At a depth of almost 1,000 meters below the earth’s surface, explosives break through ancient rocks to extract a critical mineral that plays a key role in reducing carbon emissions, which are warming our climate: Nickel.

Image: Carboncredits

Harder than iron, as durable as copper, but superior to both in its resistance to oxidation and corrosion, nickel serves a multitude of industries, including the production of stainless steel, which consumes nearly 80% of the world’s nickel supply.

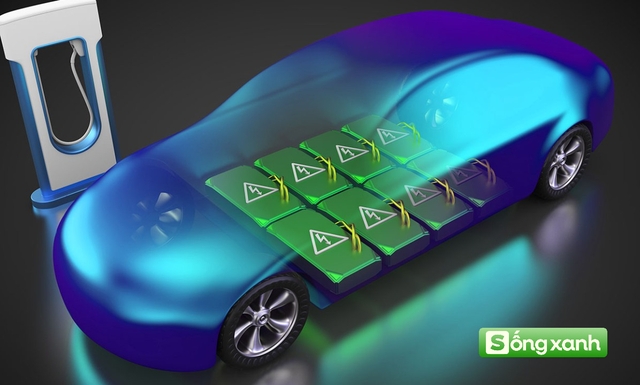

With the global electric vehicle market booming amid the need for more robust climate action, metals capable of long-term energy storage are in high demand. Nickel, a shiny, silver-white metal, is one of them. Its importance was highlighted by Forbes back in 2019, which stated, “Gold is hot, but there’s another metal that’s even hotter: Nickel.” The magazine substantiated this claim by showing that nickel outperformed gold in terms of returns, delivering twice the performance of gold during the same period, and this gap could widen further in the future due to stagnant supply and accelerating demand in the electric vehicle battery and energy storage sectors.

This in-demand metal is also found in Vietnam, particularly in the northern provinces. According to a 2021 study by ThS. Dao Cong Vu from the Institute of Mining and Metallurgy (Ministry of Industry and Trade), Vietnam’s total reserves and nickel resources are estimated at approximately 3.6 million tons of nickel metal, mainly concentrated in Thanh Hoa (3,067,020 tons), Son La (420,523 tons), and Cao Bang (133,677 tons).

While Vietnam’s reserves are not as abundant as those of other countries, producing nickel salts and utilizing nickel ore for battery manufacturing can bring dual benefits. Firstly, it can meet the growing demand for electric vehicles and renewable energy, and secondly, it can harness the potential of this valuable natural resource in Vietnam.

Nickel to Stir Up the Global Market by 2025

As of mid-2024, the global nickel market continues to experience a short-term surplus. However, despite these short-term pressures, nickel remains a crucial component in the green transition, especially in electric vehicle (EV) batteries, as emphasized by ING Bank (Netherlands).

The International Nickel Study Group (INSG) has recently updated its nickel market forecast, predicting that the surplus will narrow to 135,000 tons by 2025, with production reaching 3.649 million tons and demand climbing to 3.514 million tons.

The year 2025 could be a turning point, sending nickel prices soaring. Bloomberg reports that the Indonesian government is considering cutting its nickel mining quota by nearly 40% in 2025. According to Macquarie Group Ltd, the proposed restrictions on nickel mining activities by the Indonesian government could “reduce global supply by more than a third, pushing up prices.”

A recent analysis by Benchmark delved into the key trends and risks shaping the future of this energy transition material, with a particular focus on nickel. By 2034, nickel is projected to face a supply deficit of 839,000 tons, nearly seven times the current surplus. This underscores the urgent need to address the looming supply shortfall.

Soaring demand for electric vehicles has driven up the prices of metals capable of long-term energy storage. Image: Internet

Benchmark estimates that the world needs to invest approximately $514 billion (with $220 billion allocated to upstream projects) to meet global battery demand by 2030. Of this, nickel requires $66 billion—the highest among all green materials. Without these investments, sustaining the rapidly expanding EV market could become significantly more challenging.

Benchmark further explains how the nickel market is grappling with slow project development. While large-scale production plants and processing facilities can become operational within five years, mines typically take between 5 and 25 years to develop. This imbalance creates a “supply-demand disconnect” for nickel, threatening the EV supply chain.

Nickel’s pivotal role in the energy transition necessitates immediate investment in extraction. Without sufficient raw materials, even the most advanced gigafactories will fall short of EV production targets. Addressing this resource shortfall is crucial to stabilizing the supply chain.

As demand for nickel continues to rise, securing the necessary $66 billion in investment will be vital to meet the impending challenges by 2025. However, the market’s future hinges on resolving supply shortages and adapting to shifting global dynamics.

The U.S. Department of Energy’s Critical Materials Assessment, published in 2024, classified nickel as a near-critical material (along with uranium, platinum, and magnesium). This classification underscores its increasing importance in green energy applications and supply risks.

The International Energy Forum (IEF) emphasizes that nickel is a versatile metal. Beyond its traditional use in stainless steel, nickel has emerged as a crucial element in green technology, with the IEA projecting a 65% increase in demand by the end of this decade.

References: Forbes, Carboncredits, USGS, Vietnam Ministry of Industry and Trade, International Energy Forum (IEF)