The VN-Index closed the fourth trading week of 2025 at 1,265.05, a gain of 15.94 points or 1.28% from the previous week, with average trading values per session slightly improving from a three-year low.

The average matched trading value on the HOSE reached VND9,713 billion last week, up 14.4% from the previous week, with liquidity in the large-cap VN30 sector mainly in Banking, Retail, and mid-cap VNMID, including Electrical Equipment, increasing by +15.6% and +17.9%, respectively.

Across the three exchanges, the average trading value per session for week 4/2025 was VND13,298 billion, of which the average matched trading value was VND10,993 billion, up 15.5% from the previous week but still lower than the five-week average by -5.4%.

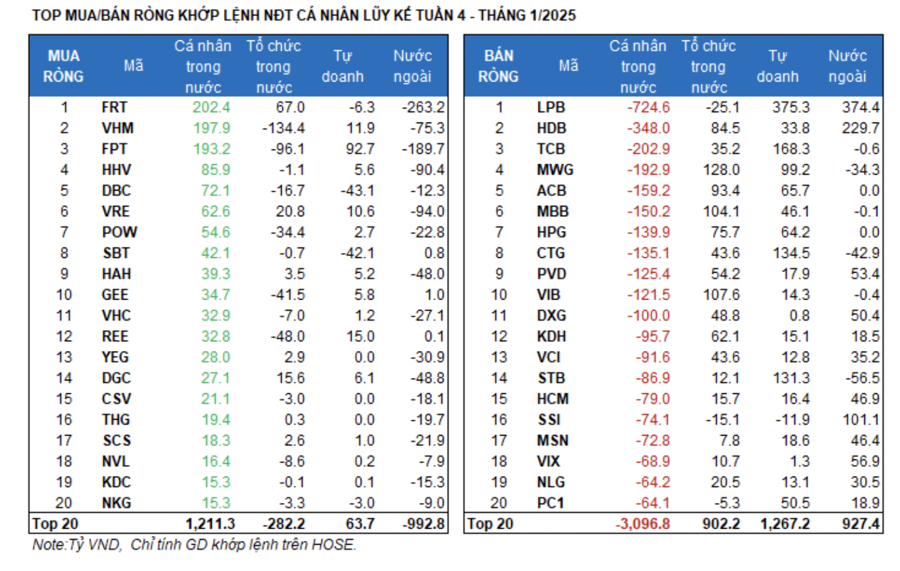

Foreign investors bought a net VND119.8 billion, but they net sold VND2,593.2 billion in matched trading.

The main sectors that foreign investors net bought on the matched trading were Media and Healthcare. The top stocks that foreign investors net bought were LPB, HDB, SSI, VIX, PVD, VGC, DXG, GEX, GMD, and PDR.

On the sell side, foreign investors net sold Banking stocks. The top stocks that foreign investors net sold were FRT, FPT, VRE, HHV, VCB, VPB, STB, DGC, and HAH.

Individual investors net sold VND2,443.9 billion, of which they net bought VND2,075.7 billion through matched orders.

In terms of matched trading, they net bought 9/18 sectors, mainly in Banking. The top stocks that individual investors net bought were FRT, VHM, FPT, HHV, DBC, VRE, POW, SBT, HAH, and GEE.

On the sell side, they net sold 9/18 sectors, mainly in Construction and Materials, and Oil and Gas. The top stocks that they net sold were LPB, HDB, TCB, MWG, ACB, MBB, CTG, PVD, and VIB.

Proprietary trading bought a net VND1,815.5 billion, but they net sold VND220.6 billion in matched trading.

In terms of matched trading, proprietary trading bought a net 8/18 sectors. The sectors with the largest net buys were Financial Services and Information Technology. The top stocks that proprietary trading net bought this week were LPB, TCB, CTG, STB, MWG, FPT, ACB, HPG, PC1, and MBB. The top net sell was the Banking sector. The top stocks that were net sold were DBC, SBT, SSI, VTP, FRT, E1VFVN30, PAN, FCN, NKG, and VGC.

Domestic institutional investors bought a net VND508.6 billion, and they net bought VND738.2 billion in matched trading.

In terms of matched trading, domestic institutions net sold 6/18 sectors, with the largest value in Financial Services. The top net sell stocks were VHM, FPT, REE, GEE, POW, CTR, LPB, DBC, SSI, and FMC.

The sector with the largest net buy value was Real Estate. The top net buy stocks were MWG, VIB, MBB, ACB, VPB, HDB, HPG, FRT, KDH, and VCB.

The allocation of money flow ratio decreased in Real Estate, Securities, Construction, Steel, Chemicals, and Aviation but increased in Banking, Retail, Information Technology, Food, Agriculture & Seafood, Electrical Equipment, Power, and Telecommunications.

Most sectors with improved money flow ratios also saw gains, notably Banking, Retail, and Electrical Equipment. Banking was supported by strong net buying from institutional investors, including domestic institutions, proprietary trading, and foreign investors.

On the other hand, Real Estate and Steel saw their money flow allocation ratio drop to a 10-week low, and the price indices of both sectors fell in week 4 due to strong net selling by domestic investors.

Money Flow Strength: Looking at the weekly frame, liquidity improved across all three market capitalizations, and money flow continued to focus on large-cap stocks in the VN30 sector.

In terms of allocation ratio, money flow concentrated on large-cap stocks in the VN30 sector, with a ratio of 49.9%, a slight improvement from the previous week (48.2%). Meanwhile, the allocation ratio of mid-cap stocks in the VNMID sector decreased slightly to 36.5%, and that of small-cap stocks in the VNSML sector decreased to 10.7%.

In week 4/2025, the average trading value per session (only matched orders) increased by VND604 billion (+15.6%) for large-cap stocks in the VN30 sector, VND572 billion (+17.9%) for mid-cap stocks in the VNMID sector, and VND59 billion (+5.3%) for small-cap stocks in the VNSML sector.

In terms of price movements, the VNMID index rose the most (+2.7%), followed by the VN30 index (+1.8%). Conversely, the small-cap VNSML sector had a negative performance of -0.5% after gaining +2.7% in the previous week.

Bond Leverage at The Maris Vung Tau Project

“As 2024 drew to a close, Allgreen Vuong Thanh Trung Duong Ltd. successfully raised an additional 535 billion VND through bond issuances, bringing their total capital raised via this route to 2,270 billion VND within just one month. This injection of funds is dedicated to expediting the development of their premium resort project, The Maris Vung Tau.”

The Psychology of Rest Dominates, Liquidity Plunges

Investor sentiment was muted in the final days of the 2024 financial year. This morning’s trading activity by foreign investors hit a record low, with overall market liquidity plunging 34% from the previous session. The stock market witnessed a sea of red, although the majority of stocks experienced only minor fluctuations. A few securities and investment stocks continued to buck the trend, swimming against the tide.