Services

|

2024 marked a significant growth in KienlongBank’s business operations amidst a volatile market. According to the published financial statements, the bank’s pre-tax profit for the fourth quarter reached VND 352 billion. Operating expenses slightly increased, mainly due to investments in technology upgrades and improvements, focusing on developing digital products and services tailored to specific customer segments and groups.

With these positive results, the cumulative pre-tax profit for 2024 surpassed VND 1,100 billion, achieving 139% of the annual plan. KienlongBank’s financial picture showed remarkable growth and positive signals.

|

As of the end of the fourth quarter of 2024, KienlongBank’s total assets reached VND 92,176 billion, an increase of VND 5,204 billion (6%) compared to the previous year, solidifying its position as a sustainably developing commercial bank. Total capital mobilization reached VND 82,906 billion, an increase of VND 6,963 billion (9.2%), while credit outstanding reached VND 61,431 billion, an increase of VND 8,852 billion (16.8%) compared to the previous year, recording a higher credit growth rate than the industry average.

Firmly executing a comprehensive digital transformation strategy with three main drivers: Technology, Governance, and Human Resources, KienlongBank also achieved significant milestones in management and operations in 2024. The proactive and synchronized implementation of Basel III and ESG standards, along with modern management tools, enabled KienlongBank to improve capital ratio and quality, build larger buffers to mitigate operational risks, and enhance risk management frameworks, contributing to the safe and sustainable development of its business.

In 2024, the bank also elected additional members to its Board of Directors and Supervisory Board at an extraordinary general meeting of shareholders in October. This leadership enhancement aimed to not only improve governance capabilities and comply with the Law on Credit Institutions 2024 but also enable the bank to formulate appropriate strategies and directions for each period to achieve its set goals.

Regarding asset quality, as of December 31, 2024, KienlongBank maintained a low non-performing loan ratio of 1.91%, which is among the lowest in the industry, in compliance with SBV requirements. This achievement is attributed to the bank’s effective control of credit capital, risk management, and focused lending in selective fields, including expanded rice farming loans in the Mekong Delta and linked loans with members of Women’s Unions and farmers.

Despite maintaining a healthy NPL ratio, KienlongBank adopted a cautious approach and optimized its resources for provision and allowance. This strategy aimed to enhance asset quality, strengthen buffers, improve the NPL coverage ratio, and ensure safe and sustainable operations. As a result, the bank’s NPL coverage ratio reached 80% by the end of 2024, a significant increase compared to the previous year.

Wrapping up 2024, KienlongBank’s outstanding business and management performance demonstrated the leadership’s commitment to a robust transformation journey, enhanced service quality, and improved customer experience. As the bank approaches its 30th anniversary (1995-2025), a symbol of innovation, creativity, and sustainable development, KienlongBank is poised for accelerated growth, exceptional performance, and positive contributions to the community and society.

– 10:00 24/01/2025

“A Revenue Boost: BIDV’s Pre-Tax Profit Surges by 19% in Q4”

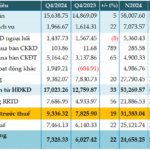

The recently released consolidated financial statements for the fourth quarter of 2024 reveal that the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) recorded a remarkable performance. With a pre-tax profit of over VND 9,336 billion, BIDV witnessed a 19% increase compared to the same period last year. This impressive growth is attributed to the bank’s successful diversification strategy, with a focus on bolstering non-interest income sources.

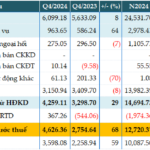

Unlocking Sacombank’s Record-Breaking Success: A Dive into the Bank’s Impressive Q4 Performance and Annual Profits Surpassing 12,000 Billion VND

The bank’s estimated pre-tax profit for Q4 2024 stood at over VND 4,600 billion, a remarkable 68% increase compared to the same period last year. For the full year of 2024, the bank’s pre-tax profit is estimated to exceed VND 12,700 billion, the highest in its history and surpassing the target set by the Annual General Meeting of Shareholders.