Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB) announces its Q4 and FY 2024 financial statements with high growth rates, meeting and exceeding targets set by the AGM.

Leading efficiency indicators, breakthrough in digital banking

In 2024, HDBank achieved a pre-tax profit of VND 16,731 billion, up 29% from 2023 and completing 106% of the plan assigned by shareholders. ROA reached 2.04% and ROE was 25.71%, both higher than the previous year and maintained in the group of leading banks in the industry. The consolidated non-performing loan ratio (according to Circular 11) was low at only 1.48%. The capital adequacy ratio (CAR) according to Basel II standards was 14.1%, higher than the requirement of the State Bank of Vietnam. Other operational safety indicators were also guaranteed.

In the consumer finance segment, HD SAISON, a subsidiary, continued to affirm its leading position in the market in terms of profit, reaching VND 1,200 billion, up 84% compared to 2023. This result once again demonstrates the company’s sustainable development strategy, the capacity to maintain high growth, and effective risk management.

HDBank’s total assets reached VND 697,281 billion, up 16% from 2023. Capital mobilization exceeded VND 621 trillion, an increase of 16%, including a rise of 18% in deposits from economic organizations and individuals. Total outstanding loans exceeded VND 437 trillion, up 24%, focusing on sectors that are the driving force of economic growth such as agriculture, rural areas, SMEs, supply chain financing, and more.

HDBank currently serves approximately 20 million customers with 97% of retail transactions conducted on digital platforms. Digital channels contribute to attracting 82% of new customers. The bank has launched numerous products and services on modern digital platforms, which have been well-received by the market, especially the Vikki Digital Bank.

In 2024, HDBank completed the payment of a high dividend of 30%, including 10% in cash and 20% in shares, ranking among the banks with the highest dividend payout in the industry.

Ready to soar in the new development phase

Recently, HDBank was selected by the Government and the State Bank of Vietnam to implement the plan to receive the transfer of DongA Bank. This event not only affirms HDBank’s strong financial foundation and extensive experience in executing restructuring projects but also opens up opportunities to expand its scale, develop new business models, and bring greater value to shareholders, customers, and partners.

In addition to its business activities, HDBank always attaches great importance to fulfilling its social responsibilities with practical and meaningful programs. In 2024, the bank deployed a preferential credit package worth VND 12,000 billion to support customers in recovering production and business and rebuilding after Storm No. 3 in the northern provinces. At the same time, HDBank and its subsidiaries contributed VND 80 billion to the program to eliminate temporary and dilapidated houses nationwide, initiated by the Prime Minister, spreading the spirit of sharing and community responsibility.

HDBank’s efforts in business and social responsibility have been recognized by reputable domestic and international organizations through numerous prestigious awards. The bank was honored for the second time by ADB as the “Leading Partner Bank in Vietnam”, continued to be included in the Vietnam Sustainability Index (VNSI) of HoSE, and notably received the title of “National Brand of Vietnam” in 2024, an important initiative of the Government to honor outstanding brands.

– 08:11 25/01/2025

A Business “They” FLC Overhauls Its Entire Board and Supervisory Team

The four newly elected members of the Board of Directors are Mr. Nguyen Thanh Tung, Mr. Do Manh Hung, Mr. Vu Anh Tuan, and Mr. Trinh Quoc Thi. Mr. Do Manh Hung was also appointed as the new Chairman of the Board.

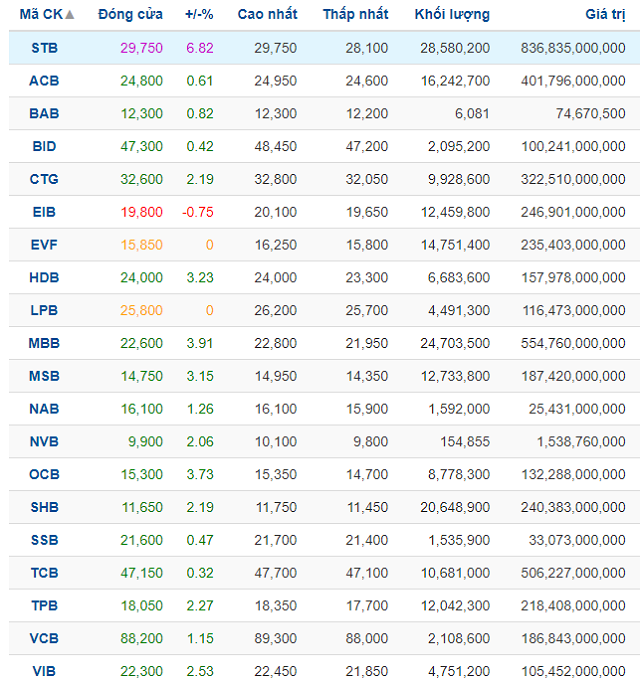

Unlocking Sacombank’s Record-Breaking Success: A Dive into the Bank’s Impressive Q4 Performance and Annual Profits Surpassing 12,000 Billion VND

The bank’s estimated pre-tax profit for Q4 2024 stood at over VND 4,600 billion, a remarkable 68% increase compared to the same period last year. For the full year of 2024, the bank’s pre-tax profit is estimated to exceed VND 12,700 billion, the highest in its history and surpassing the target set by the Annual General Meeting of Shareholders.

The Green Finance Framework: Pioneering Sustainability at HDBank

HDBank has unveiled its Sustainable Finance Framework, aligned with the standards set by the International Capital Market Association (ICMA) and the Loan Market Association (LMA). This framework was developed with technical support from the International Finance Corporation (IFC) and received a “very good” rating from Moody’s.