**BIDV’s Q4 and Full-Year 2024 Results: A Comprehensive Overview**

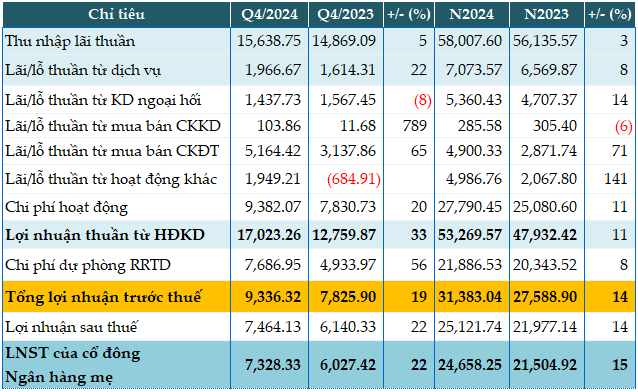

BIDV’s performance in Q4 2024 remained relatively stable, with a slight increase in core operations, generating VND 15,638 billion in net interest income, a modest 5% growth year-on-year.

A notable highlight of the bank’s performance in the last quarter was the significant boost in non-interest income sources. Service activities yielded nearly VND 1,967 billion, reflecting a 22% increase compared to the previous year. Additionally, trading activities in securities resulted in a profit of almost VND 104 billion, a substantial improvement from the mere VND 12 billion in the same period last year. Furthermore, profit from investment securities trading witnessed a 65% surge, climbing to VND 5,164 billion. Most remarkably, the “other activities” category turned around from a loss to a profit of over VND 1,949 billion.

Despite a 20% rise in operating expenses, amounting to VND 9,382 billion, BIDV’s bottom line benefited from the overall growth in its business, resulting in a 33% increase in net profit from business operations, surpassing VND 17,023 billion.

In the fourth quarter, BIDV allocated nearly VND 7,687 billion for credit risk provisions, marking a 56% increase. Nevertheless, the bank’s pre-tax profit still climbed by 19%, reaching over VND 9,336 billion.

For the full year 2024, BIDV’s pre-tax profit exceeded VND 31,383 billion, representing a solid 14% year-on-year growth.

|

BID’s Q4 and 2024 Financial Results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of 2024, BIDV’s total assets surpassed VND 2.76 quadrillion, indicating a 20% expansion from the beginning of the year. Notably, the bank’s deposits at the State Bank of Vietnam increased by 79% (VND 92,341 billion), while customer lending grew by 16% (nearly VND 2.1 quadrillion). Customer deposits also rose by 15%, surpassing VND 1.95 quadrillion.

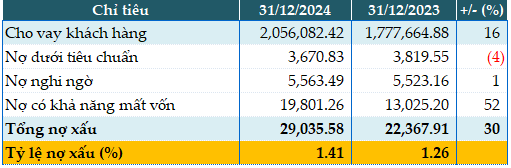

The bank’s total non-performing loans as of December 31, 2024, stood at VND 29,035 billion, a 30% increase compared to the start of the year. Consequently, the non-performing loan ratio edged up slightly from 1.26% to 1.41%.

|

BID’s Loan Quality as of December 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

Hàn Đông

– 09:12 25/01/2025

“Sacombank: 33 Years of Solid Partnership with the People and Businesses of Vietnam”

After over three decades of groundbreaking work and continuous innovation, Sacombank has transformed itself with impressive growth potential, ready to embrace its 33rd year with confidence and an elevated stature.

The Road to Success: SGR Aims High with a Profitable Future in Mind, Targeting 365 Billion VND by 2025.

Joint Stock Commercial Company Saigon Real Estate (Saigonres, HOSE: SGR) has just approved the draft production and business plan for 2025 with a projected consolidated revenue of VND 1,078 billion and an after-tax profit of VND 365 billion.