The HOSE-Index, VNX-Index, and investment indices, including VNDiamond, VNFin Lead, and VNFIN Select, are set to undergo portfolio restructuring in the upcoming period.

During this period, the capitalization indices and industry indices of the HOSE-Index, including the VN30 and VNFIN Lead indices, will undergo basket changes with alterations in their constituents. Meanwhile, the VNDiamond, VNFIN Select, and VNX-Index families will only update data and recalculate portfolio weights.

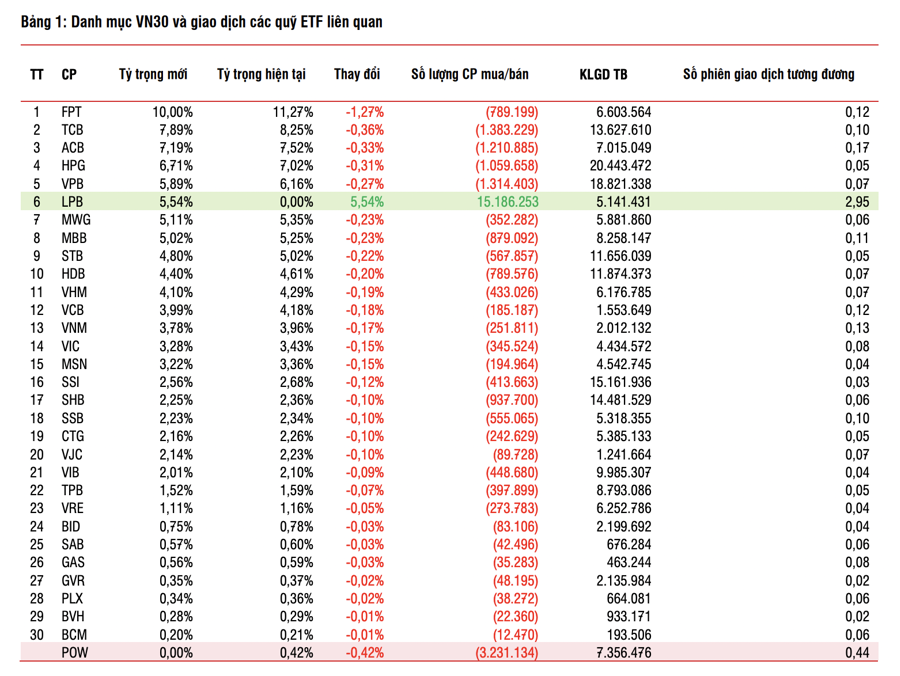

Based on the closing data as of December 25, 2024, SSI Research provides a forecast of the indices’ portfolios. For the VN30 index, LPB may be added this period as it has met the required conditions. POW may be removed from the index as it is no longer among the Top 30 stocks by market capitalization.

SSI Research is applying the Rules for Construction and Management of the HOSE Index, version 3.1 (link). If LPB is added to the index this period, the capitalization ratio of the Banking group will stand at 55%.

Among the ETFs in the market, four are currently using the VN30 index as a reference: DCVFMVN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF, and MAFM VN30 ETF. Their combined assets are estimated at VND 9,380 billion as of December 25, 2024. Specifically, the DCVFMVN30 fund alone has total assets of approximately VND 6,830 billion as of the same date. In detail, the fund’s total assets have decreased by 9.6% compared to the beginning of 2024, while its NAV has increased by 18.5%. However, the fund has experienced net outflows of VND 2,120 billion since the beginning of the year.

The fund is estimated to buy 15.1 million LPB shares and sell all 3.23 million POW shares. The remaining stocks will also be sold, with no additional purchases, including TCB selling 1.38 million shares, ACB selling 1.2 million shares, VPB selling 1.3 million shares, and HPG selling 1 million shares.

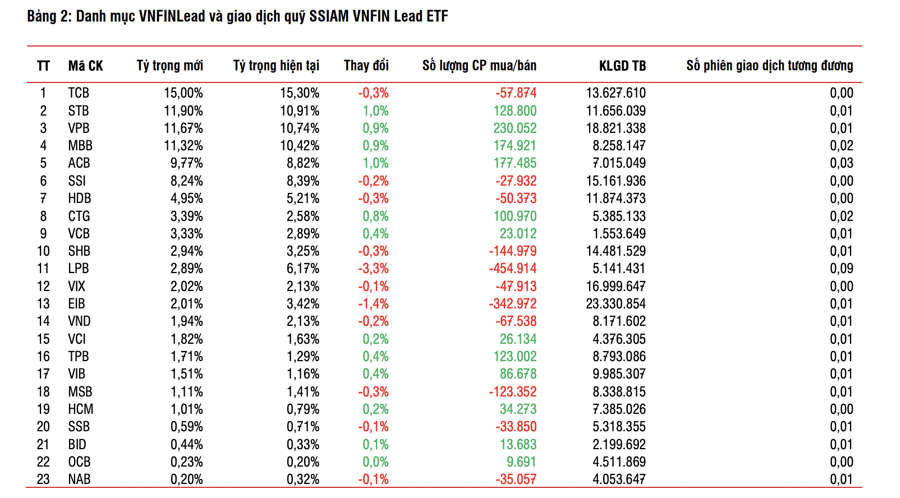

Based on the updated data as of December 25, 2024, SSI Research forecasts no changes in the VNFIN Lead index’s portfolio. The SSIAM VNFIN Lead ETF has total assets of approximately VND 475 billion. Specifically, the fund’s total assets have decreased by 79.4% compared to the beginning of 2024, while its NAV has increased by 16%. The fund has experienced net outflows of VND 2,110 billion since the beginning of the year.

The stocks to be purchased include STB, VPB, MBB, ACB, and TPB, with volumes ranging from 100,000 to 200,000 shares. Conversely, the remaining stocks will be sold off in insignificant quantities.

Previously, DSC Securities also forecasted that LPB stock would qualify for inclusion in the VN30 index as it ranked among the Top 20 stocks by market capitalization, implying that POW stock risks being excluded from the VN30 index.

It is estimated that ETFs will significantly buy LPB (15.1 million shares), STB (1.6 million shares), and MSN (1.4 million shares) and sell POW (3.1 million shares), VPB (1.1 million shares), and FPT (729,000 shares) during this review.

Conversely, stocks that will be sold include POW, with a total of 3.18 million shares sold, VPB with 1.11 million shares sold, and FPT, VHM, and ACB, with more than 700,000 shares sold each. Most stocks in the index’s portfolio will be sold to reduce their ratios.

What Stocks Will the VNM ETF and FTSE ETF Seek in the 4th Quarter Restructuring of 2024?

The VTP stock is anticipated to be included in two stock index baskets: the FTSE Vietnam Index and the MarketVector Vietnam Local. This inclusion is expected to boost the stock’s visibility and liquidity, attracting more investors and potentially leading to increased trading volume and enhanced market presence. With this development, the VTP stock is poised to gain traction and prominence in the Vietnamese market and beyond.

The Great ETF Exodus: $2.2 Trillion Outflows in 7 Weeks

For the seventh consecutive week, outflows from ETF funds continued, totaling over VND 2,200 billion. The outflows were predominantly from the VFM VNDiamond ETF fund.