, the uptrend will be reinforced. Notably, the MACD indicator has already signaled a buy opportunity by crossing above the signal line. If the Stochastic Oscillator also flashes a similar signal in the forthcoming sessions, the outlook will turn even more optimistic.