VietCredit’s Q4 2024 Financial Report: Positive Signs in Business and Digital Transformation

VietCredit, a leading financial company in Vietnam, recently released its Q4 2024 financial report, showcasing promising results in its business operations and digital transformation journey.

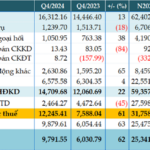

As of December 31, 2024, the company’s total assets reached VND 8,163 billion, an impressive 81% increase from the previous quarter’s VND 4,489 billion. This growth is primarily attributed to customer loan assets. Operating expenses amounted to VND 115 billion, a 14% increase from Q3 2024, but a significant 30% decrease from the same period last year due to the streamlining of traditional business models and operational structures as part of the company’s restructuring efforts.

Additionally, the company’s credit risk provisions decreased by 36% year-over-year, with a 6% reduction in customer loan risk provisions and a 23% decrease in investment securities risk provisions. The ratio of non-performing loans from existing old product balances has improved, while the ratio of non-performing loans from new digital product balances remains low, aligning with the company’s risk appetite.

Net interest income reached VND 203.2 billion, a 28% increase from the previous year and a 13% rise from the previous quarter. Interest income from other activities amounted to VND 141 billion, a significant 57% increase. VietCredit’s foreign exchange business also recorded a remarkable 135% profit growth.

Customer loan balances stood at nearly VND 6,300 billion as of December 31, 2024, reflecting a 36% growth compared to the previous year. VietCredit successfully expanded its credit reach to potential customers through digitization, partnering with major platforms such as Momo, Fiza (Zalo), and Viettel Money. As a result, digital products contributed 22% to the company’s total loan balances as of December 31, 2024.

VietCredit’s Q4 2024 performance demonstrated positive signs, with the company turning around from a loss of VND 36.5 billion in Q3 2024 to a profit of VND 69.6 billion in Q4 2024, representing a remarkable 290% increase. While this figure is a 55% decrease compared to the same period last year, it indicates that the company’s operations are heading in the right direction following its restructuring and digital transformation initiatives.

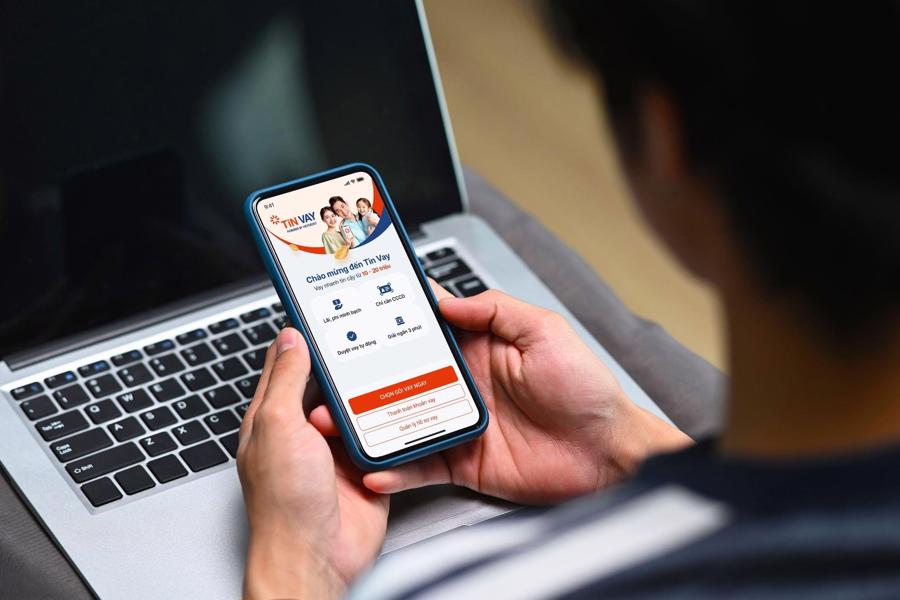

According to the company, 2024 was a year focused on digital transformation, infrastructure modernization, and talent quality enhancement. Notable achievements include the launch of the Tin Vay digital consumer lending service on multiple large platforms and the upgrade of the VietCredit application.

Looking ahead to 2025, VietCredit plans to further expand Tin Vay to cater to a broader range of individuals and small businesses, introducing Tin Vay Biz for self-employed and small-to-medium enterprises. Additionally, a new digital credit card product with advanced features is expected to be launched in 2025.

The achievements in Q4 2024 affirm that VietCredit is on the right track with its restructuring and business model innovation strategies, successfully expanding its customer base and enhancing its operational efficiency. Effective financial risk management and cost optimization have also played a significant role in improving profitability. As a result, VietCredit’s Q4 2024 financial report presents a promising outlook for the company’s future growth and development.

VCBS is Among the Top 10 Brokerage Firms in 2024

Recently, the Ho Chi Minh City Stock Exchange (HOSE) released a list of the top 10 securities companies with the largest brokerage market share in Vietnam. This list is a testament to the thriving securities industry in the country and showcases the leading firms in this competitive market.

Unblocking Bottlenecks for a Nation’s Economy to Soar.

In 2025, the government is targeting a GDP growth rate of over 8%, with aspirations to reach double digits should favorable conditions prevail. Economic experts believe that Vietnam’s growth potential is evident, but it is currently hindered by certain regulatory and administrative bottlenecks. To achieve the desired economic acceleration, it is imperative to address and unblock these constraints.

Revolutionizing Logistics with Digital Transformation

The logistics industry in Vietnam is at a nascent stage of digital transformation, with limited resource investment and budgetary constraints. To accelerate digital adoption, the industry needs a “helping hand” from the government in the form of supportive policies and private investment.

The Powerhouse Performer: VietinBank’s Stellar Growth with a Near 2.4 Million Billion Dong Total Asset Portfolio, Witnessing a 61% Surge in Pre-Tax Profit for Q4/2024

For the fourth quarter of 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) reported a remarkable performance with a pre-tax profit of over VND 12,245 billion, surging by 61% year-on-year. This impressive growth is attributed to a significant reduction in credit risk provisions.