**VHM’s 2024 Financial Results**

|

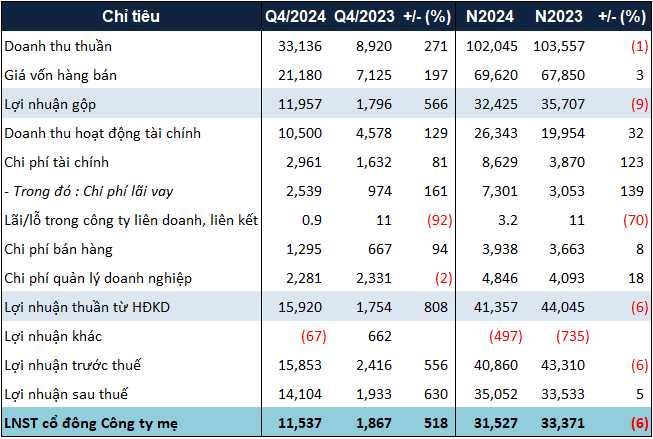

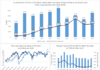

VHM’s 2024 business results in VND billion

Source: VietstockFinance

|

Of the more than 102 trillion VND in net revenue, over 73.2 trillion VND came from the handover of real estate products, with the most significant contributions from Ocean Park (9.4 trillion VND), Ocean Park 2 (17 trillion VND), Ocean Park 3 (29.1 trillion VND), and Golden Avenue (4.2 trillion VND).

According to VHM, sales revenue for 2024 and unrecorded revenue as of the end of Q4 2024 reached nearly 104 trillion VND and nearly 94.2 trillion VND, respectively, thanks to favorable sales results in the major urban areas, especially at the Vinhomes Royal Island project, which was launched at the end of March 2024.

In the last three months of 2024, VHM continued to launch The Paris Subdivision at Vinhomes Ocean Park 1 (Hanoi), Kyoto 3 (The Premium) Subdivision at Vinhomes Star City (Thanh Hoa), and inaugurated model houses and commercial streets in the mega-projects.

|

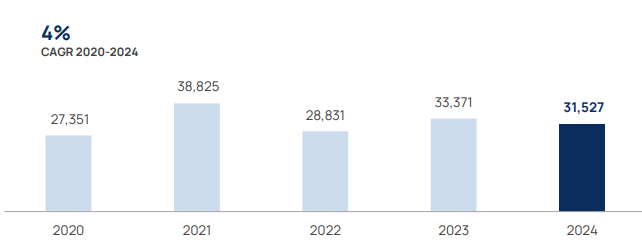

VHM’s net income from 2020 to 2024 in VND billion

Unit: VND billion. Source: VHM

|

On the balance sheet, VHM’s total assets as of December 31, 2024, exceeded 560.7 trillion VND, up 26% from the beginning of the year. Short-term cash holdings increased by 71% to nearly 30.8 trillion VND.

Payables also increased by 30% to nearly 340.3 trillion VND due to a 43% and 44% increase in short-term debt and other payables, reaching 81.3 trillion VND and 126 trillion VND, respectively.

Ha Le

– 17:28 24/01/2025

The Forex Headwind: How Petrolimex Navigates a 15% Profit Plunge in Q4

Petrolimex (Vietnam National Petroleum Group, HOSE: PLX) experienced a significant decline in profits in Q4 due to volatile exchange rates. Despite this challenge, the Group achieved growth in its cumulative results, surpassing the plans approved by the 2024 General Meeting of Shareholders.

Industrial Land Rental Revenue Plummets, KBC Loses Nearly 80% of 2024 Profits

In 2024, Kinh Bac City Development Holding Corporation (HOSE: KBC) experienced a less impressive performance compared to the previous year, with a 51% and 79% decline in revenue and profit, respectively. This was largely due to a significant 77% drop in land and industrial infrastructure leasing revenue. Consequently, the enterprise achieved only 12% of its profit plan.

The Housing Market’s Resilience in 2024: What’s in Store for 2025?

The residential real estate market in 2024 is showing promising signs of recovery, with notable improvements in supply, selling prices, absorption rates, and consumer confidence. The market is leaving behind its stagnant state and is on an upward trajectory, indicating a positive shift and a departure from the previous lows.