Services

Despite macroeconomic challenges, the bank achieved these results through a sound, flexible, and adaptable business strategy, coupled with a robust risk management system.

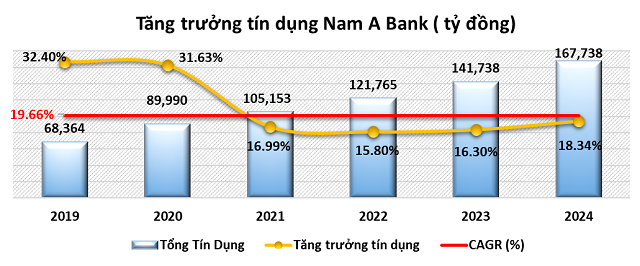

Impressive Credit and Profit Growth

Specifically, in 2024, Nam A Bank’s total assets reached over VND 245,000 billion, a nearly 16.8% increase compared to the same period in 2023. Capital mobilization neared VND 179,000 billion, a rise of more than 9% from the previous year.

In 2024, the bank’s credit activities reached nearly VND 168,000 billion, an 18.34% increase from the beginning of the year.

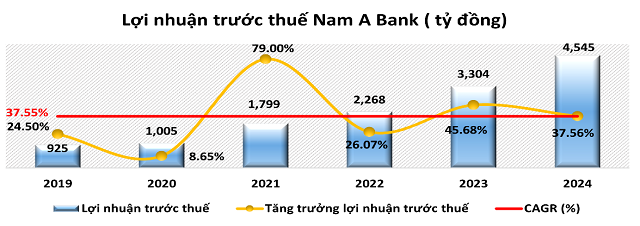

The growth in these indicators contributed to a pre-tax profit of over VND 4,545 billion in 2024 (exceeding the assigned target by 13.6% and growing by nearly 38% compared to 2023)

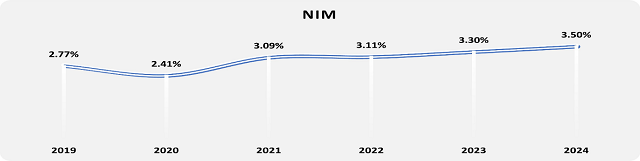

Nam A Bank’s NIM ratio continued to improve, reaching 3.5% (compared to 3.3% in 2023)

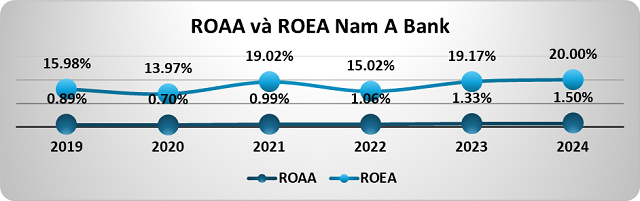

The ROE (return on equity) ratio remained at 20%, while the ROA was 1.5%, indicating that the bank not only grew in scale but also improved its profitability and operational quality.

Effective Risk Management

As of December 31, 2024, Nam A Bank’s non-performing loan ratio stood at 2.1%. The bank also increased its loan loss provisions to cover 60% of non-performing loans. The consolidated capital adequacy ratio (CAR) reached 12.46% (the minimum ratio set by SBV is 8%).

In the past year, SBV has twice adjusted credit growth targets for credit institutions (CIs) based on specific principles, ensuring transparency and fairness. Additionally, SBV instructed CIs to strictly adhere to monetary and credit policies and regulations on credit granting to enhance business efficiency, ensure system safety and stability in the monetary market, and promote safe, efficient, and healthy credit growth while curbing the rise and occurrence of bad debts to guarantee the safe operation of CIs.

Customers transacting at Nam A Bank

|

Along with other joint-stock commercial banks, Nam A Bank proactively reviewed and adjusted its credit policies to align with market developments and minimize potential risks. Liquidity ratios were consistently maintained at safe levels, with the LDR (loan-to-deposit) ratio reaching 80.64%, while the ratio of short-term capital for medium and long-term loans remained at approximately 21.41%.

