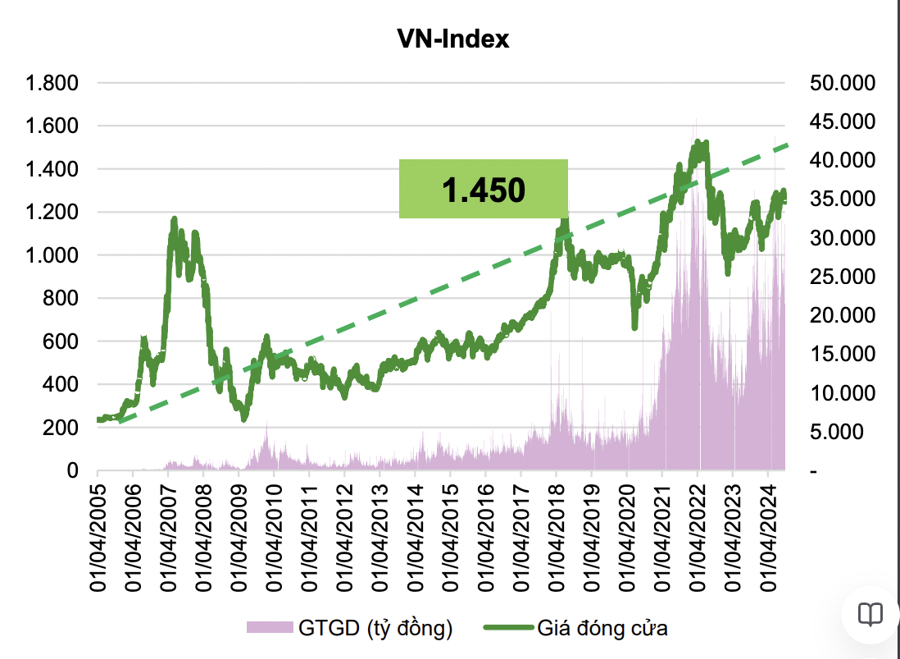

2024 was a year of ups and downs for the Vietnamese stock market, but it still managed to achieve an impressive 12.11% growth.

Alongside the rise of the VN-Index, the Vietnamese economy also demonstrated a strong recovery, with a remarkable 7.09% GDP growth rate in 2024, surpassing the government’s targets. Listed companies’ estimated profits grew by approximately 20% in 2024, reflecting the rebound in economic production and business activities.

Looking ahead, Agriseco Securities predicts that the VN-Index will reach a high of around 1,450 points in the latter half of 2025. This forecast is based on an expected 18-20% growth in market-wide profits in 2025, with a reasonable P/E of 13-14 times.

Vietnam’s economic growth is projected to outpace its regional peers. The country’s GDP is forecast to grow between 6.5% and 7% in 2025, higher than other countries in the region. This aligns with the government’s goals set at the beginning of the year, thanks to improved domestic consumer demand, sustained growth in industrial production, increased public investment, a recovering real estate market, and sustained FDI inflows, including high-tech projects.

While the trade balance will remain positive, the surplus is expected to be lower compared to the previous high base period and the impact of the Trump 2.0 trade war. The government has set a GDP growth target of 6.5-7% for 2025, striving for a range of 7-7.5%.

Profit growth is a key driver of capital inflows into the stock market. In 2024, market profits are estimated to have grown by about 20%, with core profits increasing by approximately 15%. Agriseco Research forecasts a further 18-20% profit growth for listed companies in 2025, driven by the Consumer, Banking, and Real Estate sectors.

After a record net sell-off of more than VND 90,000 billion in 2024, foreign capital is expected to turn positive in 2025.

As inflation continues its downward trend and central banks worldwide approach their inflation targets, the global labor market is regaining balance. This enables central banks to resume their interest rate reduction paths. Approximately 70% of the world’s central banks have decided to cut rates, and M2 money supply growth is recovering after the tight monetary policy period of 2022-2023.

In the US, the Fed began lowering interest rates in 2024 and is expected to continue this trajectory in 2025. However, the pace of rate cuts in 2025 may slow due to better-than-expected economic data and a potential uptick in inflationary pressures stemming from the public debt burden and tariff policies on US imports.

According to CME Group, the US is expected to cut interest rates twice in the coming year, bringing rates down to 3.75% – 4%. Europe is also forecast to cut rates amid a challenging economic outlook and weak manufacturing sector performance. China is expected to reduce lending rates to boost consumption and support the real estate market.

In 2024, global investment flows noticeably favored the US. US stock market indices such as the Dow Jones and S&P 500 surged to new highs, driven by the technology sector. The valuations of these indices have also been on a consistent upward trajectory and are currently hovering around their highest levels in history.

As a result, global investment flows may no longer view the US stock market as particularly attractive in 2025, leading to a potential shift towards frontier and emerging markets, including Vietnam.

There are expectations that Vietnam will be considered for an upgrade to emerging market status by FTSE during 2025, with possible inclusion in the second half of the year. This upgrade could attract an estimated $5-6 billion in investment funds from FTSE-referenced ETFs.

Currently, the VN-Index is trading at a P/E of ~13 times and a P/B of ~1.7 times, both of which are below the market’s 5-year average. Over the last five years, the average P/E has been ~14.5 times, and the P/B has been ~2.0 times. Notably, the VN-Index’s P/B is at a level just below one standard deviation, corresponding to the lowest range in the past five years.

With a current P/E of (~13.3 times), the VN-Index is one of the most attractively valued markets in the region. Moreover, Vietnam’s market ROE outperforms the regional average, indicating that the Vietnamese stock market offers a compelling investment opportunity at its current valuation, as emphasized by Agriseco.