At the event announcing the Research Report on the Vietnam Real Estate Market in 2024 and forecasting the market for 2025, held on January 8, experts from the Institute for Economic, Financial, and Real Estate Research Dat Xanh Services (DXS – FERI) shared that, by the end of 2024, the real estate market had left the bottom behind. Especially with the early enforcement of four laws related to the real estate market (the 2024 Land Law, the 2023 Housing Law, the 2023 Real Estate Business Law, and the 2024 Law on Credit Institutions) from August 1, 2024, many positive signs have emerged, which are expected to lay the foundation for transparent and stable development in the new cycle. This also partly promotes the acceleration of project development and the increase in new housing supply.

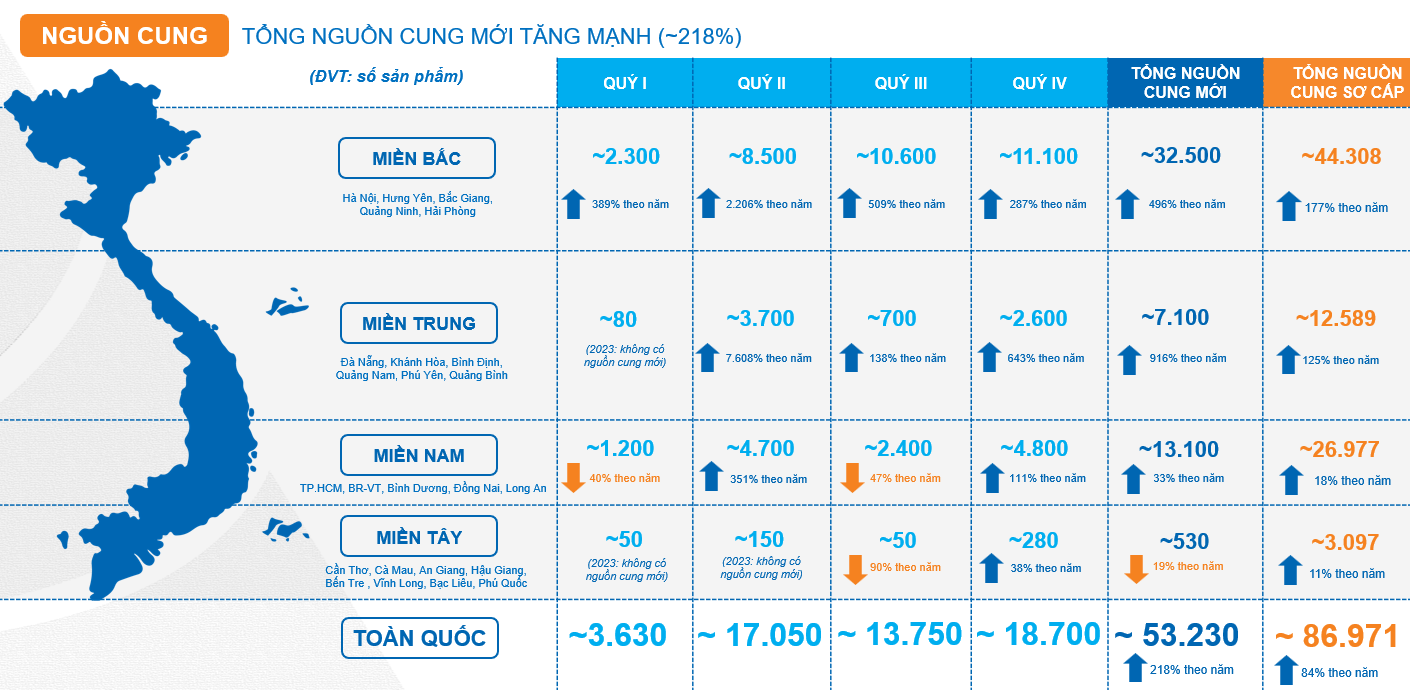

According to Ms. Trinh Thi Kim Lien, Director of DXS Business Marketing, the total national supply in 2024 reached 53.2 thousand products, a significant increase of 218% compared to 2023. Of which, the new supply mainly focused on the North with 32.5 thousand products, up 496% year-on-year, accounting for more than 60% of the country’s total new supply. In the Central region, the new supply is estimated at 7.1 thousand products, up 916%, the highest increase among all regions. The South’s new supply is estimated at 13.1 thousand products, up 33%. Meanwhile, the supply in the West decreased by 19%, reaching only 530 products, the most limited supply area in the country.

The new supply, combined with the primary supply from the old project baskets, brought the total primary supply of the whole market to 86,971 products, up 84% compared to 2023.

|

Real Estate Housing Supply in 2024

Source: DXS-FERI

|

Transaction volume doubled

The absorption rate on the total primary supply of the whole market improved significantly, reaching 30-35%, an increase of 125% compared to 2023. At the same time, the transaction volume reached 33 thousand products, an increase of nearly 20 thousand products (2.5 times) compared to 2023. Among them, the North has the best absorption rate (45-50% on average), followed by the South (25-30%), the Central (20-25%), and the West has the lowest absorption rate (10-15%). “The absorption rate increased gradually over the quarters, similar to the market recovery rhythm, with the North recording a slight decrease in the absorption rate in the fourth quarter compared to the third quarter,” said Ms. Lien.

