For three consecutive years, deposit balances have been lower than credit balances

At a press conference announcing the banking sector’s performance in 2024 and deploying tasks for 2025 on January 7, Deputy Governor of the State Bank of Vietnam (SBV) Dao Minh Tu said that as of December 31, 2024, credit increased by about 15.08% compared to the beginning of the year, with credit focusing on production and business and priority areas.

Thus, credit outstanding reached nearly VND 15.6 million billion by the end of 2024, an increase of more than VND 2.1 million billion. This is also the largest increase in credit outstanding in 11 years in absolute terms.

The positive macroeconomic performance, with GDP growth in the later quarters outperforming the earlier ones, the real estate market showing many positive signals, and import-export turnover increasing sharply compared to the same period last year, have all increased credit demand and the economy’s absorption capacity in 2024.

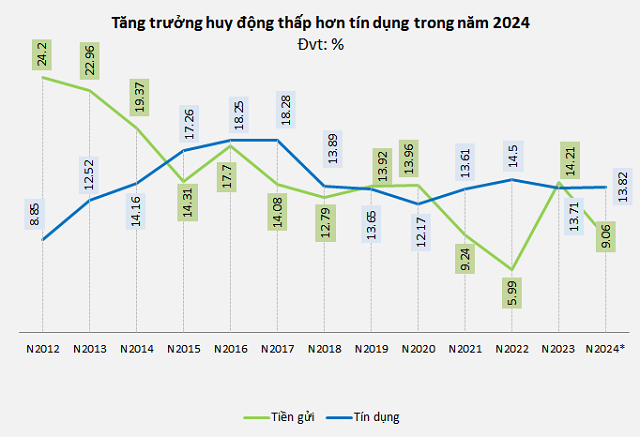

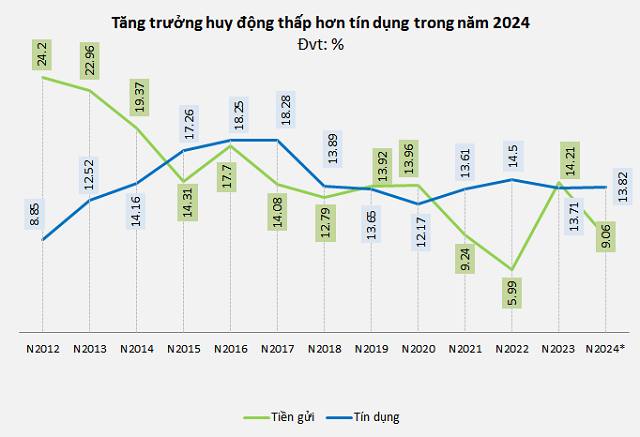

Source: SBV. For 2024 (*) according to the General Statistics Office of Vietnam as of December 25, 2024.

|

According to the General Statistics Office of Vietnam, as of December 25, 2024, credit institutions’ capital mobilization increased by 9.06%, equivalent to an increase of VND 1.2 million billion, to nearly VND 14.7 million billion. The economy’s credit growth reached 13.82%, equivalent to an increase of VND 1.9 million billion, to over VND 15.4 million billion.

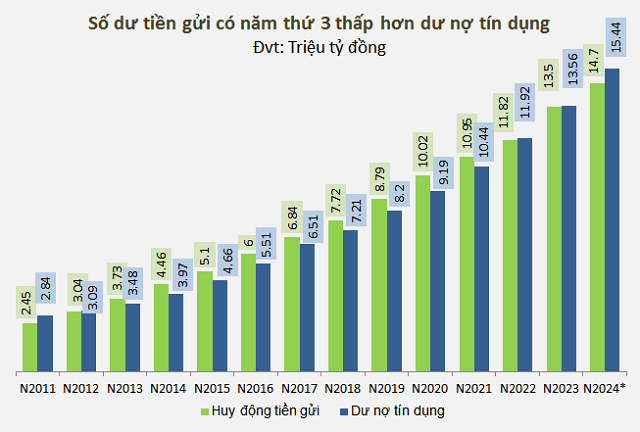

If compared with credit outstanding at the same point of December 25, 2024, capital mobilization was lower by VND 700,000 billion, marking the highest gap between credit and mobilization. Moreover, 2024 was also the third consecutive year in which deposit balances were lower than credit outstanding.

Source: SBV. For 2024 (*) according to the data of the General Statistics Office of Vietnam as of December 25, 2024

|

2022 was a turning point when credit outstanding surpassed deposit balances for the first time in 12 years, with a gap of about VND 100,000 billion. This was an inevitable result, stemming from the economy’s high demand for loans after the COVID-19 pandemic, while a portion of people’s money was “stuck” in corporate bonds after the events of Tan Hoang Minh and Van Thinh Phat.

