The morning rally fizzled out today as the market breadth turned indecisive. Many stocks that had been surging recently started to see profit-taking, but most remained in positive territory. Notably, YEG was the only stock stuck at the lower limit price after a remarkable 125% surge in December alone.

The short-term performance of small and mid-cap stocks has been significantly better than that of blue chips or basic stocks. The shift in hot money has also kept liquidity high in this group. After yesterday’s sudden surge, many speculative stocks witnessed impressive profit gains, encouraging short-term investors to take profits.

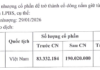

The most shocking performer lately has been YEG, with a staggering increase of nearly 125% since the beginning of December to its peak this morning. If we consider the accumulation phase from early October, the stock has soared by 175%. YEG even made it to the top 5 most traded stocks in the market. This morning, YEG witnessed another dramatic surge to the upper limit before facing substantial selling pressure. The price plummeted from the upper limit straight to the lower limit, with a sell order of over 5.3 million shares at the lower limit price. YEG’s trading volume reached approximately 150.6 billion VND with 6.44 million shares traded.

While many strongly speculative stocks from the past few days also showed signs of selling pressure, the intensity was not enough to trigger a shocking reversal like YEG. In reality, these stocks have only been sold off at higher levels and are gradually being pushed down, with many yet to breach the reference price. The group of stocks experiencing deep losses this morning was quite limited, with KBC, HAH, APG, BVH, CII, and GIL joining YEG. The HoSE floor currently has 52 stocks declining by more than 1%, but they only account for 9.2% of the total matched orders on the exchange. Excluding YEG, the trading volume of the remaining 51 stocks accounts for just 6.1%.

The HoSE floor maintained a balanced market breadth at the end of the morning session, with 189 gainers and 197 losers. Despite the slight edge of declining stocks, the trading activity remained vibrant among the gainers. Specifically, out of the 189 stocks in the green, 73 rose by more than 1%, accounting for 24.1% of the floor’s liquidity. New investors are strategically waiting to sell at better prices and are limiting the upside potential. Examples include STB, BID, PVD, DIG, AAA, HAX, and FCN, which are still performing well despite adjusting more than 1% from their daily highs.

With nearly 67% of VN-Index’s liquidity and 64% of its constituent stocks (with trading activity this morning) confined within a narrow range, the market is relatively balanced following yesterday’s strong surge. HoSE’s liquidity also witnessed a significant decline of 54% compared to yesterday morning, reaching only 4,788 billion VND. The market has cooled down considerably, and supply and demand have returned to a passive equilibrium.

The blue-chip group is also witnessing a tug-of-war, despite a few strong performers. Notably, STB rose by 1.79%, VIB by 1.56%, GAS by 1.17%, and BID by 1.03%. On the downside, BVH lost 1.87%. However, the VN30 basket’s market breadth showed 13 gainers versus 15 losers, and the weak performance of the large caps failed to exert a substantial impact on the index. Consequently, the VN30-Index is slightly down by 0.04%, while the VN-Index decreased by 0.02% (-0.2 points).

Small-cap stocks naturally still hold an advantage, but with the market turning lackluster after several strong sessions and the excitement fading, their performance is less impressive. Among the 9 stocks that hit the upper limit, most had insignificant trading volumes. Notably, PGV traded 3.6 billion VND, BMC 9 billion VND, SCR 36.2 billion VND, and HPX 23.2 billion VND. Other strong performers include HQC, up 5.41%; FCN, up 5.15%; SKG, up 4.07%; KHP, up 3.86%; APH, up 3.84%; HAX, up 3.2%; and LBM, up 3.06%…

Foreign investors, after the Christmas holiday, unexpectedly resumed strong net selling on the HoSE floor, with net selling of approximately -355.8 billion VND. Notable stocks that faced selling pressure included VCB (-85.6 billion VND), STB (-39.4 billion VND), FPT (-28 billion VND), and VNM (-26.1 billion VND). On the buying side, VHM stood out with a net purchase of 21.3 billion VND.

The slowdown in market activity is not surprising given the sudden surge yesterday and the notable inflow of funds. The euphoria did not last overnight, and investors turned more cautious. As hot stocks cooled down or started facing selling pressure, short-term opportunities diminished. The process of reshuffling capital allocation remains unclear.

The Ultimate Profit-Making Avenue: Bitcoin’s Reign, Hanoi’s Apartment Frenzy, and the Lagging Stock Market

Digital currency reigns supreme over physical assets in 2024. In Vietnam, apartments in big cities, stocks, and gold bars pale in comparison to Bitcoin when it comes to returns.

The Cautious Sentiment Rises

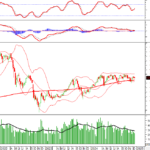

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the Middle Bollinger Band. If the index manages to hold its ground above this level in the upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

Stock Market Week of 12/16/2024 – 12/20/2024: A Prevailing Mood of Caution

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.

Vietstock Weekly: Navigating Short-Term Risks

The VN-Index ended a rather pessimistic trading week as it continued to lose points and fell below the Middle Bollinger Band. The decline was accompanied by a drop in trading volume below the 20-week average, indicating limited participation of funds in the market. Currently, the MACD indicator is poised to give a sell signal as it narrows its gap with the Signal Line. Should this occur in the coming period, the index’s situation will turn even more negative.