Nam A Bank’s risk management system has been continuously upgraded to meet international standards, including Basel II, Basel III, and Basel Reform. In 2024, the bank also completed its financial statements according to international standards (IFRS). By pioneering the implementation of these international practices, the bank has enhanced its risk management and financial management in banking operations. Additionally, the transparency of its financial reporting, achieved through the adoption of international standards, has contributed to the improvement of Nam A Bank’s reputation and position in both the domestic and international markets.

Since 2020, Nam A Bank has undergone a robust digital transformation and expanded its operations across provinces and cities nationwide. In 2024 alone, the bank inaugurated and operated five new branches, three new transaction offices, and expanded its digital transaction points with 14 new ONEBANK locations.

|

Positive Appraisals from Credit Rating Organizations 2024 was also a year when Nam A Bank received positive recognition from international and domestic credit rating organizations. Moody’s upgraded the bank’s asset quality rating from B3 to B2 and its profitability and related indicators from B2 to B1. It also assigned a stable outlook to the bank’s issuer rating. Nam A Bank was also honored with several prestigious awards in the past year, including being named the Best Risk Management Bank in Vietnam by Global Banking and Finance Review (GBAF), the Best Green Bank in Vietnam by Global Brands, the Outstanding Enterprise in Asia 2024 by Enterprise Asia, and ranked seventh in the Top 50 Most Effective Companies in Vietnam in 2024 by Nhip Cau Dau Tu magazine. The bank was also included in the Top 100 Sao Vang Dat Viet by the Central Committee of the Ho Chi Minh Communist Youth Union and the Vietnam Young Entrepreneurs Association. |

– 11:18 15/01/2025

The Race to Build Ho Chi Minh City’s Financial Hub: Unlocking Potential Amid Challenges

As Vietnam’s economic powerhouse, Ho Chi Minh City is ambitiously striving to establish itself as an international financial hub. This strategic vision is aimed at bolstering the city’s economic prowess and attracting global investment, thereby elevating its status on the world stage. This endeavor is not merely a municipal aspiration but a pivotal component of the nation’s overarching development strategy, reflecting its commitment to fostering sustainable growth and prosperity.

“BIDV Unveils Electronic Customer Authentication via VNeID”

Hanoi, December 2nd, 2024 – Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) and the Research and Application Center for Population Data and Civil Status (Center for RAR) under the Ministry of Public Security, have signed an agreement to implement electronic customer authentication services through VNeID on the BIDV SmartBanking application.

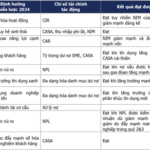

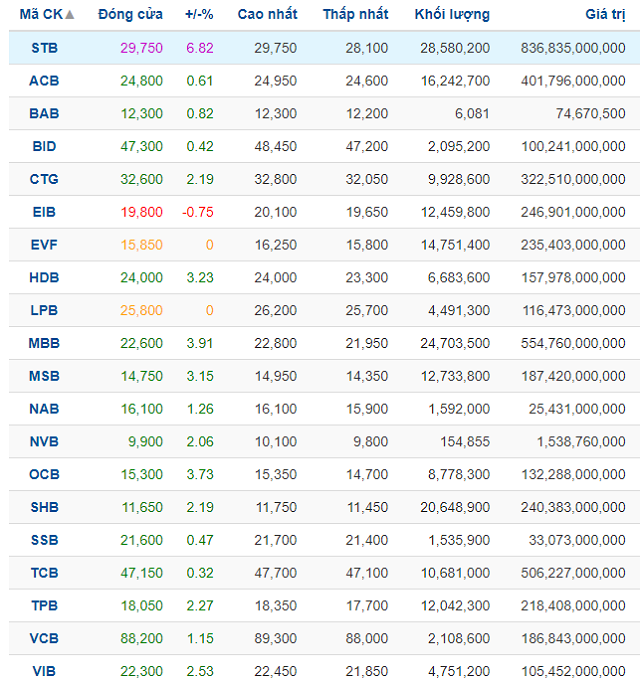

Reviewing the Banks’ Strategies for 2024

In a year of extremely challenging credit growth, it is imperative for commercial banks to choose the right growth strategy to balance risk and profitability. This was evident from the very beginning of the year, as reflected in the shareholders’ meetings, and now is the time to review the performance of the leading banks.