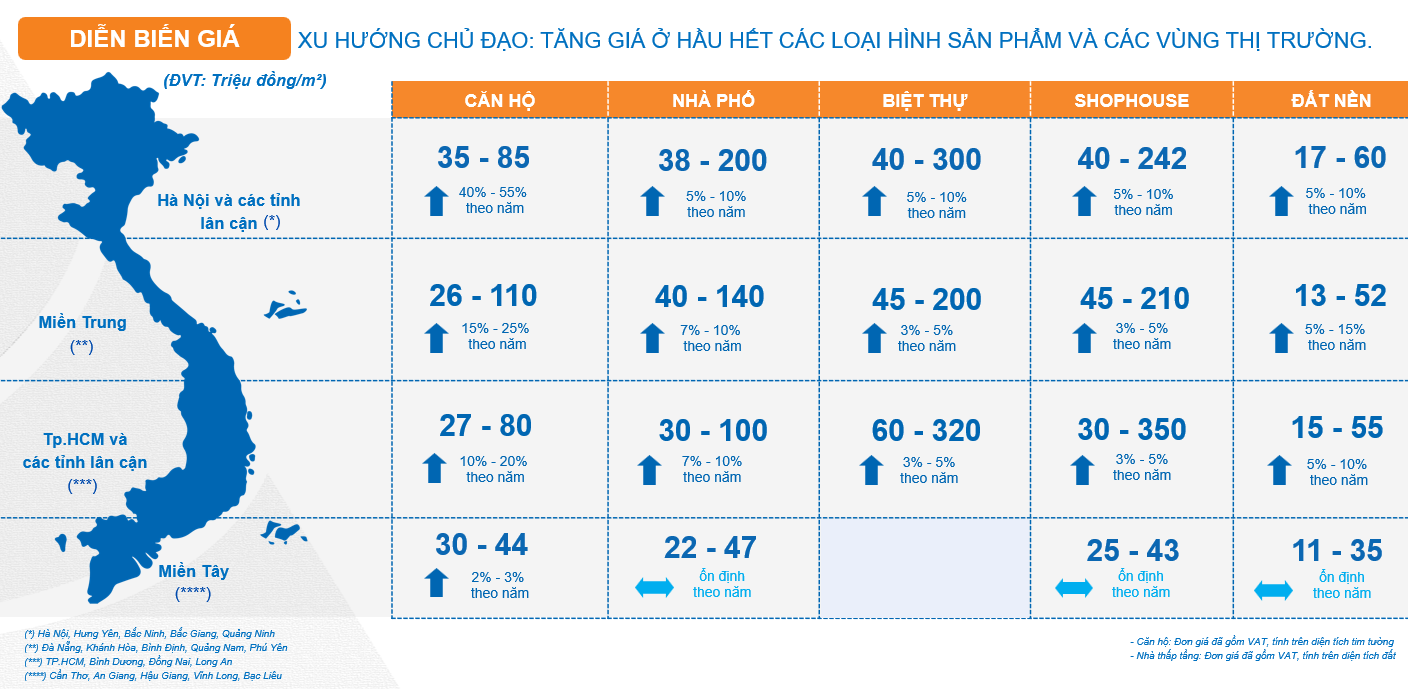

DXS-FERI statistics show that apartment transactions recorded price increases in all regions nationwide. Among them, Hanoi and its neighboring provinces had the highest increase, up to 40-55% year-on-year. Next is the Central region with an increase of 20-25%. Ho Chi Minh City and its neighboring provinces increased by 10-20%, and the West increased by 2-3% year-on-year.

For the townhouse, villa, shophouse, and land plot segments, except for the West region, where prices remained stable year-on-year, the rest tended to increase, with a common increase of 3-10%.

Source: DXS-FERI

|

Hanoi apartment prices up 30-60%, Ho Chi Minh City up 5-30%

The apartment market in the two major cities showed strong growth in selling prices and absorption rates, although the supply situation was contrasting. Specifically, new apartments in Hanoi increased sharply by 293% in 2024, reaching more than 22.3 thousand units; Ho Chi Minh City’s new supply reached only 6,429 products, down 21%.

The absorption rate in Hanoi reached 75-80% and Ho Chi Minh City reached 50-55%. In some new projects, the absorption rate was recorded at over 90%.

In terms of selling prices, Hanoi apartments recorded a higher rate of increase than Ho Chi Minh City. By the end of 2024, Hanoi apartment prices had approached the price level in Ho Chi Minh City and even surpassed it in some segments. Specifically, apartments in the A+ segment in Hanoi are priced from 200-250 million VND/sqm, up 30-40% year-on-year, while Ho Chi Minh City’s price range is from 300-400 million VND/sqm, up 20-30%.

