The market experienced its second consecutive flat day following the strong gains on December 25th. The holding power of bank stocks helped stabilize the index, while small and medium-sized stocks continued to see strong selling pressure. This rotation of capital is likely to conclude by the year’s end, paving the way for new expectations in January 2025.

This pause is normal, as after a session of expanding the range, momentum will find it challenging to persist and will need to stabilize. In reality, all explosive sessions are highly emotional and impulsive, making it difficult to sustain such behavior continuously. However, if we endure these testing sessions and the sentiment remains positive, the upward trajectory will eventually resume.

Average trading volume for the week on the two exchanges increased by nearly 16%, reaching approximately VND 13.4 trillion per session, excluding large negotiated trades. This is not a significant trading volume, but looking at the past three weeks, liquidity is on the rise. In individual sessions, low liquidity was observed during corrective periods, while high liquidity was present during volatile sessions. This indicates periodic inflows of capital. Even if strong and continuous momentum is not maintained, at the very least, the money that has entered the market will continue to circulate.

Technically, the VNI is near the short-term peak from early December and has escaped the recent corrective phase. If the index surpasses this peak, the likelihood of advancing to 1300 is high. In terms of trend, a higher low has been established around the 1250-1260 range, thus preserving the upward trajectory.

Of course, the index does not reflect all specific opportunities. The market is witnessing a rotation of capital, setting the stage for the early months of 2025 as the earnings season approaches. In reality, it is already possible to speculate on profit figures, as this type of information cannot remain confidential. Therefore, from a psychological perspective, there will be capital moving ahead of time. Looking ahead to January, there are likely to be fewer unfavorable developments, while expectations may be “suspended.” As a result, the likelihood of the market rising rather than falling is higher. This is especially true for individual stocks, even if the index may be influenced by large-cap stocks. Therefore, the most crucial step at this juncture is to construct a solid portfolio and patiently wait.

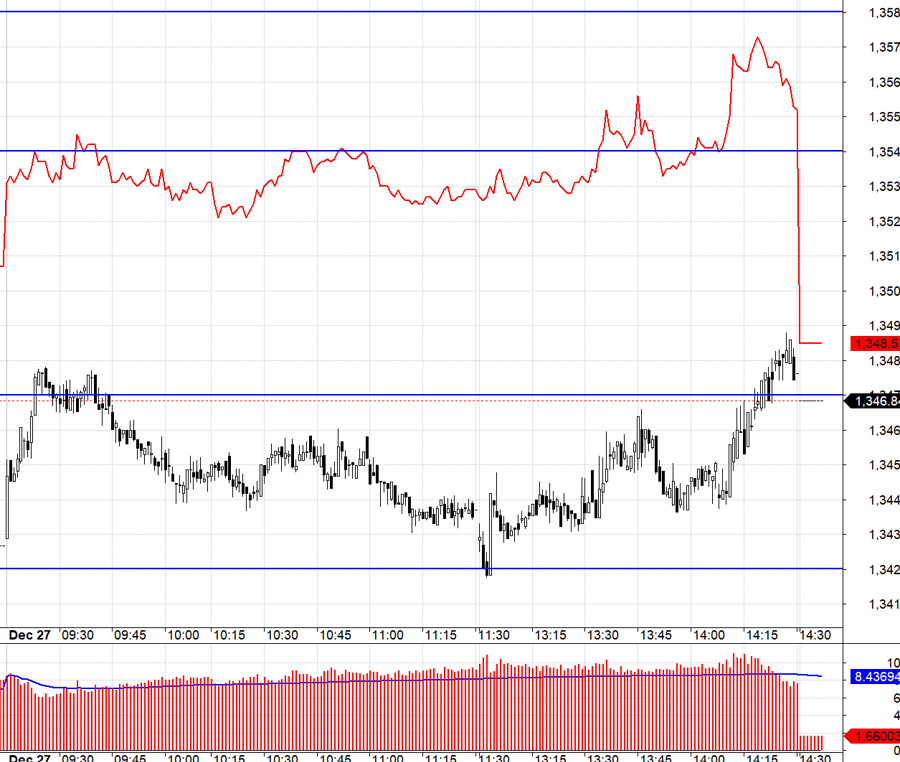

Today’s derivatives market reflected very high expectations for the underlying with a wide basis for the F1. If we exclude the ATC session, the average basis was nearly 9 points. This disparity makes trading challenging because going long requires accepting excessively high risk, while shorting entails waiting for the “luck” of the basis narrowing.

During the session, the VN30 fluctuated within a standard range of 1342.xx to 1347.xx, but with low efficiency. At the start of the session, the VN30 slid from 1347.xx to 1342.xx, clearly favoring shorts with a basis advantage of over 7 points. Even when the VN30 fell to 1342, the F1 exhibited minimal movement, and the basis continued to widen. Conversely, when the VN30 rose from 1342.xx, the basis exceeded 10 points, making it challenging for longs to enter, despite the F1’s increase. However, this setup did not meet the criteria.

Next week, the market will be closed for one day, and the outlook for an increase remains more favorable than a decline. Currently, there are no adverse developments for investors to worry about, at least until the end of January. The strategy remains to hold stocks, employ a dynamic long/short approach with derivatives, and pay close attention to the basis.

The VN30 closed today at 1346.84. The nearest resistance levels for the next session are 1347, 1354, 1358, 1363, 1368, 1374, and 1381. Support levels are 1342, 1337, 1333, 1322, and 1315.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments presented are those of the individual investor, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives published.

The Psychology of Rest Dominates, Liquidity Plunges

“Investor sentiment was muted in the final days of the 2024 financial year. Foreign investors’ trading activities hit a record low in the morning session, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.”

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.