The positive turn of events last week and VN-Index’s swift return to its mid-December peak are considered positive signs, reinforcing the upward trend since mid-November and promising another test of the 1,300-point threshold.

The market’s focus last week was on the trading session of December 25th, which not only erased the impact of the rather shocking fluctuation on December 19th but also attracted stronger capital inflows, pushing the VN-Index back to its previous peak. Experts believe that before the occurrence of the declining session on December 19th, the market had undergone a constructive consolidation phase with very low selling pressure. The session of December 19th was also solely influenced by external factors, and the Vietnamese market swiftly regained its equilibrium. Hence, the robust increase on December 25th contributed to confirming the continuing trend.

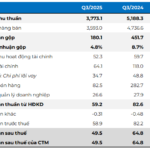

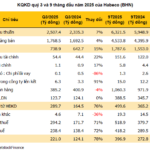

The leadership of fundamentally solid stocks, notably banks last week, indicated the resumption of the upward momentum. Currently, capital flows are showing signs of shifting back to fundamentally solid stocks, aligning with the timing as the season for reporting fourth-quarter and full-year 2024 profits approaches. Although the year-end rallies are often associated with NAV-pulling, the “January effect” with a series of supportive fundamental information also tends to occur.

Regarding speculative stocks, experts believe that capital is quietly exiting this group, and sooner or later, supply will exhibit clearer signals. As the earnings season draws near, fundamental factors will garner more attention. On the other hand, as there are no current risks, investors should restructure their portfolios and maintain a high proportion of stocks.

– Nguyễn Hoàng – VnEconomy

The “Christmas rally” last week was not exceptionally robust but managed to erase the fluctuation of the sharp decline on December 19th and bring the VN-Index back to the short-term peak at the beginning of the month. The highlight was the trading session on December 25th, which witnessed impressive figures in terms of both points and capital flows. The question arises: Is this merely a short-term development influenced by the NAV-pulling effect, or is the market resuming its upward trajectory since mid-November?

Mr. Nghiêm Sỹ Tiến – Investment Strategy Executive, KBSV Securities

Mid and small-cap stocks are currently facing selling pressure with a wider range of fluctuations, but blue-chip stocks continue to maintain stable demand and act as a market anchor. This somewhat reflects investors’ expectations of better fourth-quarter performance, especially for leading stocks in their respective sectors.

Mrs. Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

Last week, the market witnessed a strong rebound from the 1240-1260 support zone, with capital mainly flowing into the banking group. This week’s increase erased the losses of the previous two weeks, signaling the end of the correction phase.

I believe this indicates the market’s return to the upward trend since mid-November, as the recent correction did not break the trend. The NAV-pulling effect or the Christmas rally might have played a partial role in this rally. I anticipate that after these events, the market may experience another brief correction, and if selling pressure remains subdued, there will be an opportunity to continue the upward trajectory to conquer the 1,300-point level.

Mr. Lê Đức Khánh – Analysis Director, VPS Securities

The market is continuing its upward trajectory from the end of November, with the trading session on December 25th being crucial in reconfirming the market’s entry into an upward trend from now until January. I think the VN-Index will soon return to the 1,280 – 1,300-point zone in January.

Mr. Nguyễn Huy Phương – Senior Head of Analysis Center, Dragon Vietnam Securities

In my opinion, the market’s sharp decline on December 19th resulted from objective factors, such as the substantial drop in global stock markets and the significant rise in the DXY index. Essentially, the market before December 19th remained relatively stable, with low selling pressure and sustained support from the 1,260-point zone.

After several supportive sessions from December 19th to December 24th, the market regained the 1,260 – 1,265-point support zone and officially returned to the upward trajectory during the explosive session on December 25th. The market’s upward momentum could be attributed to the year-end NAV-pulling effect, but it also represents the expansion of the short-term upward trend since mid-November, with the focal point being the explosive session on December 5th.

