Why is the Pharmaceutical Industry Resilient to Market Volatility?

Vietnam’s pharmaceutical market is valued at approximately $7 billion, according to the Drug Administration of Vietnam under the Ministry of Health. Other estimates also point to a similar scale.

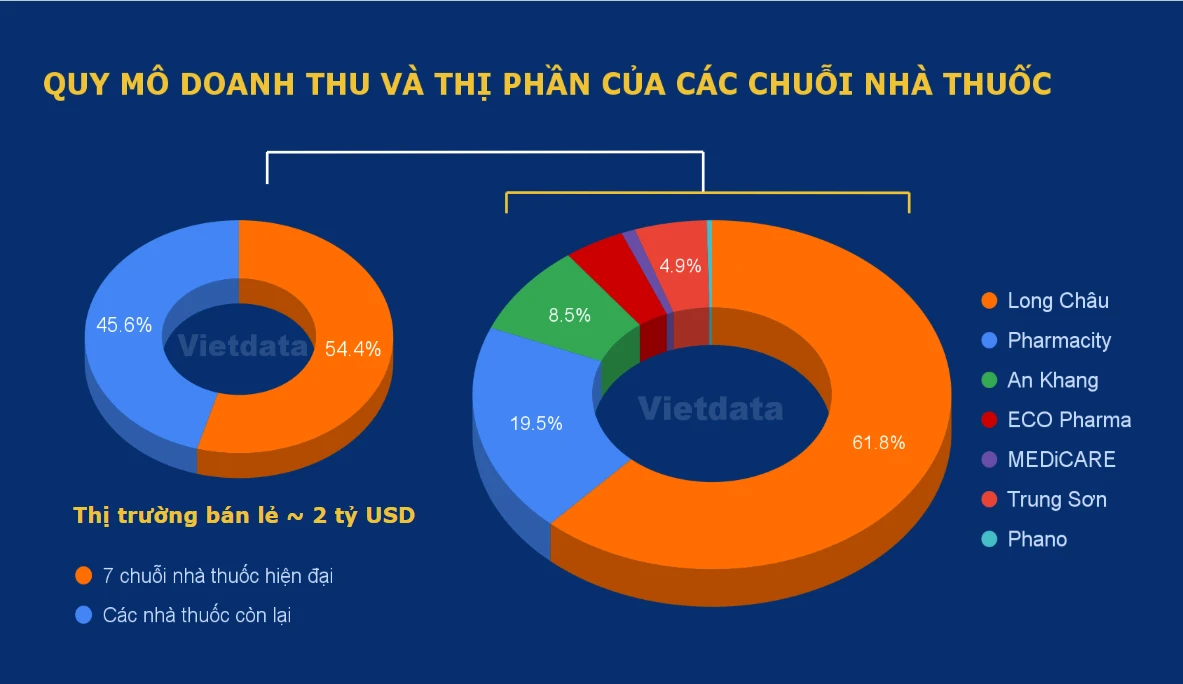

Specifically, 70% of this figure belongs to the hospital tender channel, with the remaining 2 billion dollars going to the 60,000 pharmacies in the market. Of this, modern pharmacy chains, with over 3,000 stores and a combined revenue of $1.1 billion, account for more than 50% of the pharmaceutical retail market share.

Vietdata, an economic data provider, analyzed that the Vietnamese pharmaceutical retail market has witnessed robust growth, especially since the COVID-19 pandemic outbreak. People are increasingly concerned about their health and are willing to spend more on pharmaceuticals to protect their well-being.

Additionally, the shift towards an aging population structure has also increased the demand for pharmaceuticals, as older adults tend to have more health issues.

According to the report publisher, the pharmaceutical retail market is considered “immune” to macroeconomic fluctuations due to the essential nature of pharmaceutical products. Even during the recent prolonged economic downturn, pharmacy chains have consistently grown their annual revenues.

“In the post-COVID-19 era, while some chains experienced a slight revenue decline, the overall trend for the past five years can be summed up in one word: growth,” the report states.

The Race for Market Share in the Pharmaceutical Industry

Vietdata’s insights not only encompass macroeconomic fluctuations but also offer a perspective on the intense competition among major pharmaceutical retailers.

The race to expand pharmacy networks to capture market share has become more fierce, backed by the strong financial support of parent corporations. This backing has enabled chains to continuously increase their coverage. The influx of domestic and foreign capital has further intensified competitive pressures, as all players recognize the market’s growth potential.

Currently, the three largest pharmacy chains, Long Chau, An Khang, and Pharmacity, are leading the market. In many residential areas, these chains are located on the same road or next to each other, indicative of the fierce competition to attract customers. Pharmacy systems are sprouting up like mushrooms, with dense concentrations regardless of the urban area’s size.

However, the aggressive expansion strategy has led to operational challenges for some chains, resulting in the closure of underperforming branches.

“In reality, expanding the scale does not always bring economic benefits, not to mention the waste of resources without creating any real value for the business,” Vietdata’s report cautions. Despite the backing of large corporations, chains constantly face pressure to maintain business efficiency and ensure sustainable development.

The Stock Market’s Prospects: Unlocking Opportunities in H2 2024

As of Q2 2024, the VN Index witnessed a notable shift in the weightage of its constituent stocks with the rise of new stars. These stocks exhibited a robust upward trajectory in their share prices and an increased influence on the overall index.