Apartments in the A segment in Hanoi are priced from 120-150 million VND/sqm, up 35-50%; Ho Chi Minh City’s price range is from 120-160 million VND/sqm, up 15-20%. Apartments in the B segment in Hanoi are priced from 80-110 million VND/sqm, up 40-60%; Ho Chi Minh City’s price range is from 70-95 million VND/sqm, up 10-15%. Apartments in the C segment in Hanoi are priced from 55-70 million VND/sqm, up 45-50%; Ho Chi Minh City’s price range is from 40-60 million VND/sqm, up 5-10%.

Ms. Lien explained that the good growth in Hanoi and Ho Chi Minh City was partly due to the psychology of wanting to invest in large cities with high liquidity instead of spreading investments as in the previous period and partly due to the fear of rising selling prices, so customers took advantage of buying at an “acceptable” price range.

The expert said that the time to decide on a transaction has shortened: the average time from learning about a product to deciding to buy it in 2024 decreased significantly compared to 2023, showing that customers have more trust and make faster decisions to buy real estate.

Event announcing the Research Report on the Vietnam Real Estate Market in 2024 and forecasting the market for 2025 by DXS-FERI. Photo: TV

|

Housing scenario forecast for 2025

Mr. Luu Quang Tien, Deputy Director of DXS-FERI, said that for the real estate market to recover and develop sustainably, there need to be necessary and sufficient related conditions: (1) macro-economy; (2) institutional framework; (3) planning and national development strategy; (4) monetary policy; (5) project legality; (6) demographics; (7) infrastructure; (8) capacity of investors; and (9) financial resources of related parties.

Thanks to the coordination of the Government through a series of policies, combined with the specific needs of each locality, the Vietnamese real estate market has clearly shown the role of the “leading wave” regions and the “following wave” regions. Demand in 2025 is expected to improve, with buying power focusing mainly on the “leading wave” markets, including major cities such as Hanoi, Danang, Ho Chi Minh City, and Binh Duong, and some “following wave” markets, including satellite cities of the “leading wave” provinces.

Specifically, in the North, Hanoi is still the leading market; the “following wave” areas are Hai Phong, Hung Yen, Ha Nam, Bac Ninh, Bac Giang, and Thanh Hoa, attracting much interest in apartments, low-rise project houses, and detached houses. In the Central region, the “leading wave” market is Danang, with demand focusing on mid- and high-end apartments. The “following wave” markets are Khanh Hoa, Quang Nam, Quang Binh, and Hue, attracting customers to apartments and resorts.

In the South, Ho Chi Minh City and Binh Duong continue to be the “leading wave” markets thanks to the interest of customers with real housing needs in Ho Chi Minh City, neighboring provinces, and customers from the North. The “following wave” markets are Ba Ria – Vung Tau and Dong Nai, which are expected to see notable activities in the apartment and resort segments.

In the West, the Long An market is expected to be the “following wave” area of the Ho Chi Minh City market and, at the same time, will be the “leading wave” area for the Western region, with the prominence of apartments and low-rise houses from projects by investors such as Vinhomes, Ecopark, and Nam Long. Can Tho and Kien Giang (Phu Quoc) markets are also expected to be the “following wave” markets in the Western region.

DXS-FERI experts forecast that the Vietnamese housing market in 2025 will have positive changes, with new supply significantly improved compared to 2024. However, the growth rate and absorption rate will depend on many factors, creating three different scenarios. Specifically, the ideal scenario: New supply increases by 40-50%, floating interest rates are at 9-11%, selling prices increase by 15-20%, and the absorption rate reaches 40-45%. This is the most optimistic scenario, expecting an early market recovery.

Expected scenario: New supply increases by 30-40%, floating interest rates are at 10-12%, selling prices increase by 10-15%, and the absorption rate reaches 35-40%. DXS-FERI believes that this is the most feasible scenario, reflecting the improved positive growth of the market.

Challenging scenario: New supply increases by 20-30%, floating interest rates rise to 11-13%, selling prices increase by 5-10%, and the absorption rate is only 30-35%.

A Special Edition Honda SH Has Arrived: ‘Unboxed’ with Subtle Yet Beautifully Crafted Tweaks

An exclusive version of the Honda SH has arrived in Vietnam, captivating the hearts of enthusiasts nationwide.

Do Bonuses for the Vietnamese National Football Team Have to Pay Personal Income Tax?

At a press conference held by the Ministry of Finance on January 7, Deputy Director of the General Department of Taxation, Mai Son, announced that the monetary bonuses and commemorative medals awarded to the Vietnamese football players following their victory in the 2024 ASEAN Cup will be exempt from personal income tax.

The All-New Kia Carnival Hybrid 2025: Unveiling Cutting-Edge Technologies, Setting the Benchmark in the Automotive Industry.

Alongside its all-new hybrid engine, the Kia Carnival HEV boasts an array of additional tech features that set it apart from its diesel counterpart.