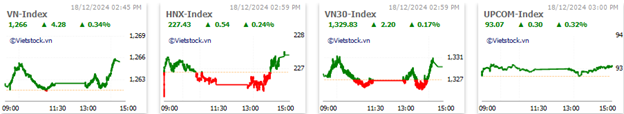

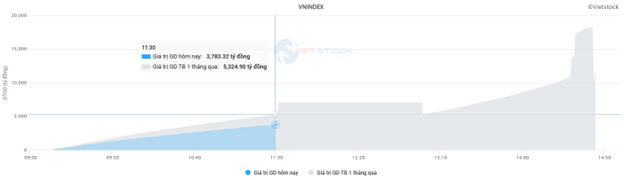

Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 391 million shares, equivalent to a value of more than VND 8.8 trillion; HNX-Index reached over 39.1 million shares, equivalent to a value of more than VND 701 billion.

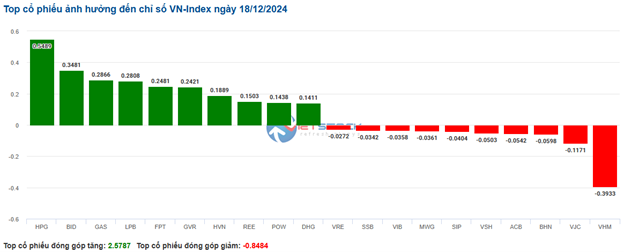

VN-Index opened the afternoon session with a tug-of-war but buyers gradually gained the upper hand towards the end of the session, helping the index close in the green. In terms of impact, HPG, BID, GAS and LPB were the codes that had the most positive impact on the VN-Index with an increase of more than 1.4 points. On the contrary, VHM, VJC, BHN and ACB were the codes with the most negative impact, but the impact was not significant.

Source: VietstockFinance

|

Similarly, the HNX-Index also had a positive performance, with the index positively impacted by the codes PVS (+3.02%), KSV (+2.38%), PVI (+2.46%), NVB (+1.16%)…

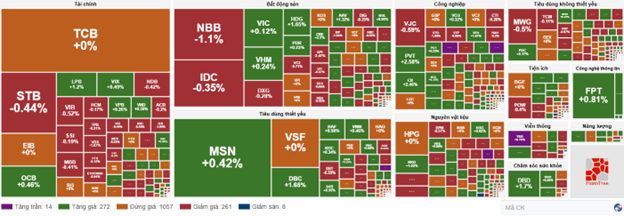

At the close, the market was up 0.34%. The energy sector was the best-performing group in the market, up 2.45%, mainly driven by PVS (+3.02%), PVD (+2.99%), BSR (+2.29%) and PVB (+9.82%). Following the recovery were the materials and healthcare sectors, up 0.9% and 0.79%, respectively. In addition, the real estate sector was the most modestly performing group in the market, up 0.01%, mainly driven by buying in DXG (+0.28%), PDR (+1.41%), HDG (+0.66%) and NTL (+2.94%).

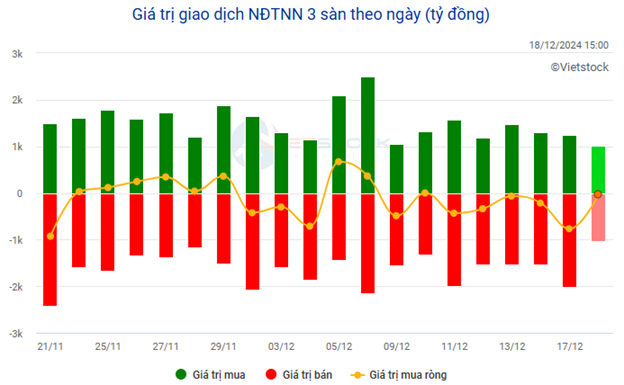

In terms of foreign trading, they continued to net sell more than VND 42 billion on the HOSE exchange, focusing on MWG (VND 71.05 billion), VRE (VND 57.44 billion), KBC (VND 42.66 billion) and DPM (VND 37.49 billion). On the HNX exchange, foreigners net sold more than VND 33 billion, focusing on SHS (VND 22.99 billion), PVS (VND 22.87 billion), TNG (VND 3.15 billion) and BVS (VND 2.14 billion).

Source: VietstockFinance

|

12h: Gloomy situation persists

The wait-and-see sentiment ahead of the upcoming events in the last two sessions of the week kept the market in a gloomy state. Session after session started on a positive note but failed to attract buying interest and reversed to close in the red. At the end of the morning session, the VN-Index was up slightly by 0.08% to 1,262.76 points; HNX-Index stood at 226.51 points, down 0.17%. The market breadth inclined towards the sell-side with 304 losers and 280 gainers.

Investors were cautious, and the VN-Index‘s matched volume in the morning session reached just over 166 million units, equivalent to a value of nearly VND 3.8 trillion, down nearly 30% compared to the 1-month average. The HNX-Index recorded a matched volume of nearly 17 million units, with a value of over VND 299 billion.

Source: VietstockFinance

|

Large-cap stocks were quiet, with no stock in the VN30 group fluctuating by more than 1%, so in terms of impact on the index, no name stood out.

