The VN-Index closed last week’s trading session at 1,275.14 points, a rise of 17.64 points or 1.4% from the previous week. The average trading value per session, excluding auction transactions, increased by 18% to 12,423 billion VND.

Across the three exchanges, the average trading value per session for the week was 17,708 billion VND. The average matched order trading value was 14,155 billion VND, an increase of 18.4% from the previous week and 9.6% from the 5-week average.

In terms of sectors, the improvement in liquidity was concentrated in Banking and several small-scale industries (in terms of both market capitalization and trading value) such as Construction, Chemicals, Mining, Building Materials, Beer, and Wood. For Banking, the average trading value increased by 61% last week, supporting a strong price index increase (+2.7%). This sector was also net bought by institutional investors last week.

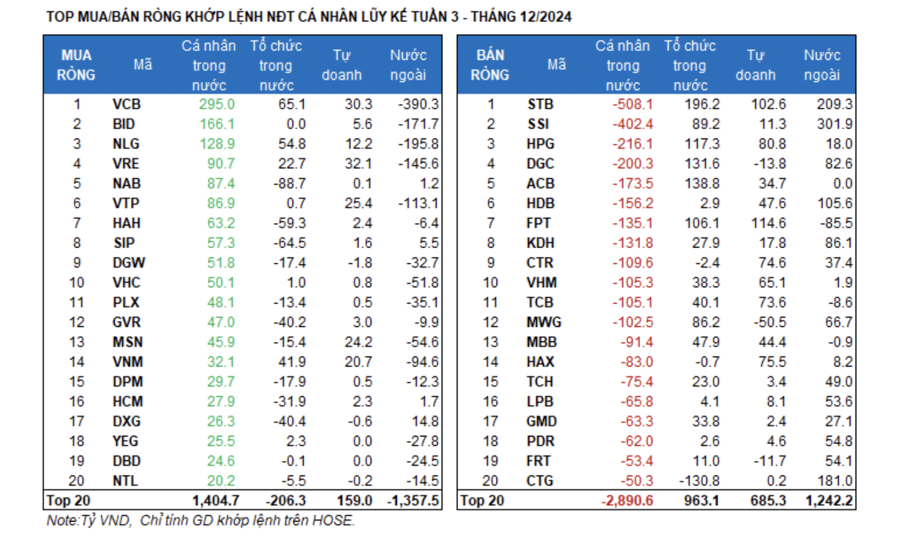

Foreign investors bought a net amount of 266.7 billion VND, with a net purchase of 244.4 billion VND in matched orders. Their main net purchase sectors were Financial Services and Retail. The top net purchased stocks by foreign investors were: SSI, STB, CTG, HDB, KDH, DGC, MWG, PDR, FRT, and LPB.

On the selling side, foreign investors net sold Food and Beverage stocks in matched orders. The top net sold stocks were: VCB, NLG, BID, VRE, VTP, FPT, MSN, VHC, and PLX.

Individual investors net sold 2,594.7 billion VND, including 2,194.5 billion VND in net selling of matched orders. In terms of matched orders, they net bought 5/18 sectors, mainly in Industrial Goods & Services. Their top net purchases included: VCB, BID, NLG, VRE, NAB, VTP, HAH, SIP, DGW, and VHC.

On the net selling side: they net sold 13/18 sectors, mainly in Banking and Financial Services. The top net sold stocks included: STB, SSI, HPG, DGC, ACB, HDB, KDH, CTR, and VHM.

Individual investors net sold 2,594.7 billion VND, including 2,194.5 billion VND in net selling of matched orders.

In terms of matched orders, they net bought 5/18 sectors, mainly in Industrial Goods & Services. Their top net purchases included: VCB, BID, NLG, VRE, NAB, VTP, HAH, SIP, DGW, and VHC.

On the net selling side: they net sold 13/18 sectors, mainly in Banking and Financial Services. The top net sold stocks included: STB, SSI, HPG, DGC, ACB, HDB, KDH, CTR, and VHM.

Proprietary trading bought a net amount of 2,636.7 billion VND, with a net purchase of 1,024.8 billion VND in matched orders.

In terms of matched orders, proprietary trading net bought 14/18 sectors. The top net purchased sectors were Banking and Real Estate. The top net purchased stocks by proprietary trading this week included: FPT, STB, HPG, HAX, CTR, TCB, DBC, VHM, HDB, and MBB.

The top net sold sector was Retail. The top net sold stocks included: FUEMAV30, MWG, VIB, DGC, FRT, HSG, SCS, VPB, BMI, and CII.

Domestic institutional investors net sold 308.7 billion VND, with a net purchase of 925.4 billion VND in matched orders.

In terms of matched orders, domestic institutions net sold 3/18 sectors, with the highest value in Oil & Gas. The top net sold stocks were: CTG, NAB, SIP, HAH, DXG, GVR, FUEVFVND, PVD, HCM, and CMG.

The highest net buying was in the Banking sector. The top net purchased stocks were: STB, ACB, DGC, HPG, FPT, SSI, FUEMAV30, MWG, VCB, and NLG.

The allocation of money flow increased in Banking, Construction, Chemicals, Agriculture & Seafood, Water Transport, Aviation, and Building Materials, while it decreased in many large sectors such as Real Estate, Securities, Steel, Retail, Food & Beverage, and Information Technology.

Looking at the weekly frame, liquidity recovered in all three capitalization groups, with the most significant improvement in the small-cap group VNSML.

Last week, money flow continued to increase in the small-cap group VNSML, with the average trading value per session increasing by +467 billion VND (+30.4%). The large-cap group VN30 and mid-cap group VNMID also saw increases of +767 billion VND (+17.4%) and +637 billion VND (+15.2%), respectively.

In terms of allocation, money flow remained focused on the large-cap group VN30, accounting for 46.7% of the total market liquidity last week, up from 43.6% in the previous week. The small-cap group VNSML saw an improvement in money flow allocation for the third consecutive week, reaching 14.1%, while the mid-cap group VNMID witnessed a decrease to 35.6%.

Regarding price movements, the large-cap group led the recovery, with the VN30 index rising by +2.2%. This was followed by the mid-cap group VNMID (+1.3%). Despite a strong improvement in money flow, the small-cap group VNSML recorded a lower increase (+1.1%), indicating a potential weakening of the upward momentum in this group.

Stock Market Blog: The Market is Accumulating Nicely

The market witnessed its second consecutive flat day following a robust surge on December 25th. The banking sector’s resilience helped anchor the index, while mid-cap and small-cap stocks experienced continued selling pressure. This shift in fund flow is likely to conclude by year-end, paving the way for fresh expectations in January 2025.

The Psychology of Rest Dominates, Liquidity Plunges

“Investor sentiment was muted in the final days of the 2024 financial year. Foreign investors’ trading activities hit a record low in the morning session, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.”

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.