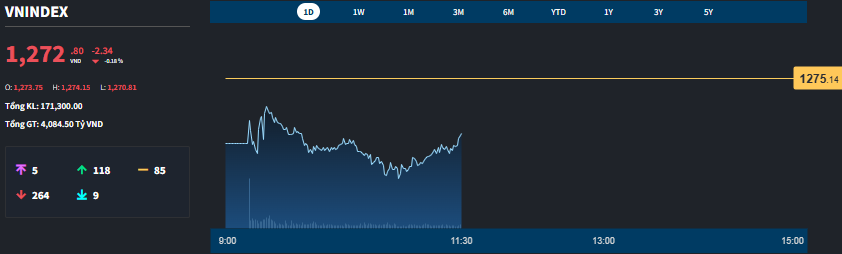

Trading momentum waned among investors during the final days of the 2024 financial year. Foreign investors’ trading activities hit a record low this morning, with overall market liquidity plunging by 34% compared to the previous session. The stock market was dominated by red, with only a few securities managing to stay afloat. However, the majority of the declines were marginal.

The VN-Index remained in negative territory throughout the morning session, recording a minimum loss of 4.33 points and closing 2.38 points lower. The breadth of the index showed 109 gainers and 272 losers at the trough, and the session concluded with 117 gainers and 264 losers.

This price movement did not signify a distinct shift, and only a minuscule number of stocks witnessed improvements substantial enough to surpass the reference level. Nonetheless, the recovery potential from the lows was quite promising. Statistics revealed that only 24% of traded stocks on the HoSE closed at their intraday lows, while over 28% rebounded by more than 1%. Bottom-fishing activities persisted, albeit with limited potential to orchestrate a market turnaround.

The subdued liquidity also underscored the unreliable nature of supply and demand dynamics. The matched order value on the HoSE plummeted by 35% compared to the previous Friday morning, barely surpassing VND 4,097 billion. Combining the figures from HNX, the overall market liquidity decline stood at 34%, amounting to VND 4,350 billion.

On the HoSE, merely eight stocks surpassed the VND 100 billion mark in trading value. The highlights included HCM, which climbed by 1.36% with a turnover of VND 183.8 billion; SSI, inching up by 0.19% with VND 125.8 billion; and VCG, advancing by 1.92% with VND 102.7 billion. These stocks represented the two most resilient sectors of the morning. Nevertheless, differentiation was evident, and the strength was not uniformly distributed.

Currently, 45 stocks on the HoSE have surged by over 1%. Aside from the aforementioned actively traded stocks, notable mentions include PDR, up by 1.94% with a turnover of VND 64 billion; LPB, rising by 2.1% with VND 56 billion; NVL, climbing by 1.96% with VND 38 billion; KSB, up by 2.14% with VND 36.1 billion; CMG, advancing by 1.24% with VND 29.7 billion; and PAN, inching up by 1.06% with VND 22.2 billion. The cumulative liquidity of these gainers above 1% merely accounted for 14.8% of the HoSE’s total turnover, indicating a dispersed rather than concentrated flow of funds. In reality, these could be considered outliers exhibiting robustness relative to the overall market.

Conversely, while numerous stocks dipped into the red, substantial trading activities were not observed among the decliners. Out of the 264 falling stocks, only a handful witnessed notable transactions, such as YEG with VND 201.2 billion in turnover, dropping by 2.49%; STB with VND 123.1 billion, slipping by 1.2%; HDB with VND 70.1 billion, declining by 1.6%; VIB with VND 67.1 billion, falling by 1%; and EVF with VND 56.6 billion, plunging by 2.83%… The cumulative turnover of these leading losers accounted for approximately 19.8% of the HoSE’s total trading value.

Consequently, the vast majority of stocks and market liquidity remained confined to a narrow trading range. This equilibrium resulted from the sluggish movement of capital. While numerous stocks bore red hues, selling pressure was not intense, primarily due to a reduction in buying interest. Hence, price alterations were relatively effortless, even though investors’ motivation to trade during the year-end tended to wane, especially with portfolios’ annual performance already settled.

Foreign investors have essentially paused their activities, with net purchases on the HoSE amounting to just VND 275.7 billion this morning, while net sales stood at VND 363.9 billion. This inactivity aligns with the typical annual cycle. As the year draws to a close, foreign investors are gearing up for the upcoming Lunar New Year holiday, resulting in diminished trading enthusiasm. The net figure of VND 88 billion on the HoSE encompasses a multitude of stocks, yet no single stock witnessed substantial net selling. The most significant net sold stock was VCB, recording a net sell-off of VND 18.2 billion, followed by three other stocks with net sell-offs exceeding VND 10 billion: HPG, VRE, and TCB. Conversely, the sole stock with a net buy value surpassing VND 10 billion was BID, with a net purchase of VND 11.4 billion.

The Stock Market Week of December 23-27, 2024: Foreign Investors Turn Net Buyers

The VN-Index rose last week, with alternating up and down sessions. Erratic trading volume around the 20-day average reflected investor sentiment lacking stability. However, foreign investors’ net buying after a continuous net-selling period bodes well for a more optimistic outlook.

Stock Market Blog: The Market is Accumulating Nicely

The market witnessed its second consecutive flat day following a robust surge on December 25th. The banking sector’s resilience helped anchor the index, while mid-cap and small-cap stocks experienced continued selling pressure. This shift in fund flow is likely to conclude by year-end, paving the way for fresh expectations in January 2025.

The Psychology of Rest Dominates, Liquidity Plunges

“Investor sentiment was muted in the final days of the 2024 financial year. Foreign investors’ trading activities hit a record low in the morning session, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.”

The Perfect Headline: “The Adjustment Pressure Persists”

The VN-Index narrowed losses with the emergence of a Hammer candlestick pattern, holding firmly above the 200-day SMA. Moreover, trading volume surged above the 20-day average, indicating a return of liquidity to the market. However, the Stochastic Oscillator and MACD continued their downward trajectory, issuing sell signals. This suggests that the risk of short-term corrections persists.