According to experts at HSBC, with the UK’s recent accession on December 15, the number of CPTPP members has reached 12, including the previous members: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. Post-Brexit, the UK’s entry into CPTPP is a significant move, and the agreement now accounts for approximately 15% of global GDP.

FREE TRADE FOR THE FUTURE

Mr. Ian Tandy, Co-Director of Global Trade Solutions, HSBC Asia-Pacific, believes that for many other members of the agreement, the UK is a highly desirable trading partner. In particular, Asian members will welcome enhanced access to the world’s sixth-largest economy and its sophisticated financial markets.

For UK businesses, there are also intriguing potential benefits, beyond just accessing the region’s expanding manufacturing sectors and its increasingly affluent, digitally connected consumers.

“Overall, this agreement marks an important element in the UK’s relationship with the Asia-Pacific region, which generates more than half of global growth.”

According to HSBC’s expert, previous trade agreements often struggled to keep up with the demands of modern economies, such as the changing relative importance of services over goods and the specific dynamics of digital trade. However, a significant advantage of CPTPP is that it was designed precisely to address these issues.

Mr. Ian Tandy commented, “This advantage is particularly important for the UK, as it is the world’s second-largest services exporter. Moreover, digital trade – the way businesses in the UK remotely export services to CPTPP countries – is also significant. The CPTPP agreement, with its improved governance requirements on issues such as data storage locations, enables smoother information flow between members.”

The Co-Director of Global Trade Solutions, HSBC Asia-Pacific, stated that one of the challenges businesses currently face is accessing new markets.

However, the agreement’s provisions are useful in alleviating the concerns and challenges that small and medium-sized enterprises (SMEs) in member economies face.

“For larger businesses, one of the most significant benefits relates to international supply chains. The pandemic and geopolitical unrest have highlighted the need for more resilient connections, and CPTPP will play a crucial role in paving the way for future improvements,” shared Mr. Ian Tandy.

This is mainly due to the modern approach taken in the CPTPP’s rules of origin, which allow for the aggregation of contributions from all members. In other words, if parts of a product are manufactured in five different CPTPP countries, those parts can collectively constitute the required CPTPP percentage of the final product.

According to the 2023 HSBC Global Connections survey, the intention to utilize CPTPP among international businesses is increasing – a rise of over 10% from the previous year. While this is a positive sign, banks like HSBC still need to do more by partnering with policymakers to explain how specific provisions of the agreement can support business growth, especially for SMEs.

UNRAVELING INTERNATIONAL COLLABORATION OPPORTUNITIES

Additionally, this link also indicates a significant growth potential. None of the CPTPP members are currently among the top 10 service export markets for the UK.

Therefore, the support from CPTPP membership presents numerous opportunities for various business types, from financial services to logistics, as well as the burgeoning “new economy” sector.

With CPTPP in force for the UK, the country’s exports to member countries will be almost entirely tariff-free. The UK government has estimated that the long-term boost to UK exports to CPTPP countries could be worth up to £2.6 billion. Many UK businesses with “Brand Britain” products – ranging from automobiles and machinery to ceramics and Scotch whisky – will benefit from improved access to CPTPP markets.

In the opposite direction, the UK is also an important export market for Asian countries, with products such as fruits, seafood, rice, rubber, and metals, among others.

Back home, statistics from the General Department of Vietnam Customs show that total trade turnover with CPTPP markets in the Americas surged by 56.3%, from $8.7 billion in 2018 to $13.6 billion in 2023.

During the same period, Vietnam’s exports to these markets nearly doubled, from $6.3 billion to $11.7 billion. The trade surplus of Vietnam in these markets also increased nearly threefold, from $3.9 billion to $11.01 billion.

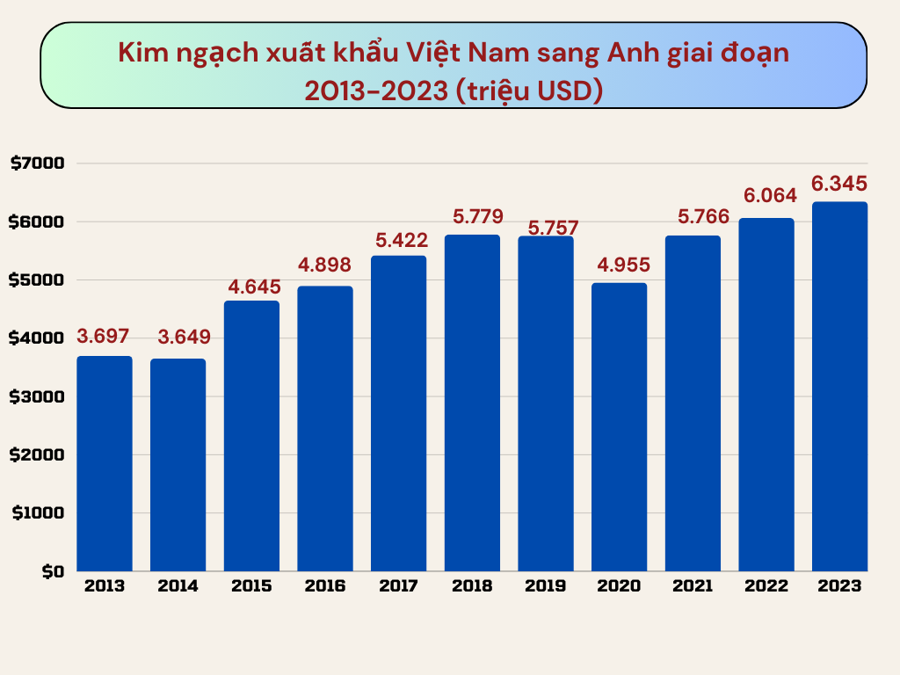

In 2023, while Vietnam’s exports to other markets declined, exports to the UK rose by 11%. According to data from the General Department of Vietnam Customs, in the first 11 months of 2024, Vietnam’s exports to the UK continued to grow, increasing by 19.5% year-on-year.

Mr. Surajit Rakshit, National Director of Global Trade Solutions, HSBC Vietnam, stated that Vietnam is one of the beneficiaries of the CPTPP implementation. Vietnamese businesses now have more opportunities to access high-quality markets such as Japan, Canada, Australia, and now the UK.

“As we enter 2025, with the UK’s entry into CPTPP, along with the Vietnam-UK Free Trade Agreement already in force, coupled with all the strong fundamentals in place, Vietnam’s economy continues to stand out in the region, offering more preferential trade opportunities to global partners,” added Mr. Surajit Rakshit.

UOB: Vietnam’s Central Bank Isn’t Under Much Pressure to Rush Monetary Easing

With the economy booming in 2024 and continuing its strong growth into 2025, the State Bank of Vietnam (SBV) is under no immediate pressure to loosen its policies.

Weaving a Brighter Future: Vietnam’s Textile Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s export target of 44 billion USD by 2024 is well within reach. The association bases this optimism on the fact that the end of the year typically sees a surge in production orders for the festive season, encompassing both Christmas and New Year celebrations.