– Nguyễn Hoàng – VnEconomy

Liquidity remains a limiting factor in the market’s positive performance last week, except for the session on December 25th, which witnessed relatively low trading volumes. In previous discussions, you also didn’t anticipate improved liquidity towards the year’s end. However, this is also the time when early indications of the fourth-quarter and full-year 2024 financial results are unveiled. Have you noticed any early accumulation or capital flow shifts in anticipation of the most critical financial reporting season?

Mr. Lê Đức Khánh – Analysis Director, VPS Securities

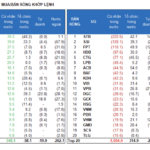

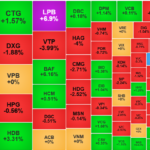

I’ve observed that the leading and pivotal stocks continue to attract robust buying demand, accompanied by high liquidity. Banks remain prominent, with certain stocks recording price increases or even surpassing accumulation and new peaks, such as TCB, STB, and LPB. Although the securities group hasn’t witnessed a price surge, it has registered positive accumulation with increasing buying demand. In my perspective, capital will soon shift towards fundamentally solid stocks, including financial, chemical, basic resources, and port sectors – a wave of capital riding on the anticipation of financial results and the potential emergence of the “January effect” in early 2025.

Mrs. Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

It’s typical for market liquidity to diminish towards the year’s end and during the Tet holiday season. However, this doesn’t imply a lack of trading opportunities during this period. Sectors anticipated to report positive fourth-quarter profits, coupled with robust technical charts, are likely to attract capital. I notice that capital is already showing signs of shifting towards these sectors, most evidently in the banking group. Additionally, investors can consider construction, aviation, electricity, and retail sectors.

Mr. Nguyễn Huy Phương – Senior Head of Analysis Center, Dragon Vietnam Securities

I understand that liquidity hasn’t significantly improved, except for the session on December 25th. This is a delayed and somewhat cautious response from investors as the market rises and approaches the 1,280 – 1,300-point zone, an area associated with short-term distribution in the past.

Currently, as risks remain unclear, investors can still anticipate market support in the upcoming period. Consequently, capital continues to circulate and seek short-term opportunities, including expectations of positive fourth-quarter results for certain stocks, notably banks. However, it’s still premature to conclude that the market is accumulating. We need to await further signals within the 1,280 – 1,300-point zone to make a more informed assessment.

Mr. Nghiêm Sỹ Tiến – Investment Strategy Executive, KBSV Securities

The performance of the VN-Index last week indicates a shift in capital flows towards large-cap stocks. Generally, mid and small-cap stocks are facing selling pressure with a wider range of fluctuations, but blue-chip stocks maintain stable demand and serve as a market anchor. This somewhat reflects investors’ expectations of better fourth-quarter performance, especially for leading stocks in their respective sectors.

– Nguyễn Hoàng – VnEconomy

Small-cap and speculative stocks witnessed substantial increases last week but weakened towards the end. During the six consecutive positive sessions, many stocks delivered impressive profits. In your opinion, should investors take profits now?

Mrs. Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

Sectors anticipated to report positive fourth-quarter profits, coupled with robust technical charts, are likely to attract capital. I notice that capital is already showing signs of shifting towards these sectors, most evidently in the banking group. Additionally, investors can consider construction, aviation, electricity, and retail sectors.

Mr. Nguyễn Huy Phương – Senior Head of Analysis Center, Dragon Vietnam Securities

Small-cap and speculative stocks displayed positive dynamics at the beginning of last week, benefiting from the pervasiveness of green signals among mid and small-cap stocks previously, while the momentum of large-cap stocks at that time was rather lackluster and ambiguous. However, the explosive session on December 25th disrupted capital flows, favoring large-cap stocks, particularly banks. Consequently, speculative stocks underwent profit-taking and weakened towards the week’s end.

In the current market context, when stocks surge rapidly towards resistance zones, investors should proactively take profits, especially in speculative stocks, to seek alternative opportunities.

