I. MARKET ANALYSIS OF THE STOCK MARKET BASIS ON DECEMBER 31, 2024

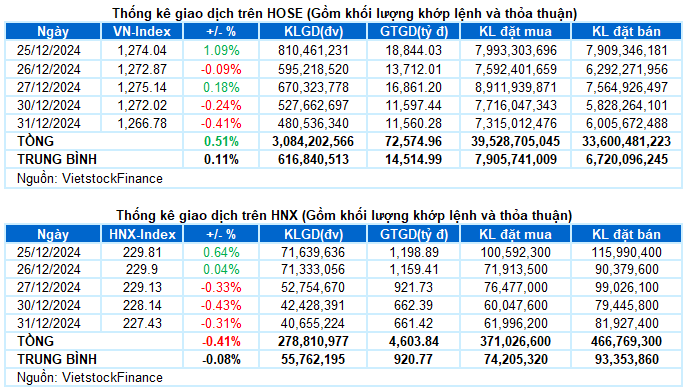

– The main indices decreased during the last trading day of 2024. VN-Index closed the session down 0.41%, reaching 1,266.78 points; HNX-Index decreased by 0.31% compared to the previous session, falling to 227.43 points.

– The matching volume on HOSE reached just over 407 million units, a 10.1% decrease compared to the previous session. The matching volume on HNX increased by 3.7%, reaching over 36 million units.

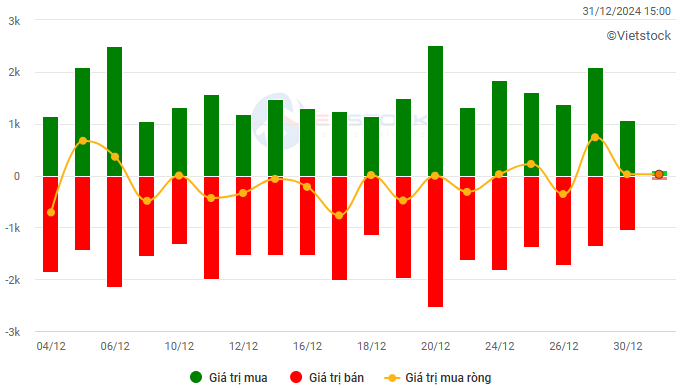

– Foreign investors net sold slightly on the HOSE with a value of more than 257 million VND and net sold more than 4.5 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

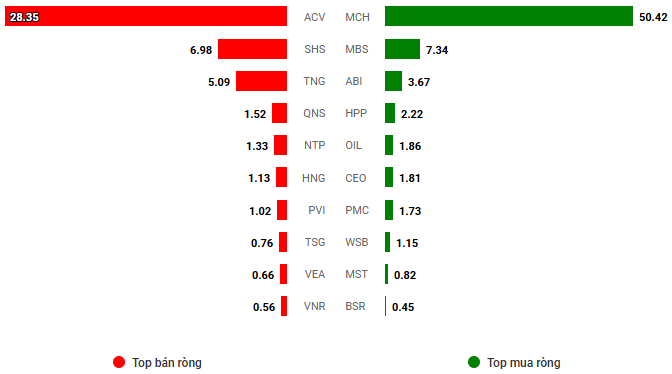

Net trading value by stock code. Unit: Billion VND

– The last trading session of 2024 took place in a quiet atmosphere as liquidity dried up, reflecting the clear holiday sentiment of investors. The market mainly fluctuated and fluctuated below the reference mark throughout the trading session; however, strong selling force suddenly appeared in the ATC session, especially focusing on the group of pillar stocks, causing VN-Index to lose more than 5 points. Closing the year 2024, VN-Index stopped at the mark of 1,266.78 points, recording an increase of 12.11% compared to the beginning of the year.

– In terms of impact, CTG, VCB, BID, and HDB were the main pillars that pulled the market down the most in the last session, taking away nearly 4.5 points from the VN-Index. On the other hand, FPT, ACB, and TCB pulled back 1.5 points for the general index.

