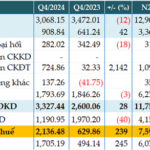

Eximbank experienced a comprehensive growth spurt in the fourth quarter. Net interest income increased by 9% year-on-year, surpassing VND 1,518 billion.

Non-interest income sources saw a surge, with service income increasing by 5.8 times (VND 742 billion) and foreign exchange trading profits soaring by 7.7 times (VND 185 billion). Additionally, the bank successfully turned losses from securities investment trading into gains.

Operating expenses rose by only 6%, reaching VND 967 billion. Consequently, profit from business operations climbed by 64% to VND 2,075 billion. Eximbank set aside nearly VND 265 billion in provisions for the quarter, resulting in a pre-tax profit of over VND 1,810 billion, an impressive 80% increase year-on-year.

For the full year 2024, Eximbank’s pre-tax profit exceeded VND 4,188 billion, a substantial 54% increase from the previous year. However, the bank fell short of its annual target, achieving only 80% of the VND 5,180 billion pre-tax profit goal.

|

EIB’s Q4 and 2024 Business Results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of 2024, Eximbank’s total assets stood at VND 239,768 billion, reflecting a 19% increase from the beginning of the year. Meanwhile, deposits with other credit institutions decreased by 30% (to VND 29,829 billion), and outstanding loans reached VND 165,154 billion, a rise of 18%.

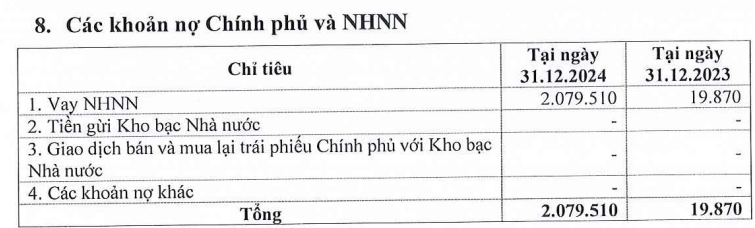

Borrowings from the State Bank of Vietnam witnessed a sharp increase to VND 2,079 billion, compared to nearly VND 20 billion at the start of the year. Customer deposits grew by 7% year-to-date, totaling VND 167,447 billion. Notably, Eximbank recorded VND 7,602 billion in borrowings from other credit institutions at the year’s end, while none were reported at the beginning of the year.

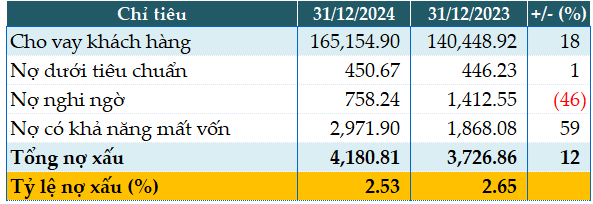

The bank’s total non-performing loans as of December 31, 2024, amounted to VND 4,180 billion, a 12% increase from the beginning of the year. However, the NPL ratio improved, declining from 2.65% to 2.53% during this period.

|

EIB’s Loan Quality as of December 31, 2024. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

– 19:12 24/01/2025

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

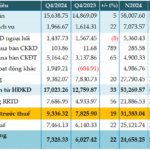

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.

“A Revenue Boost: BIDV’s Pre-Tax Profit Surges by 19% in Q4”

The recently released consolidated financial statements for the fourth quarter of 2024 reveal that the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) recorded a remarkable performance. With a pre-tax profit of over VND 9,336 billion, BIDV witnessed a 19% increase compared to the same period last year. This impressive growth is attributed to the bank’s successful diversification strategy, with a focus on bolstering non-interest income sources.

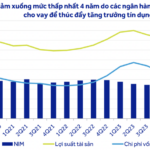

The Future of Banking: A Brighter Outlook with Declining NPA’s and 15% Profit Growth

The banking sector’s financial performance remains robust, indicating a much stronger resilience compared to the previous financial crisis of 2012-2013. The industry’s pre-tax profit forecast for 2025 projects a growth of 14.9% year-over-year, showcasing a healthy and stable outlook.