The VN-Index closed the first month of 2025 at 1,265.05 points, a slight decrease of 1.73 points or -0.14% from December 2024. The average trading value of the sessions decreased sharply by 23.4% to 11,406 billion VND, approaching the 3-year low in liquidity on a monthly time frame.

The total average trading value on the three exchanges reached 12,836 billion VND in January 2025. For matched orders alone, the average trading value was 10,719 billion VND, a decrease of 20.7% from the December average and -42.4% from the 1-year average.

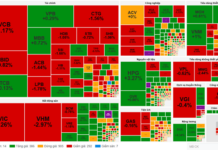

In terms of capitalization, liquidity decreased significantly in the mid-cap VNMID and small-cap VNSML groups, while it decreased for the third consecutive month in the large-cap VN30 group. By industry, with the exception of Construction, all key sectors recorded a sharp drop in liquidity, notably Banking, Real Estate, Securities, Steel, Food, and Retail.

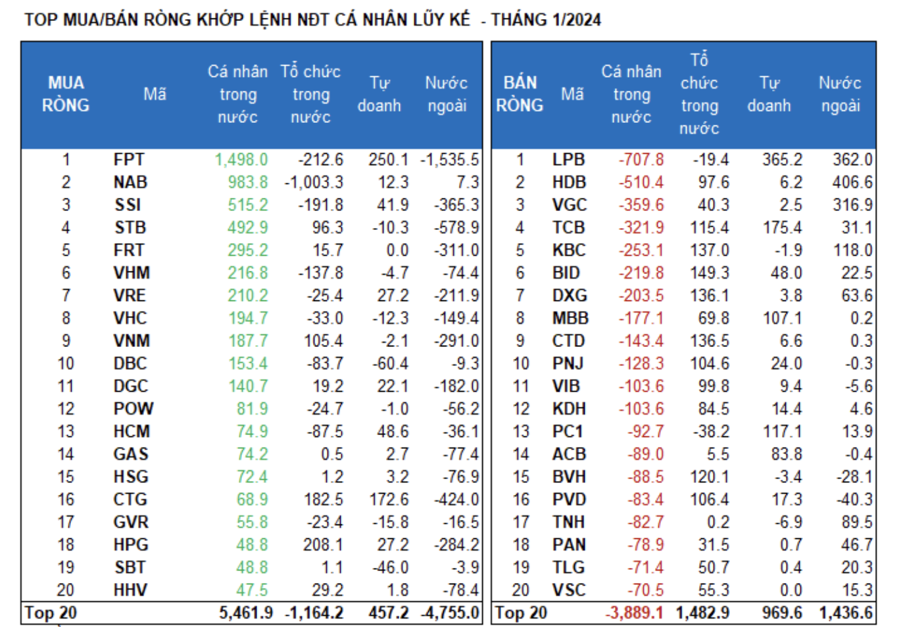

Foreign investors sold a net amount of 6,486.1 billion VND, and for matched orders alone, they sold a net amount of 4,318.3 billion VND.

The main net buying sectors for foreign investors through matched orders were Construction and Materials, and Healthcare. The top net bought tickers by foreign investors through matched orders included HDB, LPB, VGC, KBC, MSN, TNH, GEX, DXG, PDR, and PAN.

On the net selling side through matched orders, foreign investors focused on the Information Technology sector. The top net sold tickers by foreign investors through matched orders were FPT, STB, CTG, SSI, FRT, HPG, VCB, VRE, and MWG.

Individual investors bought a net amount of 3,059.4 billion VND, of which 1,304.9 billion VND was through matched orders.

For matched orders alone, they were net buyers in 9 out of 18 sectors, mainly in the Information Technology sector. The top net bought tickers by individual investors through matched orders included FPT, NAB, SSI, STB, FRT, VHM, VRE, VHC, VNM, and DBC.

On the net selling side through matched orders, they sold a net amount in 9 out of 18 sectors, mainly in the Banking, Construction, and Materials sectors. The top net sold tickers included LPB, HDB, VGC, TCB, KBC, BID, MBB, CTD, and PNJ.

Proprietary trading bought a net amount of 982.8 billion VND, and for matched orders alone, they bought a net amount of 2,100.4 billion VND.

For matched orders alone, proprietary trading was net buyers in 15 out of 18 sectors. The sectors with the strongest net buying were Banking and Information Technology. The top net bought tickers by proprietary trading through matched orders included LPB, FPT, TCB, CTG, VPB, MWG, PC1, CTR, MBB, and ACB.

The top net sold sector was Food and Beverage. The top net sold tickers included FUEVFVND, DBC, SBT, FCN, VTP, GVR, VCB, DGW, VHC, and DCM.

Domestic institutional investors bought a net amount of 2,443.8 billion VND, and for matched orders alone, they bought a net amount of 913 billion VND.

For matched orders alone, domestic institutions were net sellers in 6 out of 18 sectors, with the largest value in the Financial Services sector. The top net sold tickers included NAB, FPT, SSI, VHM, HCM, DBC, REE, GEE, MSN, and VCI.

The sector with the highest net buying value was Real Estate. The top net bought tickers included VCB, HPG, CTG, BID, KBC, CTD, DXG, BVH, TCB, and PVD.

In terms of time frame, the money flow ratio decreased in Real Estate, Steel, Chemicals, Textiles, and Aviation, while it increased in Banking, Construction, Information Technology, Food, and Oil Equipment. It remained almost unchanged in Securities, Aquaculture, and Retail.

By capitalization, the money flow ratio decreased in the mid-cap VNMID and small-cap VNSML groups, while it increased in the large-cap VN30 group.

In January 2025, liquidity decreased significantly in the mid-cap VNMID (-1,219 billion VND/-25.3%) and small-cap VNSML (-484 billion VND/-28.9%) groups, while it decreased less in the large-cap VN30 (-792 billion VND/-14.3%) group. Notably, this was the third consecutive month of declining liquidity in the VN30 group.

The money flow ratio in the large-cap VN30 group was 47.7% in January 2025, slightly higher than the 45% level in December 2024. In contrast, it decreased to 36.8% in the mid-cap VNMID group and 11.6% in the small-cap VNSML group.

In terms of price movements, the VNMID index went against the general market trend with a gain of +0.37%, but it lacked the support of money flow as this group experienced the sharpest drop in liquidity. Meanwhile, the VN30 and VNSML indices decreased by -0.53% and -2.05%, respectively.

Bond Leverage at The Maris Vung Tau Project

“As 2024 drew to a close, Allgreen Vuong Thanh Trung Duong Ltd. successfully raised an additional 535 billion VND through bond issuances, bringing their total capital raised via this route to 2,270 billion VND within just one month. This injection of funds is dedicated to expediting the development of their premium resort project, The Maris Vung Tau.”

Stock Market Week of 12/16/2024 – 12/20/2024: A Prevailing Mood of Caution

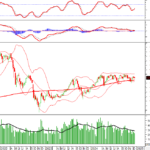

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.

Vietstock Weekly: Navigating Short-Term Risks

The VN-Index ended a rather pessimistic trading week as it continued to lose points and fell below the Middle Bollinger Band. The decline was accompanied by a drop in trading volume below the 20-week average, indicating limited participation of funds in the market. Currently, the MACD indicator is poised to give a sell signal as it narrows its gap with the Signal Line. Should this occur in the coming period, the index’s situation will turn even more negative.