Following the corporate bond crisis in 2022, the real estate market – an area that attracts a large amount of credit – became almost “frozen” in 2023. In addition, many unfavorable factors from external sources (weak global aggregate demand, escalating geopolitical conflicts) further weakened domestic loan demand and business expansion.

Faced with many uncertainties in the economy, people turned to bank savings deposits, prioritizing safer investment channels. As a result, deposit balances almost caught up with credit outstanding, narrowing the gap to VND 60,000 billion in 2023.

However, in 2024, the story of deposit balances being lower than credit outstanding became more prominent with an unprecedented gap. The main reason for this outcome was the record low deposit interest rate.

Source: SBV

|

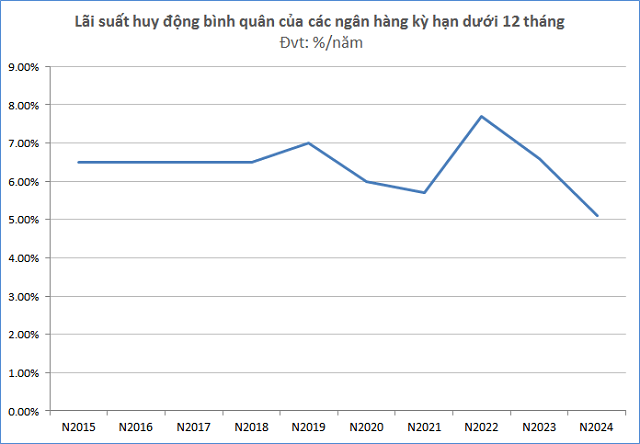

According to the SBV’s report for December 2024, the average deposit interest rate for terms below 12 months of commercial banks was only 5.1%/year – the lowest compared to the same period in the last nine years (2015-2024).

Since the four consecutive interest rate cuts in 2023, the SBV has maintained the operating interest rates and directed commercial banks to reduce operating expenses to cut lending rates, thereby helping to reduce lending rates in 2024 for new transactions of commercial banks, contributing to economic growth.

However, this has also caused a large amount of money to flow out of bank savings deposits and into other investment channels, with gold being the natural choice as it has long been considered a “value-preserving asset against inflation.”

According to the General Statistics Office of Vietnam, on average in 2024, domestic gold prices increased by 28.6% compared to the end of 2023. The “gold rush” last year was driven by rising global gold prices due to geopolitical instability and the shift towards monetary easing by major central banks worldwide to stimulate consumption.

Is the savings deposit channel still attractive?

According to KBSV Securities Co., Ltd. (KBSV), the pressure on deposit interest rates remains, as the gap between capital mobilization and credit growth in 2024 has caused the loan-to-deposit ratio (LDR) of many banks to increase to nearly the SBV’s prescribed ceiling of 85%, while the credit growth target for the following year remains high (about 13-15%). On the other hand, interbank interest rates will not cool down soon due to potential foreign exchange rate tensions in the first half of 2025, making it difficult to mobilize funds from the interbank market (market 2). Deposit interest rates for 2025, in general, will increase to meet liquidity needs but will vary across bank groups.

Accordingly, the deposit interest rate of state-owned banks may increase by 30-50 basis points from the current level. However, this increase will still be lower than that of joint-stock commercial banks due to the support of state treasury deposits, so liquidity concerns are not significant.

The remaining joint-stock commercial banks will be divided into different groups, and the increase will also be larger (50-100 basis points). Small-scale banks without the advantage of current accounts and savings accounts (CASA) will face more pressure to increase deposit interest rates.

FIDT experts also forecast that as the economy recovers, capital demand increases, and foreign exchange rate pressure remains, savings deposit interest rates will slightly increase in 2025, in line with the SBV’s monetary easing orientation.

Regarding savings deposits, FIDT recommends that investors prioritize mid-sized banks with medium capitalization and high capital mobilization pressure in 2025 to obtain higher interest rates. At the same time, investors should choose short-term deposits from 6 to 12 months to take advantage of the expected interest rate adjustments in the near future.

For borrowers, FIDT believes that this is an ideal time to choose long-term loans, taking advantage of the current low-interest rate environment before rates are expected to rise in the coming years.

– 20:00 15/01/2025

Trump’s Statement Sends Gold Prices Soaring to Near-Record Highs

The catalyst for this rally was a weakening U.S. dollar, which came under pressure after U.S. President Donald Trump declared that he would demand “lower interest rates immediately.”