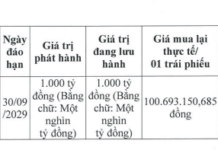

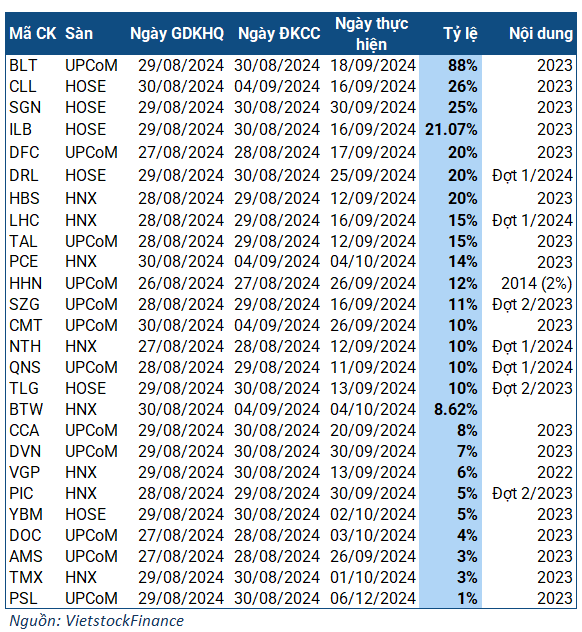

The Vietnam National Oil and Gas Group (PVN) has approved a plan to increase the charter capital of Binh Son Refining and Petrochemical Joint Stock Company (BSR) to VND 50,073 trillion (approximately $2 billion). The proposal is also being submitted to the competent authorities, with the expectation of receiving approval before the first quarter of 2025.

The capital increase aims to meet the investment needs of the Research Project for Expanding the Dung Quat Refinery and BSR’s long-term development strategy until 2030, with a vision towards 2045. Currently, BSR’s charter capital stands at VND 31,000 billion.

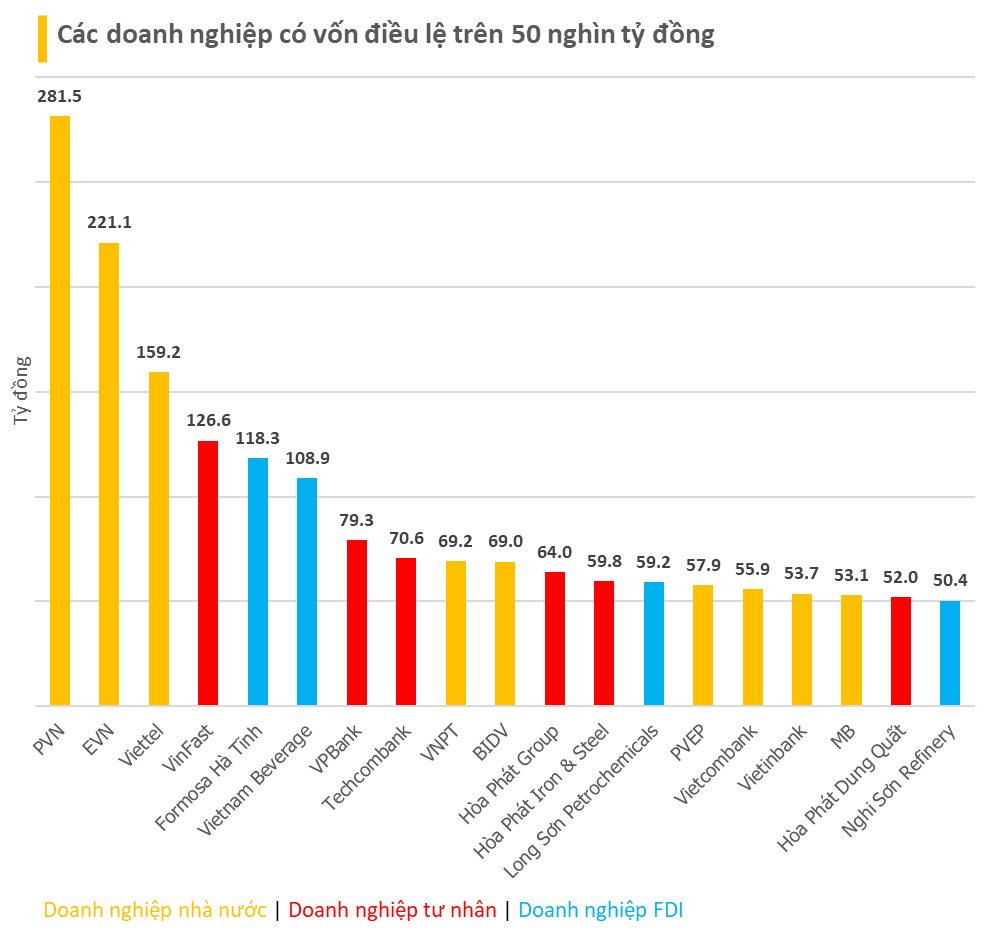

If the capital increase proposal is approved, BSR will become the 20th company in Vietnam to reach the VND 2 billion charter capital milestone.

With a capital below VND 55,000 billion, BSR joins the likes of Nghi Son Refinery, Hoa Phat Dung Quat, MB, and Vietinbank.

Among the 19 enterprises with charter capital exceeding VND 50,000 billion, there are 9 state-owned enterprises, 4 FDI enterprises, and 6 private enterprises.

3 state-owned enterprises, namely PVN, EVN, and Viettel, are the largest in Vietnam in terms of charter capital, all surpassing VND 100,000 billion. The private company with the largest charter capital is VinFast, owned by billionaire Pham Nhat Vuong.

In Vietnam, there are two companies with similar business lines to BSR: Long Son Petrochemical Refinery Limited Company and Nghi Son Refinery and Petrochemical Limited Liability Company. Both possess significant charter capital, amounting to VND 59,200 billion and VND 50,400 billion, respectively.

However, these two companies have been incurring losses for several years. In contrast, BSR consistently generates profits of thousands of billions each year.

Reasons for Companies Requiring Large Charter Capital

Charter capital refers to the amount of money invested by shareholders to establish a company or increase its capital. It is typically determined in the company’s establishment license and reflects the company’s asset value.

According to Vietcap Securities, charter capital holds significant importance for a company. Firstly, it demonstrates the company’s initial financial capacity and the level of commitment from its founders to the business. Higher capital enhances the company’s ability to borrow funds and expand its operations.

The brokerage also believes that charter capital is a crucial factor in assessing a company’s value. Investors often consider a company’s charter capital when evaluating its profitability and growth potential.

Additionally, charter capital plays a vital role in the management and operation of the company. Important decisions, such as issuing shares, bonds, or transferring assets, must be made in accordance with the law and the provisions of the charter capital.