Mr. Lê Đức Khánh – Analysis Director, VPS Securities

I think it’s prudent to adopt a flexible trading strategy and take profits when stocks reach or surpass short-term targets. In many cases, if a stock has been held for an extended period but experiences a rapid increase in a short period, it’s necessary to adjust the proportion or realize gains. Investors tend to hold diverse portfolios, so it’s crucial to be mindful of and control the number of stocks in their possession.

Mrs. Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

With capital flows showing signs of reverting to large-cap stocks, particularly banks, small and mid-cap stocks may encounter a turbulent phase as capital is withdrawn from these groups. Therefore, investors should consider selling if they are in profit or facing selling pressure near resistance zones.

Mr. Nghiêm Sỹ Tiến – Investment Strategy Executive, KBSV Securities

In my view, investors can take profits or reduce their holdings in mid and small-cap stocks, transferring a portion of their investments to large-cap stocks, as last week witnessed signs of increasing capital inflows into blue-chip stocks. This could be a relatively positive signal, as the index is supported by the VN30 group.

– Nguyễn Hoàng – VnEconomy

Last week, many of you refrained from bottom-fishing and awaited signals around the 1,260-point threshold. Is the rally this week convincing enough? Have you increased your stock holdings, and what is your current allocation?

Mr. Lê Đức Khánh – Analysis Director, VPS Securities

Regarding stock allocation, I believe it’s advisable to maintain a high proportion, ideally in carefully selected stocks with solid fundamentals and promising price dynamics. If you hold a diverse portfolio with many stocks that don’t align with the market’s “civilization,” it’s better to be cautious and limit your purchases while awaiting opportunities to restructure your portfolio. Stock allocation can range from 70% to 80% or higher at this juncture.

Mrs. Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

I assess the market’s performance this week as positive, providing sufficient confirmation of a short-term bottom around 1,250 points and a resumption of the upward trend. Consequently, I increased my stock holdings in the first half of the week. My current stock allocation is relatively high. I anticipate that the market may undergo another brief correction at the 1,285 – 1,300-point resistance zone. If positive signals emerge, I will consider full investment with the expectation of conquering the 1,300-point level in this bullish wave.

Mr. Nguyễn Huy Phương – Senior Head of Analysis Center, Dragon Vietnam Securities

Despite the sharp decline on December 19th, the overall market hasn’t exhibited substantial risks, as selling pressure remained low before and after that date. Therefore, the potential for market participation, anticipating the expansion of the upward trend, remains viable, especially after the rebalancing around the 1,260-point zone at the beginning of last week.

My perspective is to continue purchasing stocks that display positive signals from their accumulation zones until the market manifests specific risks or distribution signals. Accordingly, I have gradually increased my portfolio allocation over time, with my current stock allocation at approximately 80%. I will proactively reduce my holdings if the market encounters risks or specific distribution signals.

Mr. Nghiêm Sỹ Tiến – Investment Strategy Executive, KBSV Securities

I augmented my stock holdings to 80% as the index retreated to the nearby support zone of around 1,260 points. Overall, the short-term upward trend remains intact, and the positive session last week further reinforced this trajectory.

The positive turn of events last week and VN-Index’s swift return to its mid-December peak are considered positive signs, reinforcing the upward trend since mid-November and promising another test of the 1,300-point threshold.

The market’s focus last week was on the trading session of December 25th, which not only erased the impact of the rather shocking fluctuation on December 19th but also attracted stronger capital inflows, pushing the VN-Index back to its previous peak. Experts believe that before the occurrence of the declining session on December 19th, the market had undergone a constructive consolidation phase with very low selling pressure. The session of December 19th was also solely influenced by external factors, and the Vietnamese market swiftly regained its equilibrium. Hence, the robust increase on December 25th contributed to confirming the continuing trend.

