## LDG’s 2024 Financial Results: A Challenging Year

|

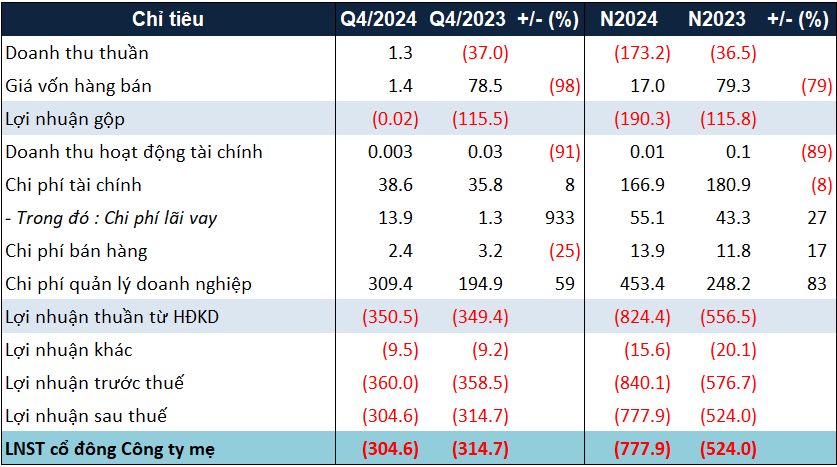

LDG’s 2024 business results in VND billion

Source: VietstockFinance

|

In 2024, LDG faced significant challenges as reflected in their financial results. The company recorded returns on sales of over VND 358 billion, a staggering 4.2 times higher than the previous year, while total revenue fell short at just over VND 185 billion. Consequently, LDG experienced a negative gross revenue of more than VND 173 billion.

Adding to their woes, LDG’s selling and management expenses increased by 17% and 83%, respectively, amounting to nearly VND 14 billion and over VND 453 billion. Of this, over VND 417 billion was attributed to provisioning costs, a significant jump from the previous year.

As a result of these unfavorable factors, LDG incurred a net loss of nearly VND 778 billion in 2024, marking the second consecutive year of losses. Moreover, with this loss, the company’s cumulative loss as of December 31, 2024, surpassed VND 1 trillion.

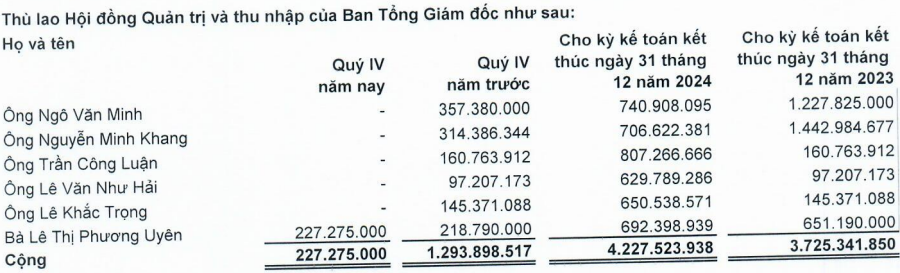

Despite the company’s financial struggles, all board members except Chairman Ngo Van Minh and Vice Chairman Nguyen Minh Khang received increased remuneration in 2024 compared to the previous year.

|

LDG’s Board of Directors’ remuneration in 2024

Source: LDG

|

Turning to the balance sheet, LDG’s total assets at the end of 2024 decreased by 9% from the beginning of the year, amounting to nearly VND 6.7 trillion. This decline was primarily due to an increase in provisions for doubtful debts, causing short-term receivables to drop by 22% to over VND 2.9 trillion. Notably, LDG’s remaining cash balance stood at just over VND 900 million, a significant reduction of 74%.

LDG’s bad debts from customers also highlighted a concerning trend, as the recoverable value decreased significantly from over VND 1.6 trillion (out of a total of VND 1.8 trillion in principal debt) at the beginning of the year to over VND 1 trillion (out of a total of over VND 1.6 trillion in principal debt) by year-end. The highest provisioning for bad debts was nearly VND 663 billion from CTCP Bac Phuoc Kien.

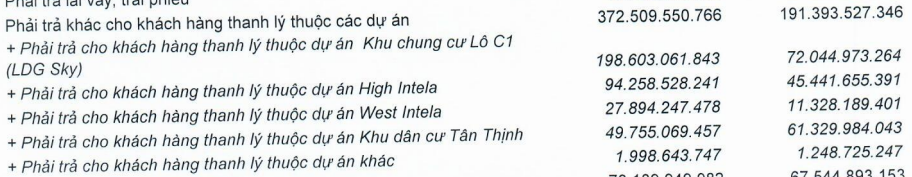

On the liabilities side, LDG’s total liabilities increased by 12%, reaching over VND 4.1 trillion, mainly due to a 17% rise in other short-term payables to nearly VND 1.5 trillion. This included a nearly 95% increase in amounts payable to customers for project cancellations, totaling nearly VND 373 billion. Meanwhile, the company’s debt decreased by 6%, settling at nearly VND 1.3 trillion.

|

LDG’s project cancellation liabilities as of the end of 2024

Source: LDG

|

LDG has yet to repay over VND 200 billion in principal and interest on bonds after multiple extensions

Ha Le

– 11:20 31/01/2025

![[What’s Happening] “Neighborhood Chief” Steps In: Livestreaming God’s Outrageous Ads Get Shut Down!](https://xe.today/wp-content/uploads/2025/08/chuyen-j-d-100x70.jpg)