Investors lacked motivation to trade during the final days of the 2024 financial year. Foreign investors recorded their lowest buying and selling activity, while overall market liquidity fell by 34% compared to the previous session. Red stocks dominated the board, but the majority experienced minimal fluctuations.

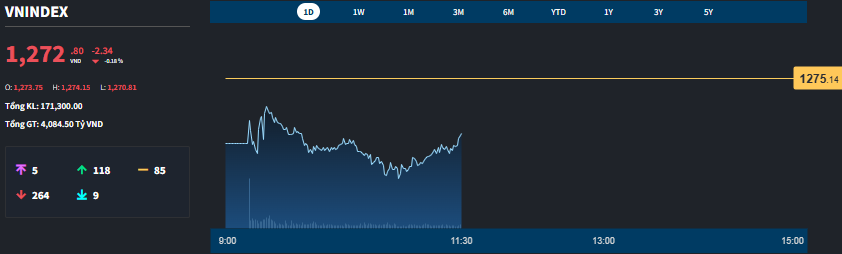

The VN-Index remained in negative territory throughout the morning session, posting a minimum loss of 4.33 points and closing 2.38 points lower. The breadth of the index showed 109 gainers and 272 losers at the bottom and 117 gainers and 264 losers at the close.

Such price movements did not exhibit significant changes, and only a small number of stocks improved enough to surpass the reference level. However, the recovery potential from the lows was quite good. Statistics revealed that only 24% of stocks on the HoSE closed at their intraday lows, while over 28% rebounded by more than 1%. Bottom-fishing activities persisted, albeit with limited potential to trigger a trend reversal.

Low liquidity indicated a lack of reliability in supply and demand. The matching value on the HoSE decreased by 35% compared to the previous Friday morning session, reaching just over VND 4,097 billion. Including HNX, liquidity fell by 34% to VND 4,350 billion.

Only eight stocks on the HoSE traded above VND 100 billion, with HCM as the standout, rising 1.36% with a matching volume of VND 183.8 billion. SSI increased by 0.19% with VND 125.8 billion, and VCG climbed 1.92% with VND 102.7 billion. These stocks represented the two most positive groups for the morning. However, differentiation was evident, and strength was not evenly distributed.

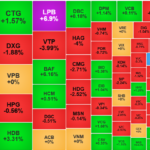

Currently, 45 stocks on the exchange have risen over 1%. Aside from the aforementioned active stocks, notable mentions include PDR, up 1.94% with a turnover of VND 64 billion; LPB, up 2.1% with VND 56 billion; NVL, up 1.96% with VND 38 billion; KSB, up 2.14% with VND 36.1 billion; CMG, up 1.24% with VND 29.7 billion, and PAN, up 1.06% with VND 22.2 billion. The total liquidity of the group rising over 1% accounted for only 14.8% of the HoSE’s matching value, indicating a lack of strong capital concentration. In reality, these stocks can be considered stronger than the overall market.

Similarly, while there were many stocks in the red, no significant large transactions were observed. Out of the 264 declining stocks, only a few stood out in terms of liquidity, such as YEG with VND 201.2 billion, down 2.49%; STB with VND 123.1 billion, down 1.2%; HDB with VND 70.1 billion, down 1.6%; VIB with VND 67.1 billion, down 1%; and EVF with VND 56.6 billion, down 2.83%… The total liquidity of the group experiencing the most significant declines accounted for approximately 19.8% of the market’s transactions.

Thus, the majority of stocks and market liquidity in the morning remained in a narrow range. This equilibrium resulted from the slow movement of capital. While many stocks were in the red, selling pressure was not intense, mainly due to a decrease in buying intensity. Consequently, price changes were relatively easy, even though investors were less motivated to trade during the year-end period, with portfolios’ performance already stabilized.

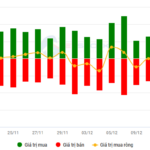

Foreign investors have essentially taken a break, with net purchases on the HoSE amounting to just VND 275.7 billion and net sales of VND 363.9 billion. This is the lowest trading activity since the beginning of 2024 and aligns with the typical annual cycle. At this point, foreign investors are on the verge of celebrating the Western New Year and have minimal trading activity. The net figure of VND 88 billion on the HoSE is a cumulative result for a large number of stocks, but no single stock experienced a strong net sell-off. The most significant net sell-off was observed in VCB, with a net sell value of VND 18.2 billion, followed by three other stocks with net sell values exceeding VND 10 billion: HPG, VRE, and TCB. On the net buying side, only one stock, BID, stood out with a net purchase value of over VND 10 billion, at VND 11.4 billion.

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.

Bank Stocks Continue to Attract Cash Flow, Speculative Stocks Take a Hit

The banking stocks on the HoSE exchange contributed a significant 32% to the total matched orders value today. All ten of the VN-Index’s top-performing stocks were from the banking sector, which has become a market pillar, holding its ground while speculative stocks faced heavier selling pressure.

The Art of Contrarian Investing: Navigating Market Swings with a Twist

The VN-Index has been on a rollercoaster ride lately, with alternating up and down sessions. Erratic trading volumes, fluctuating around the 20-day average, reflect investors’ unstable sentiment. However, the MACD and Stochastic Oscillator indicators continue to point upwards, providing a buy signal. If this status quo persists in the upcoming sessions, the short-term outlook may not be as risky as it seems.

Market Beat: Transport Sector Sustains Recovery, VN-Index Holds Green Fort

The market ended the session on a positive note, with the VN-Index climbing 0.42% to 1,262.76, and the HNX-Index gaining 0.63% to close at 228.51. Buyers dominated the market breadth, with 484 tickers advancing against 253 declining tickers. However, the VN30 basket tilted towards the red, recording 19 gainers, 7 losers, and 4 unchanged stocks.

The Hesitancy Hurdle: Navigating Market Uncertainty

The VN-Index edged slightly higher, snapping a four-day losing streak with the emergence of a Doji candlestick pattern. Accompanying this pattern, the trading volume remained below the 20-day average, indicating investor indecision in the market. Notably, the Stochastic Oscillator has now crossed into overbought territory and is flashing a sell signal. This development suggests that the risk of a market correction increases if the indicator falls out of this zone.