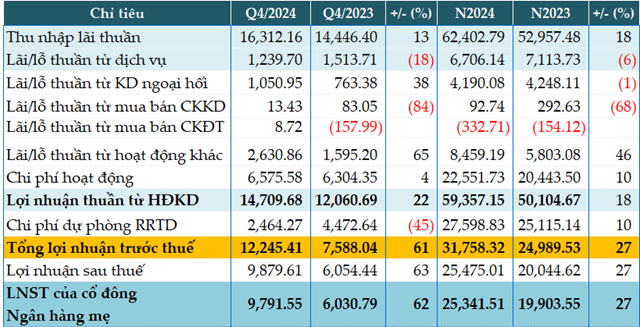

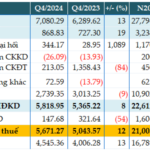

VietinBank’s fourth-quarter net interest income increased by 13% year-over-year, reaching over VND 16,312 billion.

While profits from services (-18%) and securities trading (-84%) declined, foreign exchange activities (+38%) and other operations (+65%) showed growth compared to the previous year.

As a result, the bank’s net profit from business operations increased by 22% to VND 14,710 billion. However, VietinBank significantly reduced its risk provisions by 45%, allocating just over VND 2,464 billion, leading to a 61% surge in pre-tax profits, which climbed to VND 12,245 billion.

For the full year 2024, VietinBank recorded a consolidated pre-tax profit of over VND 31,758 billion, a 27% increase year-over-year. The bank’s standalone pre-tax profit reached nearly VND 30,361 billion, representing a 25% growth.

Looking ahead to 2024, VietinBank expects a 9% rise in standalone pre-tax profit compared to 2023, targeting VND 26,300 billion. This performance surpasses the bank’s initial profit goal by 15%.

|

CTG’s Q4 and 2024 Business Results. Unit: VND billion

Source: VietstockFinance

|

As of the end of 2024, VietinBank’s total assets grew by 17% year-to-date, reaching nearly VND 2.4 quadrillion. Customer lending increased by 17% to VND 1.72 quadrillion, while lending to other credit institutions decreased by 61% to VND 7,952 billion.

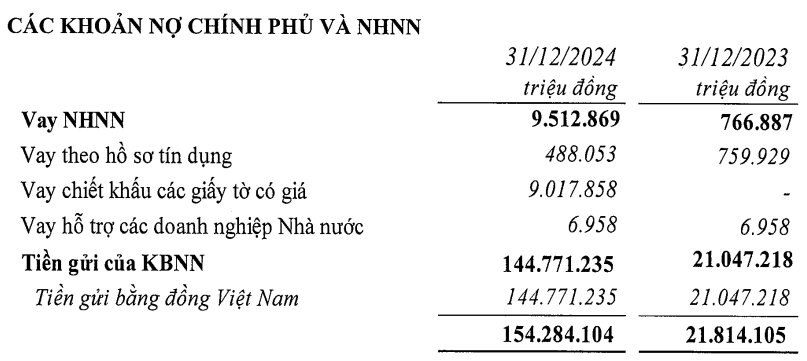

In terms of capital sources, customer deposits climbed by 14% year-to-date, reaching VND 1.6 quadrillion. Borrowings from the State Bank of Vietnam rose to VND 9,512 billion, up from VND 766 billion at the beginning of the year, due to the occurrence of VND 9,017 billion in discounted paper borrowings. Simultaneously, the year-end balance of Treasury deposits stood at VND 144,771 billion, a sixfold increase.

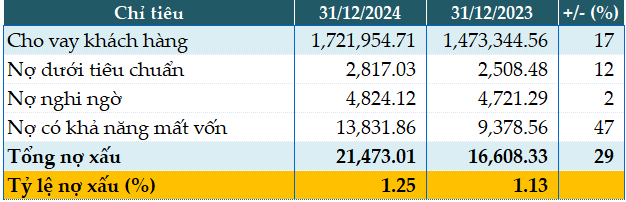

VietinBank’s total non-performing loans as of December 31, 2024, amounted to VND 21,473 billion, a 29% increase year-to-date. The non-performing loan ratio also witnessed a slight uptick, rising from 1.13% at the beginning of the year to 1.25%.

|

CTG’s Loan Quality as of December 31, 2024. Unit: VND billion

Source: VietstockFinance

|

Han Dong

– 21:31 24/01/2025

The Secret to VIB’s 9,000 Billion VND Profit in 2024: Unveiling the Strategies for Success

Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has announced its consolidated financial statements, reporting a pre-tax profit of over VND 9,004 billion in 2024, a 16% decrease compared to the previous year. This comes amidst a 22% growth in credit.

Chairman Tran Hung Huy’s Bank Posts Record Profit, CASA Grows to 23.3%

The recently released consolidated financial statements reveal that Asia Commercial Joint Stock Bank (HOSE: ACB) recorded a pre-tax profit of nearly VND 21,006 billion in 2024, reflecting a 5% increase compared to the previous year.