Similar to the previous bond issuance of over VND 1,700 billion, the new VND 535 billion bond (face value) has a term of 5 years from the completion date of the offer on 12/25/2024, with an interest rate of 12% in the first year and floating rates plus a margin of 4.5% for subsequent years. The bonds are deposited with HD Securities (HDS) and guaranteed by the HCM City Development Joint Stock Commercial Bank (HDBank). Allgreen also has the right to buy back the bonds before maturity by agreement or at the request of investors in certain specific cases.

Trùng Dương Tourist Area (commercially known as The Maris Vũng Tàu) with a scale of 23ha is located on the favorable 3/2 road of the coastal city, with a total investment capital of VND 6,000 billion, developed into a high-class resort complex. The project includes 192 villas, 3 apartment towers of 18 floors providing nearly 1,700 apartments. The “leveraged” bond issuance helps the investor accelerate the progress of the Serenity villa area, Alaric and Polaris apartment towers. The company said it started construction of the Polaris tower in August 2024, and the Alaric tower is expected to be topped out this month and will be handed over by the end of this year.

The Maris Vũng Tàu project is under construction in Vũng Tàu. Source: TDG Group

|

Allgreen – Vuong Thanh – Trung Duong was established in 2008 as a joint venture with a Singaporean partner to develop the The Maris Vũng Tàu project, but it was not until 2018 that the project officially started. The company currently has a chartered capital of VND 860 billion. Also in this coastal city, in addition to the project on 3/2 road, TDG Group – the parent company of Allgreen – also owns another project located on Phan Chu Trinh road with a scale of 1.9ha.

According to a report published by Saigon Ratings in August 2024, Allgreen was rated vnBB+ with a relatively high-risk warning due to the imbalance between supply and demand in the resort real estate market. Currently, resort apartments have a low absorption rate and volatile demand. In addition, the capital structure of the project is also quite high, increasing financial pressure.

However, Saigon Ratings assessed that if Allgreen successfully increases its charter capital to VND 1,400 billion as planned, financial risks will be significantly reduced. Especially, the project is having a positive sales rate along with a large volume of products sold, helping to improve cash flow. Another bright spot lies in the fact that the project has basically completed the necessary legal documents and procedures, ensuring the progress of implementation.

In 2024, TDG Group recorded more than VND 350 billion in revenue and VND 50 billion in pre-tax profit, mainly from the handover of a part of the Serenity villas at The Maris Vũng Tàu project. The company’s total assets by the end of the previous year reached over VND 5,000 billion. To continue accelerating the progress, TDG Group plans to increase its charter capital to VND 1,500 billion in 2025.

Tu Kinh

– 16:56 01/09/2025

The Quiet Giant: Unveiling the Purchase of Vinhomes Ocean Park 2 with a Twist

Prior to the issuance of the 1,000 billion VND bond, this company had mortgaged its contractual rights as collateral at a bank.

State-Owned Refinery to Join $2 Billion Capitalized Group, Joining Ranks with Hoa Phat Dung Quat, MB, and Vietinbank

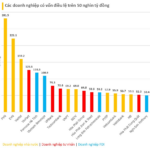

Among the 19 businesses with a charter capital of over $2 billion, there is a diverse mix of ownership structures. This includes 9 state-owned enterprises, showcasing the strong presence of the public sector, alongside 4 foreign-invested companies, and 6 private enterprises, each bringing their unique contributions to the table.

“Mortgaging KBC’s 12.6 Trillion VND Stake in the Trang Cat Urban Area Project”

The Kinh Bac City Development Holding Corporation (HOSE: KBC) has leveraged its assets as collateral to secure loans for the Trang Cat urban and service area development project.