Recovering Credit, Accelerating Profits

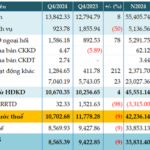

Riding the wave of a clear recovery trend in the economy during the last quarter, VPBank’s consolidated credit scale reached VND 710 trillion, with pre-tax profit (PBT) for the year exceeding VND 20 trillion. In the fourth quarter alone, VPBank’s consolidated profit reached over VND 6,100 billion, a 2.4-fold increase compared to the same period.

The parent bank recorded a pre-tax profit of nearly VND 18.3 trillion, a 36% increase compared to 2023. The subsidiaries continued to make significant contributions to the group’s business results, especially the strong comeback of FE Credit after a comprehensive restructuring, reporting profits for the last three consecutive quarters and earning VND 500 billion in profit for the full year 2024.

With a retail-focused strategy, VPBank benefited from the high growth of the trade-services sector (up 8.21% in the fourth quarter and 7.38% for the full year 2024, according to the General Statistics Office) and accelerated the expansion of its credit portfolio. As of December 31, 2024, the credit portfolio at the parent bank exceeded VND 629 trillion, a 19.4% increase compared to the beginning of the year and higher than the industry average of 15%. In the last quarter alone, the parent bank’s credit increased by 8.2% compared to the previous quarter, with the Individual Customer and SME segments recording a nearly 7% increase in credit compared to Q3. The auto loan product continued to thrive, maintaining its leading position in the market share of personal passenger car loans.

Thanks to improving consumer demand and a successful restructuring, FE Credit’s credit portfolio grew by 10.3%, and disbursements for the full year 2024 increased by 40% compared to 2023.

In addition to maintaining its leading position in retail, VPBank continuously seeks opportunities in new potential segments. With the support of its strategic shareholder, SMBC, the bank’s FDI segment recorded a threefold increase in credit balances compared to 2023.

Effective Balance Sheet Management, Well-Controlled Capital Costs

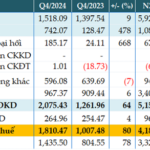

Through meticulous and efficient balance sheet management, VPBank maintained stability and improved the bank’s performance in 2024. By optimizing the portfolio of customer deposits and diversifying mid- to long-term international capital sources, the bank was able to keep its cost of capital at 4.3%, a nearly 2% decrease compared to 2023, positively contributing to the growth of interest income.

Liquidity safety ratios such as the loan-to-deposit ratio (LDR) of 81.6% and the short-term capital for mid- to long-term loans of 27.3% were well within the limits set by the State Bank of Vietnam (SBV). Additionally, the consolidated bank’s capital adequacy ratio (CAR) under Basel II remained at 15.4%, leading the industry.

VPBank’s systematic approach to debt collection, coupled with the enhanced application of digital technology, resulted in significant growth in debt recovery. Consolidated income from resolved non-performing loans (NPLs) in 2024 reached VND 5.6 trillion, more than 2.3 times higher than in 2023.

VPBank continued to employ a diverse range of NPL resolution measures, ensuring that the parent bank’s NPL ratio, as per Circular 11, remained below the 3% threshold mandated by the SBV. Meanwhile, FE Credit’s NPL ratio continued its notable improvement, decreasing for three consecutive quarters.

A Distinctive, Expanding Ecosystem, Poised for Future Breakthroughs

VPBank’s distinctive, expansive ecosystem positions it strongly in the market, capable of comprehensively meeting the financial needs and lifestyle aspirations of diverse customer segments. This ecosystem paves the way for the bank’s sustainable development in the future.

With the recent addition of GPBank to the VPBank ecosystem, the group gains not just a subsidiary but also a synergistic force that strengthens its business network. This move further solidifies the group’s competitive position in the market and is expected to facilitate GPBank’s recovery, stabilize the financial and monetary market, and enhance investor and public confidence in the banking system.

In 2024, VPBank remained committed to its long-term sustainable development strategy and actively sought partnerships with international organizations to diversify green financing sources to meet the significant domestic capital demands. Notably, the bank signed a credit contract worth USD 150 million with the Japan Bank for International Cooperation (JBIC) to finance renewable energy and power transmission projects in Vietnam, contributing to the country’s net-zero emission goal by 2050.

To seize new opportunities, VPBank has relentlessly invested in digital transformation to enhance service quality and customer experience. In 2024, the bank began applying artificial intelligence (AI) in its operations, with notable projects such as the automated call quality control and Voice of Customer analysis system, the intelligent document extraction tool, and the Gen AI chatbot.

VPBank’s governance capabilities have consistently strengthened and improved year after year. In 2024, the bank was recognized as one of the Top 10 Best-Managed Companies – Large Cap Group at the 2024 Listed Companies Forum. Additionally, it marked the sixth consecutive year that VPBank was included in the Top 20 companies with the highest ESG scores and the Top 5 largest-cap stocks in the Vietnam Sustainability Index (VNSI) of HOSE.

The recognition from the market and regulatory authorities affirms the bank’s unwavering efforts to build a sustainable and comprehensive ecosystem that brings added value to the community, society, and the economy.

– 18:31 22/01/2025

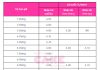

Borrowing Over VND 2,000 Billion from the State Bank, Eximbank Targets a 54% Surge in Pre-Tax Profit by 2024

“Eximbank’s consolidated financial statements reveal a remarkable performance in 2024, with a profit before tax of over VND 4,188 billion, reflecting a significant 54% year-on-year increase. This impressive growth was achieved despite a substantial rise in provisions for potential risks.”

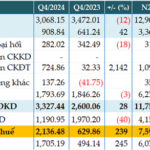

Reaping Rewards from Investment Securities: TPBank’s Q4 Pre-Tax Profits Surge 3.4x YoY

For the fourth quarter of 2024, the Joint Stock Commercial Bank Tien Phong (TPBank, HOSE: TPB) reported a profit before tax of over VND 2,136 billion, a 3.4-fold increase compared to the same period last year. This impressive performance is attributed to a significant reduction in risk provisions and a surge in investment securities income.

The Revenue Slump: ThaiBev’s Vietnam Sales Retreat for the Second Year Running

According to Thai Beverage Public Company Limited’s (ThaiBev) 2024 financial statements (covering the period from September 2023 to September 2024), the parent company of Sabeco (HOSE: SAB) experienced growth in both revenue and profit. However, the Vietnamese market saw a second consecutive year of declining revenue.