Hanoi Stock Exchange (HNX)-listed Thien Ha – Bang Duong Investment and Construction JSC recently announced that it had raised VND 1.1 trillion ($46.5 million) through a bond issuance in the final month of 2024.

The bonds, issued on December 26, 2024, with a coupon rate of 12% for the first two interest periods, will mature in five years, on December 26, 2029. The interest rate for the remaining periods will be determined by a formula based on a reference rate plus a spread of 4.5%.

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) guaranteed the payment of the bonds, which are registered and deposited with HD Securities (HDBS). The bond codes are THBCH2429002, THBCH2328001, and THBCH2429001, with respective values of VND 1.1 trillion, VND 800 billion, and VND 600 billion.

Established in December 2014, Thien Ha – Bang Duong was founded by Truong Thien Ha JSC, holding 97% of the shares, and Bang Duong Investment, Construction, and Commerce Company Limited, with 3%. The company has since increased its charter capital, and the founding shareholders have fully divested, with Mr. Truong Xuan Binh now holding 49% and Mr. Nguyen Dai Duong holding 51%.

The company is the investor of The Esme Di An, a residential and commercial complex in Di An City, Binh Duong Province. Approved in April 2015, the project has undergone several adjustments in terms of area and construction plans, leading to delays. In 2022, the project received approval for its 1/500 planning, with construction expected to be completed by 2027.

The Esme Di An Project Facade

|

Spanning 4.3 hectares, The Esme Di An is located in Di An City, Binh Duong Province. It is expected to accommodate a population of nearly 4,000 people. The project comprises two apartment blocks with 39 floors and three basements, 81 commercial townhouses, and 41 resettlement houses.

According to sources, the rumored selling price of the project reaches VND 62-133 million per square meter, an extremely high price for the Binh Duong real estate market.

Location of the Project Site

|

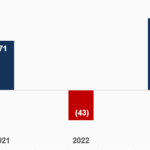

Despite raising a significant amount of bond capital in the past two years, Thien Ha – Bang Duong has consistently incurred losses. In the first half of 2024, the company posted a loss of over VND 375 million. The company also recorded losses of VND 793 million and VND 1.4 billion in 2023 and 2022, respectively.

In its inaugural credit rating for Thien Ha – Bang Duong in mid-2024, FiinRatings assessed the company’s creditworthiness as ‘Weak’ in the residential real estate industry. This assessment considered the company’s lack of established brand recognition, small scale, and unproven operational efficiency. From its establishment in 2014 until 2024, Thien Ha – Bang Duong had no significant revenue sources and solely focused on developing The Esme Di An project.

The project has a history of delays, receiving its initial investment license in 2015 and subsequent approval for adjustments in scope, investment scale, and timeline in May 2024. As of June 2024, the company was in the process of fulfilling its land payment obligations and expected to deliver resettlement and adjacent products in the first quarter of 2025.

Thien Ha – Bang Duong’s operational efficiency remains unproven, as the company has not engaged in any other activities over the past five years. For The Esme Di An project, the company anticipates a revenue of approximately VND 9,105 billion, with an estimated profit margin of 8.8%. The selling prices of the project’s products are considered higher than the average for similar products in the Binh Duong region.

FiinRatings projects Thien Ha – Bang Duong’s debt-to-equity ratios to be 2.2 and 2.4 in 2024 and 2025, respectively. The high leverage, coupled with the project’s early stage of development, makes the company’s debt repayment capacity susceptible to changes in selling prices or cost fluctuations due to construction or sales delays. The primary sources of liquidity are the VND 1,700 billion in bond debt and approximately VND 220 billion in owner’s equity. Additionally, the company plans to pay land-related costs, including VND 134 billion for land-use conversion and approximately VND 400 billion in land taxes, to gradually complete the project’s legal framework.

– 14:04 21/01/2025

The Billionaire’s Stock Surge: Nguyễn Đăng Quang and Nguyễn Thị Phương Thảo’s Unexpected End-of-Year Rally to New Heights

As of December 30, billionaire Nguyen Thi Phuong Thao’s HDB stock holdings were valued at nearly VND 3,485 billion, marking an increase of over VND 222 billion for the day.

The Green Finance Framework: Pioneering Sustainability at HDBank

HDBank has unveiled its Sustainable Finance Framework, aligned with the standards set by the International Capital Market Association (ICMA) and the Loan Market Association (LMA). This framework was developed with technical support from the International Finance Corporation (IFC) and received a “very good” rating from Moody’s.

“Encapital Raises $4.3 Million in Bond Offering”

Encapital Financial Technology JSC successfully issued a 100 billion VND bond on December 6, 2024, secured by shares of a securities company listed on the Ho Chi Minh Stock Exchange (HOSE).