Experts believe that while Circular No. 02/2023/TT-NHNN (Circular 02) on debt rescheduling and debt classification for credit institutions and foreign bank branches has expired, asset quality can still be managed. (Photo: Vietnam+)

|

Circular 02 officially expired at the end of December 2024, after a one-time extension in mid-June 2024. This means that debt rescheduling and debt classification policies will not be further extended into 2025.

Positive Impact of Circular 02

Previously, Circular 02 was issued by the State Bank of Vietnam in late April 2023 to provide guidelines for credit institutions and foreign bank branches on debt rescheduling and maintaining debt classification to support customers facing difficulties.

Eligible customers for debt rescheduling and debt classification relief were those facing challenges in their production and business operations, as well as those struggling to repay consumer and lifestyle loans.

Initially, Circular 02 was set to be effective until June 30, 2024. However, considering the slow recovery and persistent challenges, on June 18, 2024, the State Bank of Vietnam issued Circular 06/2024/TT/NHNN, extending the implementation of policies outlined in Circular 02 until December 31, 2024.

Over the course of a year and a half, the issuance and extension of Circular 02 helped alleviate some of the difficulties faced by credit institutions in handling bad debts, reduced repayment pressure, and facilitated new loan access for individuals and businesses.

Through this policy, banks were able to support customers by restructuring their debt repayment schedules, providing them with more flexibility and time to reorganize their business operations and cash flow management. Circular 02 also allowed banks to defer the recognition of credit-related expenses for restructured loans until the end of 2024.

However, some argued that Circular 02 only benefited strong businesses that needed a year to recover and regain their growth momentum. For weaker businesses, additional time would not lead to recovery, but instead create a sense of complacency, with businesses becoming reliant on the policy and failing to repay their debts. In such cases, the risks fell entirely on the banks.

Will Non-Performing Loans Increase?

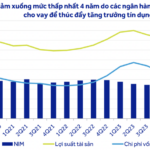

According to experts from Vietnam Credit Rating JSC (VIS Rating), the expiration of Circular 02 will not lead to a significant deterioration in asset quality for banks in 2025.

The issuance and extension of Circular 02 helped alleviate difficulties in handling bad debts and reduced repayment pressure for credit institutions. (Photo: Vietnam+)

|

VIS Rating experts attribute this to the slower formation of problematic debts as borrowers’ operating cash flows improved throughout 2024. They expect borrowers’ repayment capacity to continue strengthening, given Vietnam’s favorable business conditions and robust macroeconomic fundamentals, supported by the government’s relentless efforts to boost economic activity.

However, VIS Rating experts caution that banks with significant restructured debts related to large borrowers and a low bad debt coverage ratio face the highest asset risks.

“We note that these banks continue to grapple with residual issues in the real estate sector, with some property developers entangled in legal problems or facing low demand for their new projects,” the VIS Rating analyst warned. “These banks also struggle to improve profitability to meet higher credit costs.”

Echoing this sentiment, analysts from BSC Securities Company believe that the expiration of Circular 02 will not significantly impact banks’ balance sheets, and there will not be a sudden increase in non-performing loan ratios or provisioning costs.

Furthermore, to comply with regulations, banks have already made specific additional provisions of 100% in 2024, with most having made sufficient or near-sufficient provisions. Additionally, borrowers still within the restructuring period (up to 12 months) will continue to benefit from the circular even after its expiration.

Some experts also assess that the impact of Circular 02’s expiration will vary across banks. Large banks, such as BIDV, Vietcombank, Vietinbank, Techcombank, and ACB, are expected to be less affected thanks to their robust loss reserves and strong financial health. In contrast, banks with a high proportion of Group 2 debts and a low bad debt coverage ratio are anticipated to face more significant challenges.

Bank transaction. (Photo: Vietnam+)

|

Dr. Chau Dinh Linh, a lecturer at the University of Banking in Ho Chi Minh City, commented that the issuance of circulars on debt rescheduling and maintaining debt classification was a reasonable and effective policy during challenging times for businesses and the economy. It contributed to the recovery of business operations and yielded positive results. However, he cautioned that prolonging a supportive policy could lead to policy reliance or exploitation, resulting in extended repayment periods and uncontrollable risks.

Nevertheless, experts acknowledge that banks still face obstacles in disposing of assets, hindering their ability to address non-performing loans effectively.

Mr. Nguyen Quoc Hung, Vice Chairman and General Secretary of the Vietnam Banks Association, stated that the banking sector has implemented various solutions to mitigate bad debt pressure. These include risk provisioning, bad debt settlement using internal resources, enhanced debt recovery efforts, and disposal of collateral for uncollectible debts.

Mr. Hung emphasized that non-performing loans would remain a challenge for banks in 2025, especially as businesses continue to navigate difficulties following the prolonged impact of COVID-19 and natural disasters like Typhoon Yagi.

Thuy Ha

– 16:32 22/01/2025

Borrowing Over VND 2,000 Billion from the State Bank, Eximbank Targets a 54% Surge in Pre-Tax Profit by 2024

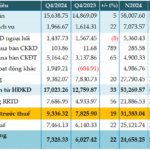

“Eximbank’s consolidated financial statements reveal a remarkable performance in 2024, with a profit before tax of over VND 4,188 billion, reflecting a significant 54% year-on-year increase. This impressive growth was achieved despite a substantial rise in provisions for potential risks.”

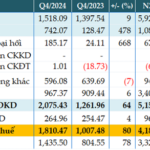

“A Revenue Boost: BIDV’s Pre-Tax Profit Surges by 19% in Q4”

The recently released consolidated financial statements for the fourth quarter of 2024 reveal that the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) recorded a remarkable performance. With a pre-tax profit of over VND 9,336 billion, BIDV witnessed a 19% increase compared to the same period last year. This impressive growth is attributed to the bank’s successful diversification strategy, with a focus on bolstering non-interest income sources.

The Future of Banking: A Brighter Outlook with Declining NPA’s and 15% Profit Growth

The banking sector’s financial performance remains robust, indicating a much stronger resilience compared to the previous financial crisis of 2012-2013. The industry’s pre-tax profit forecast for 2025 projects a growth of 14.9% year-over-year, showcasing a healthy and stable outlook.