Stock Market Review for Week of December 23-27, 2024

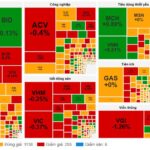

For the week of December 23-27, 2024, the VN-Index had a positive trading week after rising above the Middle Bollinger Band while staying above the 50-week SMA.

However, trading volume has remained below the 20-week average since November 2024, indicating a lack of active participation from investors. If the upcoming sessions see improved liquidity, the index could target the October 2024 peak, which corresponds to the 1,285-1,300 point range.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – ADX yet to show signs of recovery

On December 27, 2024, the VN-Index slightly increased, while trading volume fluctuated erratically in recent sessions, indicating investors’ unstable psychology.

Currently, the index remains above the Middle Bollinger Band, and the MACD indicator continues to rise, giving a positive signal, suggesting a positive short-term outlook.

However, the ADX indicator remains weak and below 20, suggesting that the current trend may lack strength. It is likely that a sideways trend with volatile sessions will persist in the near term.

HNX-Index – Bollinger Bands continue to narrow

On December 27, 2024, the HNX-Index declined and formed a candle pattern resembling a Spinning Top. It is currently testing the 100-day SMA, with volume below the 20-session average, indicating investors’ cautious sentiment.

Additionally, Bollinger Bands are narrowing (Bollinger Squeeze), while the ADX remains below 20, suggesting a weak trend. Therefore, a sideways trend with alternating positive and negative sessions is likely to continue.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index of the VN-Index crossed above the 20-day EMA. If this status persists in the next session, the risk of an unexpected downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors returned to net buying on December 27, 2024. If this trend continues, the outlook will become more optimistic.

Vietstock Consulting Analysis Team

– 16:58 29/12/2024

The Market Beat on December 24th: Strong Inflows in the Afternoon Session See VN-Index Recover to Near Reference.

Despite a negative mid-session turn, the market recovered to close near reference levels today. The VN-Index ended at 1,260 points, a minor loss of 2.4 points, while the HNX-Index dipped 0.15 points to 228.36 points.

Vietstock Daily: Is the Short-Term Outlook Not Too Gloomy?

The VN-Index witnessed a slight dip as trading volumes fell below the 20-day average, indicating a cautious investor sentiment following a strong previous rally. However, a key technical indicator, the MACD, has turned positive, crossing above the Signal Line, and the Stochastic Oscillator is also flashing a similar signal. Should this status quo persist in the upcoming sessions, the outlook may not be as pessimistic as some might believe.

The Market Pulse: Is the Risk of Adjustment Rising?

The VN-Index witnessed a significant decline, forming a bearish Falling Window candlestick pattern and dipping below the Middle Bollinger Band. This suggests a potential shift in market sentiment. The volume also spiked above the 20-day average, indicating heightened investor anxiety. The Stochastic Oscillator is firmly in oversold territory and continues to signal a sell-off. If the MACD also turns bearish in the coming days, the likelihood of a more pronounced correction will increase.