Despite being allowed to adjust prices quarterly, EVN has only increased electricity prices once so far.

On March 26, the Prime Minister approved Decision No. 05/2024/QD-TTg on the mechanism for adjusting average retail electricity prices. The new decision shortens the minimum time between two price adjustments from six months to three months, subject to certain conditions. Specifically, when the average electricity price decreases by 1% or increases by 3% or more compared to the current price, a corresponding adjustment is allowed.

Despite being allowed to increase prices, EVN has only done so once in 2024

|

The decision also states that in the event the calculated updated average electricity price is 1% lower or 3% to 5% higher than the current price, EVN is responsible for making the necessary adjustments.

If the increase ranges from 5% to less than 10%, EVN can raise prices after reporting and obtaining approval from the Ministry of Industry and Trade. For increases of 10% or more, suggestions from the Ministry of Finance and other relevant ministries and branches are required, or a report must be submitted to the Price Management Steering Committee before reporting to the Prime Minister.

However, throughout the past year, EVN has only adjusted electricity prices upward once. From October 11, 2024, the average retail electricity price increased from 2,006.8 VND/kWh to 2,103.1 VND/kWh (excluding VAT), equivalent to a 4.8% increase. In 2023, electricity prices were adjusted upward twice, the first time on May 4, 2023, by more than 55.9 VND/kWh (a 3% increase), and the second time on November 9, 2023, by more than 86.4 VND/kWh (a 4.5% increase).

EVN’s price increase was not unexpected, as the corporation continues to face financial challenges. According to the Ministry of Industry and Trade, EVN incurred losses of over 34 trillion VND in electricity production and trading activities in 2023. Income from activities related to electricity production and trading in 2023 amounted to 12,423 billion VND, resulting in a total loss of nearly 22 trillion VND. In the first six months of 2024, the corporation continued to incur losses of about 13 trillion VND.

As of the end of 2023, EVN was selling electricity at a price approximately 135 VND/kWh below the cost price, or 6.92% lower.

Introduction of the Direct Power Purchase Agreement (DPPA) mechanism for renewable energy.

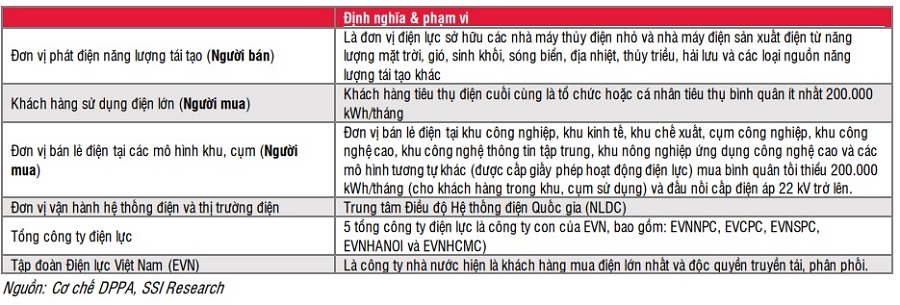

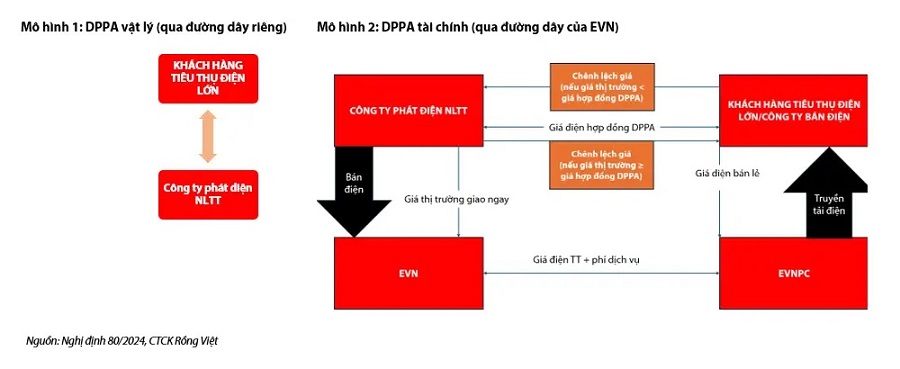

The DPPA mechanism has been a topic of discussion for several years and was partially addressed in 2024. Specifically, on July 3, 2024, the government issued a decree on the DPPA mechanism between renewable energy generators (RE Gencos) and large electricity consumers for production purposes.

