Marketing Update for December 16, 2024

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 385 million shares, equivalent to a value of over 9.2 trillion VND; HNX-Index reached over 35.6 million shares, equivalent to a value of over 570 billion VND.

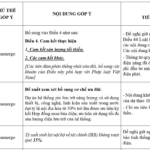

At the start of the session, with selling pressure continuing to dominate, the VN-Index continued to weaken, but a sudden return of buying pressure helped the index recover and turn green by the end of the session. In terms of impact, BID, HVN, VNM, and VHM were the codes with the most positive impact on the VN-Index, with an increase of over 1.6 points. On the contrary, HPG, GVR, MBB, and GAS were the codes with the most negative impact, but the impact was not significant.

| Top 10 stocks with the strongest impact on the VN-Index on December 16, 2024 |

Similarly, the HNX-Index also had a fairly positive performance, with the index positively impacted by the KSV (+9.97%), IDC (+1.42%), MBS (+0.69%), and SHS (+0.76%) codes…

|

Source: VietstockFinance

|

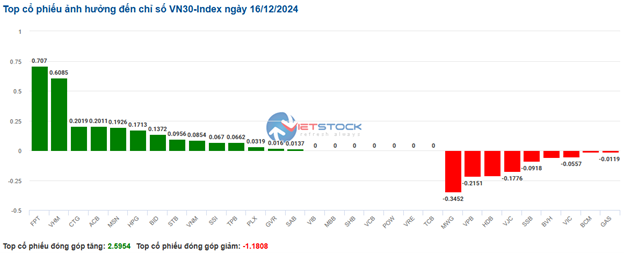

The essential consumer goods industry was the group with the best market performance, with a 0.99% increase mainly driven by the VNM (+1.25%), DBC (+0.19%), KDC (+2.25%), and HAG (+0.81%) codes. Following the recovery were the telecommunications and industrial sectors, with increases of 0.63% and 0.44%, respectively. On the contrary, only the energy sector had the largest decrease in the market, at -1.4%, mainly driven by the BSR (-2.22%), PVS (-0.59%), TMB (-0.27%), and THT (-1.63%) codes.

In terms of foreign trading, they continued to sell a net of over 204 billion VND on the HOSE exchange, focusing on the HPG (148.28 billion), PDR (54.78 billion), BID (54.66 billion), and DIG (35.58 billion) codes. On the HNX exchange, foreigners bought a net of over 3 billion VND, focusing on the IDC (23.68 billion), VTZ (2.09 billion), and TVC (1.91 billion) codes.

| Foreigners’ net buying and selling flow |

Morning session: Turning red

After the short-lived excitement at the beginning of the session, the VN-Index gradually lowered its altitude and even turned red at the end of the morning session. At the midday break, the VN-Index fell slightly by 0.07%, settling at 1,261.66 points; HNX-Index decreased by 0.11%, reaching 226.74 points. The number of declining codes exceeded the number of advancing codes, with 334 declining codes and 230 advancing codes.

The initial upward momentum failed to attract buying pressure as there were no significant catalysts. Liquidity continued to hover at low levels, with the matched trading value in the morning session reaching just over 3.9 trillion VND on the HOSE exchange and over 262 billion VND on the HNX exchange.

Most of the stocks in the VN30 basket rose or fell slightly around the reference level, with only BID up 1.2%. This was also the stock with the most positive impact on the VN-Index in the morning session, contributing nearly 0.8 points. In contrast, MWG, VCB, and TCB were the codes with the most negative impact on the overall index.

In terms of sectors, the energy group was at the “bottom” with a decrease of nearly 2% due to the large pressure on BSR (-2.67%), as this stock accounts for more than 60% of the sector’s market capitalization. Most of the other sectors fluctuated within a narrow range. The essential consumer goods sector led the recovery, with the positive performance of MCH (+3.11%), VLC (+3.51%), VNM (+0.62%), and HAG (+1.21%)…

Foreign net selling continued this morning, with a value of nearly 68 billion VND on the HOSE exchange in the morning session. The selling volume was concentrated in BID (36.51 billion) and DIG (30.68 billion) stocks. Meanwhile, SIP (43.43 billion) led the net buying side. On the HNX exchange, foreigners sold a net of nearly 9 billion VND, focusing on selling the PVS (6.51 billion) code.

10:30 am: The challenge of surpassing the 1,265-point threshold for the VN-Index remains

Investors’ hesitation continued to cause the main indices to fluctuate around the reference level. As of 10:30 am, the VN-Index increased by 2.16 points, trading around 1,264 points. HNX-Index increased by 0.23 points, trading around 227 points.

Most of the stocks in the VN30 basket maintained a positive momentum. Notably, FPT, VHM, CTG, and ACB contributed 0.7 points, 0.6 points, 0.2 points, and 0.2 points to the VN30 index, respectively. On the contrary, MWG, VPB, HDB, and VJC were the stocks still facing selling pressure, but the impact was not significant.

Source: VietstockFinance

|

The essential consumer goods group led the current recovery, although their performance was somewhat mixed. Specifically, on the buying side, the green color appeared in stocks such as MSN up 0.28%, VNM up 0.16%, DBC up 0.75%, and HAG up 1.61%… The rest remained unchanged or faced slight selling pressure, such as BAF, QNS, ANV, and SBT, but the decline was not significant.

Following this was the information technology sector, which also contributed to the overall market’s upward momentum. In particular, the two industry leaders, FPT and CMG, increased by 0.47% and 1.29%, respectively. Additionally, the green color was also observed in stocks such as SMT up 5.88%, CMT up 2.14%, and ITD up 0.38%.

However, the energy group exhibited mixed performance, with the selling side regaining dominance after an eight-session winning streak. The selling pressure was concentrated in BSR, which decreased by 1.33%, PVC by 0.96%, PVB by 0.36%, THT by 1.63%, and HLC hitting the daily lower limit… Only a few stocks managed to maintain a modest gain, such as PVD up 0.21%, TMB down 0.96%, and NBC up 2.15%.

Compared to the beginning of the session, the fluctuating state persisted, with over 1,000 codes unchanged and the buying side slightly dominating. There were over 280 advancing codes and over 240 declining codes.

Source: VietstockFinance

|

Opening: Mild increase at the beginning of the session

At the start of the December 16 session, as of 9:30 am, the VN-Index turned green immediately and increased by nearly 3 points, reaching 1,264.71 points. Meanwhile, the HNX-Index also witnessed a slight increase, maintaining its level at 227.17 points.

The green color temporarily dominated the VN30 basket, with 9 declining codes, 16 advancing codes, and 6 unchanged codes. Among them, HDB, VJC, and BCM were the stocks with the largest decreases. On the contrary, BID, POW, PLX, and MSN were the stocks with the strongest increases.

The telecommunications services group was one of the most prominent sectors at the beginning of the morning session. Stocks that traded positively from the start included YEG, which increased by 1.7%, VGI by 0.89%, CTR by 0.66%, DST by 7.32%, and MFS by 0.28%…

Along with this, the essential consumer goods group contributed positively to the market’s performance this morning. Notably, stocks such as MCH increased by 1.86%, MSN by 0.42%, VNM by 0.16%, HAG by 0.4%, VLC by 4.09%, and KDC by 0.52%…