The leadership of fundamentally solid stocks, notably banks last week, indicated the resumption of the upward momentum. Currently, capital flows are showing signs of shifting back to fundamentally solid stocks, aligning with the timing as the season for reporting fourth-quarter and full-year 2024 profits approaches. Although the year-end rallies are often associated with NAV-pulling, the “January effect” with a series of supportive fundamental information also tends to occur.

Regarding speculative stocks, experts believe that capital is quietly exiting this group, and sooner or later, supply will exhibit clearer signals. As the earnings season draws near, fundamental factors will garner more attention. On the other hand, as there are no current risks, investors should restructure their portfolios and maintain a high proportion of stocks.

Nguyễn Hoàng – VnEconomy

The “Christmas rally” last week was not exceptionally robust but managed to erase the fluctuation of the sharp decline on December 19th and bring the VN-Index back to the short-term peak at the beginning of the month. The highlight was the trading session on December 25th, which witnessed impressive figures in terms of both points and capital flows. The question arises: Is this merely a short-term development influenced by the NAV-pulling effect, or is the market resuming its upward trajectory since mid-November?

Mid and small-cap stocks are currently facing selling pressure with a wider range of fluctuations, but blue-chip stocks continue to maintain stable demand and act as a market anchor. This somewhat reflects investors’ expectations of better fourth-quarter performance, especially for leading stocks in their respective sectors.

Mr. Nghiêm Sỹ Tiến

Mr. Nghiêm Sỹ Tiến – Investment Strategy Executive, KBSV Securities

Despite the sharp decline on December 19th, the overall market hasn’t exhibited substantial risks, as selling pressure remained low before and after that date. Consequently, the potential for market participation, anticipating the expansion of the upward trend, remains viable, especially after the rebalancing around the 1,260-point zone at the beginning of last week.

My perspective is to continue purchasing stocks that display positive signals from their accumulation zones until the market manifests specific risks or distribution signals. Accordingly, I have gradually increased my portfolio allocation over time, with my current stock allocation at approximately 80%. I will proactively reduce my holdings if the market encounters risks or specific distribution signals.

Mrs. Nguyễn Thị Mỹ Liên – Head of Analysis, Phu Hung Securities JSC

Last week, the market witnessed a strong rebound from the 1240-1260 support zone, with capital mainly flowing into the banking group. This week’s increase erased the losses of the previous two weeks, signaling the end of the correction phase.

I believe this indicates the market’s return to the upward trend since mid-November, as the recent correction did not break the trend. The NAV-pulling effect or the Christmas rally might have played a partial role in this rally. I anticipate that after these events, the market may experience another brief correction at the 1,285 – 1,300-point resistance zone, if selling pressure remains subdued, there will be an opportunity to continue the upward trajectory to conquer the 1,300-point level.

Mr. Lê Đức Khánh – Analysis Director, VPS Securities

The market is continuing its upward trajectory from the end of November, with the trading session on December 25th being crucial in reconfirming the market’s entry into an upward trend from now until January. I think the VN-Index will soon return to the 1,280 – 1,300-point zone in January.

Stock Market Outlook for Week of December 9-13, 2024: Short-Term Correction Pressure

The VN-Index had a lackluster performance last week, declining in 4 out of the last 5 trading sessions. Moreover, the trading volume remained below the 20-day average, indicating a shift towards cautious sentiment among investors. Adding to this, the return of net selling by foreign investors suggests that the short-term outlook for the market remains risky.

The Stock Market Sell-Off: A Whopping 1,756.1 Billion VND Net Selling by Individual Investors

The market is buzzing with liquidity as banks take the lead. Today’s trading volume across all three exchanges reached an impressive 19,000 billion VND, with foreign investors making a remarkable turnaround. They net bought an outstanding 738.1 billion VND, and their matched orders alone accounted for 588.2 billion VND in net purchases. It’s a clear sign of confidence in the market, and we can expect some exciting movements in the coming days.

The Psychology of Rest Dominates, Liquidity Plunges

Investor sentiment was muted in the final days of the 2024 financial year. This morning’s trading activity by foreign investors hit a record low, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.