– VN30-Index closed the session down 0.19%, reaching 1,344.75 points. The sellers still dominated with 18 codes decreasing, 7 codes increasing, and 5 codes referencing. Of which, HDB after the “flash” ceiling session yesterday, has strongly adjusted back down, decreasing by 4.3%. Next are CTG, STB, and BVH, which also plunged more than 2%. On the opposite side, 5/7 codes with green color increased by more than 1%, including ACB, BCM, FPT, MBB, and TCB.

Today’s decline was mainly due to pressure from the group of pillar stocks. The financial group “bottomed out” with a decrease of 0.76% as the red color spread widely. Stocks under strong selling pressure include HDB (-4.32%), CTG (-2.83%), STB (-2.51%), BID (-1.83%), PVI (-3.94%), PSI (-2.56%), BVH (-2.5%), SSI (-1.51%), FTS (-1.4%) and MSB (-1.38%). A few bright spots in this industry are OCB (+3.64%), ACB (+1.57%), MBB (+1.21%), TCB (+1.02%), VAB (+2.17%), and ABB (+1.37%),…

Following is the group of raw materials also dominated by red color as many stocks with large capitalization in the industry adjusted, typically KSV had the second consecutive floor session, HSG (-1.34%), NKG (-1.37%), GVR (-0.65%), DCM (-1.79%), DPM (-1.27%), BMP (-1.21%) and KSB (-2.37%).

On a positive note, the groups of essential consumer goods, information technology, and telecommunications respectively topped the table with an increase of over 1%. Main contributions came from the upward momentum of stocks such as MCH (+6.38%), ANV (+1.02%), HNG (+1.67%); FPT (+1.33%), CMT (+2.58%); VGI (+1.21%), CTR (+1.22%), and FOX (+2%).

VN-Index decreased quite negatively with trading volume falling below the 20-day average. This indicates that investors’ psychology is showing signs of becoming cautious again. However, the index is above the Middle line of the Bollinger Bands. If, in the next sessions, the index holds above this threshold, along with the MACD indicator continuing to maintain a buy signal, the situation will not be too negative.

II. ANALYSIS OF TRENDS AND PRICE FLUCTUATIONS

VN-Index – Located above the Middle line of the Bollinger Bands

VN-Index decreased quite negatively with the trading volume falling below the 20-day average. This indicates that investors’ psychology is showing signs of becoming cautious again.

However, the index is above the Middle line of the Bollinger Bands. If, in the next sessions, the index holds above this threshold, along with the MACD indicator continuing to maintain a buy signal, the situation will not be too negative.

HNX-Index – The MACD indicator appears to be a sell signal

HNX-Index decreased for 3 consecutive sessions in the context of trading volume maintained below the 20-day average. This indicates that investors’ caution is increasing.

Currently, the Stochastic Oscillator indicator appears to be a sell signal again, while the MACD is also giving a similar signal. This suggests that the risk of short-term adjustments remains.

Analysis of Capital Flows

Fluctuations in smart money flow: The Negative Volume Index indicator of VN-Index cuts down below the EMA 20 day line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will increase.

Fluctuations in capital flow from foreign investors: Foreign investors net sold again in the trading session on December 31, 2024. If foreign investors maintain this action in the coming sessions, the situation will be more pessimistic.

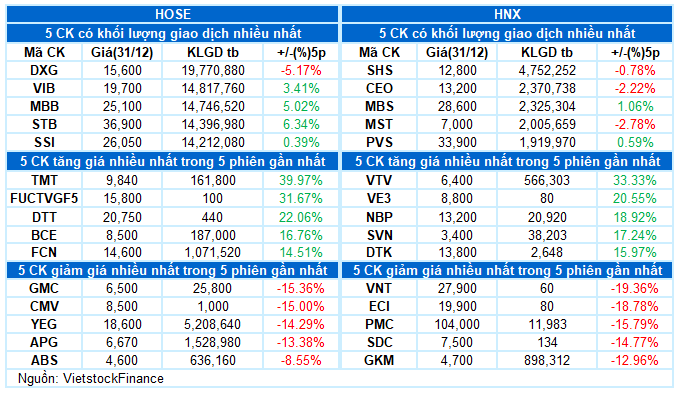

III. MARKET STATISTICS ON DECEMBER 31, 2024

Department of Economic Analysis & Market Strategy, Vietstock Consulting

– 17:06 31/12/2024