In terms of sectors, the healthcare group temporarily took the lead thanks to the outstanding performance of DHG (+3.91%), DBD (+1.53%), IMP (+0.83%), DMC (+1.71%), PBC (+1.49%) and MKP (+1.03%). The information technology, energy, consumer staples, utilities, and materials sectors also maintained a slight gain.

On the opposite side, the telecommunications sector ranked last as large-cap stocks in the industry such as VGI, FOX, CTR, VNZ, etc., were dominated by sellers, except for YEG, which hit the daily limit-up right at the beginning of the session.

Foreigners also traded cautiously, continuing to net sell more than VND 47 billion on the HOSE and more than VND 44 billion on the HNX in the morning session. No stock stood out, and FPT was net bought by foreign investors by nearly VND 50 billion in the morning after being net sold strongly in the previous session.

10:30 am: Leaning towards the upside

After surging at the opening, selling pressure gradually returned, narrowing the gains. Currently, the main indices are fluctuating around the reference level. As of 10:30 am, the VN-Index rose 2.32 points, trading around 1,264 points. The HNX-Index gained 0.11 points, trading around 227 points.

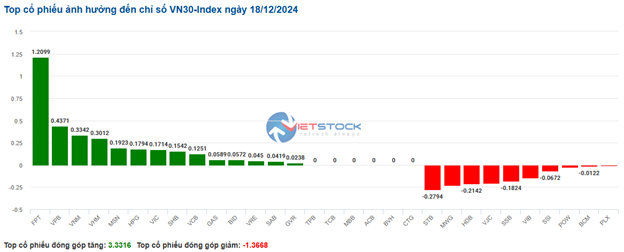

Stocks in the VN30 basket were strongly divided with gainers slightly dominating. Specifically, FPT, VPB, VNM, and VHM contributed 1.2 points, 0.43 points, 0.33 points, and 0.3 points to the overall gain, respectively. On the other hand, STB, MWG, HDB, and VJC faced selling pressure, but the impact was not significant.

Source: VietstockFinance

|

The information technology sector led the market’s advance with a recovery of 0.79%. Buying interest was concentrated in two large-cap stocks, namely FPT, up 0.81%, and CMG, up 0.36%… Conversely, the number of stocks that stood at the reference price remained high, and selling pressure persisted in some stocks such as VTB, down 0.46%, and CMT, down 0.7%. Currently, this sector has the third-highest return on the market since the beginning of the year, only behind telecommunications and industry.

Source: VietstockFinance

|

Source: VietstockFinance

|

Following the energy stocks, they also recovered positively after two consecutive losing sessions, and the market breadth was divided with most stocks standing at the reference price. Buying interest was concentrated in some large-cap oil and gas stocks such as BSR, up 0.46%, PVD, up 0.43%, PVC, up 0.97%, and PSB, up 1.85%. Meanwhile, the remaining stocks were in negative territory, such as TMB, down 1.92%, MGC, down 1.69%, and NBC, down 1.08%.

Compared to the opening, buyers and sellers were locked in a fierce tug-of-war, with more than 1,000 stocks standing at the reference price, and buyers slightly outperformed with 272 gainers (14 stocks hitting the ceiling price) while there were 261 losers (8 stocks hitting the floor price).

Source: VietstockFinance

|

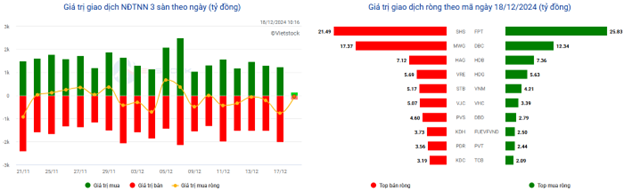

Additionally, as of 10:30 am, foreigners continued to net sell more than VND 28 billion. The selling pressure mainly came from SHS (VND 21.51 billion), MWG (VND 16.68 billion), HAG (VND 7.12 billion), and VRE (VND 5.98 billion). Conversely, on the buying side, FPT, DBC, HDB, and HDG were net bought the most, with a total net bought value of more than VND 50 billion.

Source: VietstockFinance

|

Opening: Green dominated most sectors

At the beginning of the December 18 session, the VN-Index rose more than 2 points to 1,263.81 points. Meanwhile, the HNX-Index edged up slightly to 226.69 points.

The Dow Jones index made history on Tuesday (December 17) with a 9-session losing streak for the first time since 1978. Specifically, at the end of the December 17 session, the Dow Jones index fell 267.58 points (equivalent to 0.61%) to 43,449.90 points. The S&P 500 lost 0.39% to 6,050.61 points, while the Nasdaq Composite fell 0.32% to 20,109.06 points.

The green dominated the VN30 basket with 10 losers, 14 gainers, and 6 stocks standing at the reference price. Specifically, GAS, FPT, and BID were the best-performing stocks. Conversely, stocks such as VJC, SSB, and POW fell slightly by 0.69%, 0.58%, and 0.4%, respectively.

As of 9:30 am, information technology stocks were leading the market. Notably, FPT and CMG rose 0.54% and 0.91%, respectively.

In addition, consumer staples stocks also maintained a stable growth rate from the beginning of the session, with stocks such as MCH up 0.78%, SAB up 0.35%, VNM up 0.46%, MSN up 0.14%, QNS up 1.17%, DBC up 1.29%, HNG up 3.85%,…