The decree states that direct power purchases can be made through two forms: direct power purchase through a dedicated connection line and direct power purchase through the national grid.

According to Rong Viet Securities (VDSC), there are currently about 7,700 large consumers, with a minimum monthly consumption of 200,000 kWh, accounting for 36.5% of total electricity consumption in Vietnam. DPPA provides a mechanism for renewable energy project investors to initiate investment after a long period without a deployment framework following the issuance of the FiT-2 preferential price mechanism in 2020.

The DPPA mechanism will apply to renewable energy projects that receive a Commercial Operation Date (COD) certificate after November 2021, including transitional projects, and will replace the fixed-price and FiT mechanisms applied to previous projects.

SSI Securities believes that the introduction of DPPA is expected to reduce dependence on EVN and the national grid, create a more competitive environment for participants, and address EVN’s financial issues. With Electricity Planning 8 (Power Development Plan 8, or PDP8) aiming for net-zero emissions by 2050 and a continued expansion of capacity (over 150,000 MW by 2030 and nearly 600,000 MW by 2050), renewable energy is expected to play a key role in this process.

However, the implementation of DPPA is expected to face challenges. For physical DPPA, investors will encounter difficulties in adding the grid to provincial and regional planning. On the other hand, virtual DPPA faces the challenge of optimizing the efficiency of negotiating output and forward contract prices (cfDs) with large electricity consumers. Determining whether to set a fixed contract price for the year or adjust it monthly, seasonally, or daily to ensure a balance between supply and demand is a critical issue.

Moreover, for any surplus electricity that is not consumed by customers who have signed DPPA contracts, investors will face difficulties in operating price bids on the wholesale electricity market (VWEM), which has a trading cycle of 48 sessions per day, with each session lasting 30 minutes. In addition, the optimization of investment efficiency when bidding on the wholesale electricity market needs to be considered.

From the proposal of selling surplus solar rooftop electricity at 0 VND to the approval of selling up to 20%.

The issue of surplus solar rooftop electricity has been a headache in the past year. According to a draft in April 2024, agencies, organizations, and individuals were allowed to discharge or not discharge surplus electricity (if any) from solar rooftop systems into the national grid. However, the power company would record the electricity output at 0 VND and no payment would be made. In other words, it could only be used and not sold.

Surplus solar rooftop electricity can be sold to the system up to 20% of capacity

|

However, the proposal has been changed with the approval of Decree No. 135/2024/ND-CP on October 22. The decree includes mechanisms and policies to encourage the development of solar rooftop systems for self-production and self-consumption. Notably, solar rooftop systems with a capacity of less than 100 kWh that are connected to the national grid and have surplus electricity can sell it back, but not exceeding 20% of the actual installed capacity.

In addition, solar rooftop projects for self-production and self-consumption are entitled to tax incentives and streamlined administrative procedures. Households and individual houses are exempt from or not required to adjust their business licenses. Moreover, organizations and individuals are encouraged to install energy storage systems (BESS) to ensure safe and stable operation.

The revised Electricity Law was passed.

On November 30, the revised Electricity Law was officially passed, comprising 81 articles across nine chapters. The law covers various aspects, including electricity development planning and investment in electricity projects, development of renewable and new energy sources, electricity licenses, the competitive electricity market, electricity prices, electricity trading activities, rights and obligations of organizations, individuals engaged in electricity activities and electricity users, operation and dispatch of the national electricity system, electricity sector governance, and state management of the electricity sector.

One notable aspect is the resolution of issues in electricity trading transactions through the introduction of forward electricity contracts. These are financial derivative contracts that enable parties to manage risks in the electricity market. Including forward electricity contracts in the law provides a legal basis for guiding value-added tax (VAT) policies for such contracts.

The Ministry of Industry and Trade considers this a necessary requirement to address the shortcomings of the current wholesale electricity market, create conditions for expanding the scope of the competitive wholesale electricity market, and pave the way for the future retail electricity market.

Proposal to apply a two-part electricity tariff from 2025.

