Mr. Luu Quang Tien, Vice President of the Institute of Economic – Financial – Real Estate Research, Dat Xanh Services (DXS-FERI), shared insights into the positive growth of the industrial real estate supply in 2024, particularly in the northern region. The supply increased by 9% compared to the previous year, reaching 15,800 ha, while the southern region recorded 28,100 ha, a 2% increase.

Meanwhile, the occupancy rate witnessed a slight dip of 1% from the previous year, settling at 82% in the north, and remained stable at approximately 91% in the south.

Rental rates for industrial real estate continued their upward trajectory, with a growth margin of 6-8% compared to 2023. The average rate stood at 132 USD/m2 in the north and 185 USD/m2 in the south.

According to Mr. Tien, the industrial real estate sector has been undergoing a noticeable transformation. The land area in industrial parks (IPs) has been increasing significantly, and there has been a diverse development of ready-built factories and warehouses, custom-built facilities, and cold storage. Industrial real estate remains a magnet for investment, attracting substantial FDI, particularly in high-tech sectors such as processing, electronics, automotive components, green technology, and semiconductors.

The M&A market for industrial real estate has also been vibrant, with investors seeking large-scale land funds to capitalize on the shift of supply chains to Southeast Asia, especially Vietnam.

2024 marked a shift, with domestic and foreign investors in residential real estate venturing into the industrial real estate sector. This move aligns with the government’s focus on sustainable planning for IPs, emphasizing the adoption of green technologies and environmental friendliness to meet global standards and Vietnam’s “net zero” goal by 2050.

From 2024 to 2026, Vietnam is expected to add approximately 15,000 ha of new supply from 23 new IPs, including 7 in the north, 6 in the central region, and 10 in the south.

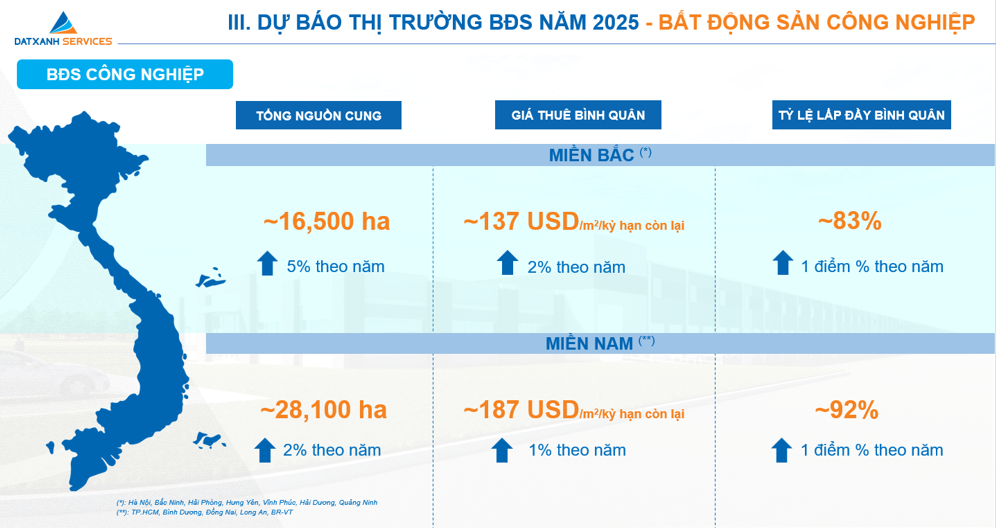

Looking ahead, DXS-FERI experts forecast a slight increase of 2-5% in the supply of industrial park real estate in 2025, attributed to the approval and ongoing construction of projects like the Trang Due Industrial Park (Haiphong) Phase 3, covering 687 ha, and the Loc Giang Industrial Park (Long An) with 466 ha.

FDI inflows, driven by the global supply chain relocation trend to mitigate trade conflict risks, are expected to sustain demand growth. DXS-FERI anticipates stable high occupancy rates of 83% in the north and 92% in the south. Rental rates are projected to increase marginally by 1-2% due to limited supply compared to demand, with the north offering more competitive rates.

The experts emphasize the emergence of new models and types of industrial parks to meet the stringent requirements of international tenants, especially those in the high-tech sector. The rapid growth of e-commerce in Vietnam fuels the development of logistics, data centers, service warehouses, and RBW (Ready-built warehouses).

There is also a growing trend of eco-friendly and scenic industrial parks, flexible conversions between warehouses and factories, RBF (Ready-built factories), and custom-built facilities. With the Land Law 2024 broadening the scope of eligible investors and transferees of industrial real estate, DXS-FERI anticipates a more vibrant M&A market in 2025.

Source: DXS-FERI

|

– 19:03 09/01/2025

The New Rent: Navigating Ho Chi Minh City’s Revised Rental Landscape

Compared to Decision 22/2018, the rental rates for old public housing in Ho Chi Minh City, which has been allocated for use since January 19, 2007, has seen a significant increase with a multiplier of 3, up from the previous rate of 2.

How to Find Gold While Sifting Through Sand: A Guide to Seizing Opportunities

Sharing his insights at the ‘Khớp lệnh’ program on November 25, 2024, Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities Joint Stock Company (VPBankS), asserted that several sectors exhibit positive signals based on their profit growth prospects for 2025. These sectors are expected to be relatively unaffected by external factors and offer suitable valuation ranges.