The adjustment factors for each corresponding year are provided in Table 1:

Table 1

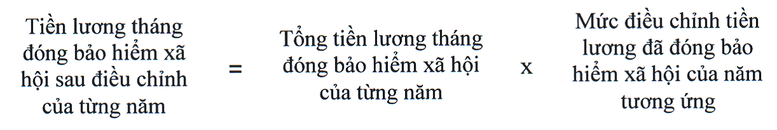

For employees with a combination of state-regulated and employer-determined salary periods, the above formula will be used to adjust both their state-regulated and employer-determined monthly salaries, provided they started participating in social insurance under the state-regulated salary regime from January 1, 2016, onwards.

Adjusting previous social insurance contributions will improve pension and social insurance benefits for employees.

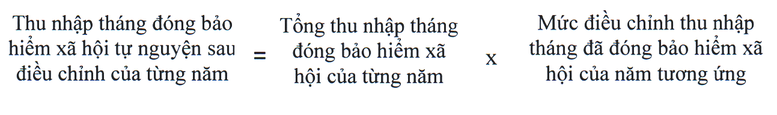

According to the circular, participants in voluntary social insurance who are entitled to a pension, a lump-sum allowance upon retirement, a one-time social insurance payment, or whose dependents are entitled to a lump-sum survivor benefit between January 1, 2025, and December 31, 2025, will have their monthly income adjusted according to the following formula:

The adjustment factors for each corresponding year are provided in Table 2:

Table 2

For employees with a combination of mandatory and voluntary social insurance periods, the above formula will be used to adjust their voluntary social insurance contributions. The adjustment of mandatory social insurance contributions will follow the provisions of Clause 10 of Decree No. 115/2015/NĐ-CP and the above-mentioned regulations on adjusting previous social insurance contributions.

The average monthly salary and income used as the basis for calculating pension benefits, lump-sum allowances upon retirement, one-time social insurance payments, and lump-sum survivor benefits shall be determined in accordance with Clause 4, Article 11 of Decree No. 115/2015/NĐ-CP and Clause 4, Article 5 of Decree No. 134/2015/NĐ-CP.

This circular takes effect on February 28, 2025, and the provisions of this circular shall be applied from January 1, 2025.

Streamlining the Redundancy Process: A Fair Approach for Civil Servants

(NLĐO) – With an ever-growing need to streamline the public sector, it is imperative that the government implements additional policies to support those affected by the reduction in civil servants and public employees. These policies should focus on providing new job opportunities and helping them stabilize their lives.

The Golden Years: Unlocking Retirement Benefits After 40 Years of Social Insurance Contributions – What’s Your Pension Worth?

Retirement benefits serve as a solid financial foundation for social insurance participants and their families when they reach retirement age. This is especially true for those who have diligently contributed to the social insurance program for 30 years or more, providing them with a sense of security and stability in their golden years.

Informal Workers’ Incomes Significantly Lag Behind Their Formal Counterparts

Informal labor in Hanoi is predominantly found in sectors that are transient in nature and do not require high skill levels. As a result, their income is significantly lower than that of formal workers.