In 2024, EVN proposed a two-part electricity pricing system, including capacity and energy charges, along with an implementation roadmap for the electricity sector.

According to EVN, the consulting firm suggested that the ideal timeframe for implementing the two-part electricity pricing mechanism would be from January 1, 2025, provided that the pilot phase is completed as planned. The initial target customers are production facilities that purchase electricity directly from EVN, including those at high voltage (110 kV and above), medium voltage (6 kV to less than 110 kV), and low voltage (less than 6 kV) levels.

The two-part electricity tariff is expected to address gaps in the electricity pricing structure.

|

In fact, the two-part electricity tariff structure has appeared in government documents requesting research over a decade ago but has not been implemented. Experts believe that the two-part pricing mechanism will be fairer as it accurately reflects the costs of each customer, avoiding the cross-subsidization between customers as seen in the current structure.

Additionally, the new mechanism will prevent instances where customers register for a large capacity but do not utilize it, or where factories register for a high capacity, requiring the power company to prepare transmission lines and transformers but do not use them for several years. The associated costs during those years are wasted and end up being passed on to other customers.

Proposal to adjust the implementation plan for Electricity Planning 8 (PDP8)

More than a year after the approval of PDP8 in May 2023, the Ministry of Industry and Trade has proposed adjustments to the implementation plan.

There are several reasons behind this proposal. The Ministry of Industry and Trade stated that the growth rate of commercial electricity has been significantly higher than the forecast in PDP8, making the targets challenging to achieve.

Each type of power generation also faces challenges. For gas-fired power, the goal is to reach over 30,000 MW by 2030 with 23 domestic gas and LNG projects, but investment and construction face challenges, leading to a potential power shortage. For coal-fired power, PDP8 aims to add nearly 3,400 MW by 2030 and phase out coal-fired power by 2050. Currently, five coal-fired power projects are behind schedule, and with the shift towards reducing coal-fired power, many projects face difficulties in obtaining approval from local authorities and financial institutions, hindering capital arrangement and new capacity addition.

Regarding hydropower, while it can be developed according to the plan (over 29,000 MW by 2030), it is less favorable due to limited development potential, not accounting for the risks of climate change, which are beyond control. For wind power, the Ministry of Industry and Trade assesses that it will be challenging to achieve the capacity targets set in PDP8 (nearly 22,000 MW by 2030 and 60,000-77,000 MW by 2050). As of September, no offshore wind power projects have been granted investment approval, and given the long implementation period, which can take up to 6-8 years from the survey stage, it is highly unlikely to be achieved.

For solar power, the Ministry of Industry and Trade believes that the development scale by 2030 will not be significant. In the context of large power sources like gas and coal struggling to meet deadlines, the expansion of solar power is necessary to meet demand.

Additionally, the Ministry of Industry and Trade assesses that the power grid is currently passive and confused, with many power projects delayed and struggling to meet the PDP8 schedule.

– 10:00 27/12/2024

The Power Sector’s Pivotal Year: 2024’s Key Policies Unlocked

In 2024, the power industry witnessed a series of events and policy changes. Notably, EVN was authorized to increase electricity rates every three months, the amended Power Law was passed, and regulations on renewable energy were introduced. These developments marked significant shifts in the industry’s landscape over the past year.

The Impact of Rising Electricity and Rental Prices on November’s CPI Increase of 0.13%

The rise in residential electricity prices, rental costs, and home maintenance materials were the key drivers behind the 0.13% increase in the consumer price index (CPI) in November 2024 compared to the previous month.

The Future of Electricity Pricing: A Market-Driven Approach

According to the Ministry of Industry and Trade and industry experts, the newly amended Power Law, passed by the National Assembly, will bring about significant changes in legal regulations. This will untie the knots hindering the development of the electricity industry, particularly in terms of capital mechanisms and investment incentives to attract resources for electricity development and operation.

Unlocking New Frontiers in Energy: The Amended Power Law Lights the Way for Innovative Electricity Ventures

On November 30, the National Assembly passed the amended Power Law with an overwhelming majority of 439 out of 463 delegates voting in favor, accounting for 91.65%. This pivotal piece of legislation carries significant weight, impacting the economy and ensuring the nation’s growth, development, and energy security.