In a recent update on the tech sector’s outlook, SSI Research noted that tech and telecom stocks surged by 140% in 2024, significantly outperforming the VN-Index (+12%). This impressive performance is attributed to a re-rating trend, with P/E multiples expanding in line with global tech peers.

This trend began in 2023, fueled by positive sentiment around artificial intelligence (AI) prospects, particularly generative AI.

The year 2024 also marked a significant milestone for Vietnam as mobile network operators officially discontinued 2G-only services, and the leading mobile network operator, Viettel, pioneered 5G commercialization. This could be a primary reason for TowerCo’s P/E expansion of 32% while the global average remained relatively flat. CTR, as the only listed TowerCo in Vietnam, stands to benefit from this shift.

According to SSI Research, the collaboration with NVidia paves the way for Vietnam to achieve breakthroughs in AI in the coming years. In fact, the world’s leading AI chip manufacturer considers Vietnam its “second home” and has signed a cooperation agreement with the Vietnamese government to establish the country’s first research and development (R&D) center, dubbed the Vietnam Research and Development Center (VRDC), and Viettel’s AI Data Center, powered by NVIDIA technology.

Additionally, on the same day, NVidia announced the acquisition of VinBrain, a transaction value that was not disclosed. This marks one of the initial steps toward developing AI capabilities in Vietnam. VinBrain was previously known as an affiliate of Vingroup (VIC), with VIC holding 49.7% of its shares as of September 2024. VinBrain is a pioneer in AI, computer vision, and machine learning in Vietnam, offering customized solutions in healthcare, serving over 180 hospitals worldwide.

Moreover, NVIDIA is also collaborating with leading Vietnamese tech and telecom companies, including FPT, Viettel, CMC Corporation, and Vietnam Posts and Telecommunications Group (VNPT), further solidifying its presence in the country.

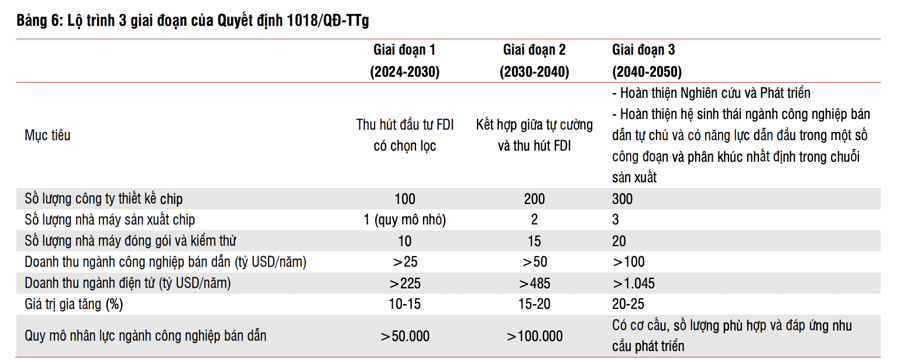

Turning to the semiconductor industry, SSI Research acknowledges both the opportunities and challenges presented in pursuing this strategic sector. In September 2024, the Vietnamese government unveiled its strategy (Decision 1018/QD-TTg) for semiconductor development, emphasizing the formula “C=SET+1” and a three-phase roadmap toward 2050. Notably, the strategy sets out important targets to be achieved by 2030, including having 100 chip design companies, one chip manufacturing facility, ten packaging and testing factories, and 50,000 semiconductor engineers.

Meanwhile, according to the Ministry of Information and Communications (MIC), as of November 2024, Vietnam has approximately 50 chip design companies and seven packaging and testing factories. The country currently boasts around 26,000 semiconductor engineers, including roughly 6,000 chip design engineers and an equal number of packaging and testing specialists.

In terms of the strategy’s feasibility, around 40 universities in Vietnam offer semiconductor-related education programs. FPT, for instance, has approximately 200 chip design engineers, and its educational institutions enrolled 1,500 semiconductor students in 2024.

Additionally, in recent years, authorities in various localities, such as Ho Chi Minh City, Danang, Binh Duong, Vinh Phuc, Bac Giang, and Bac Ninh, have proactively developed the semiconductor ecosystem, attracted investments, and fostered international cooperation to advance the industry.

The Ministry of Planning and Investment has also been in discussions with leading global technology corporations like Google, Meta, AIChip, Lam Research, Qorvo, and Qualcomm to relocate their supply chains to Vietnam. Consequently, the country now has 174 FDI projects related to the semiconductor industry, with a total registered capital of nearly $11.6 billion.

Furthermore, NVIDIA has signed agreements with several partners to relocate production from other countries to Vietnam, committing to invest between $4 billion and $4.5 billion in the next four years.

SSI Research views these developments as crucial enablers for the growth of the semiconductor industry. However, there remains a significant gap between the current state of implementation and the strategy’s goals. Notably, Vietnam has yet to engage in chip manufacturing (with Viettel being tasked by the government to develop a plan for a small-scale production project), and the current number of semiconductor engineers is only slightly over half of the targeted 50,000.

“Therefore, we are concerned that the talent training and chip manufacturing processes require substantial capital investment and a high-quality workforce, which may pose significant challenges in the medium term,” expressed SSI Research.

The 2024 P/E multiples for the global information technology sector, including Vietnam, improved due to positive sentiment surrounding AI prospects. Regarding FPT, SSI Research maintains its attractiveness. SSI anticipates robust profit-before-tax growth, primarily driven by the information technology segment, with the launch of the FPT AI Factory expected to contribute approximately 5% to this segment’s revenue.

“Vietnam’s Strategic Advantage: Prime Minister Vows to Develop Semiconductor Industry”

“Prime Minister Pham Minh Chinh emphasized the development of the semiconductor industry as a strategic breakthrough and a key focus area. He underscored that it is not only a possibility but also a determination, leveraging Vietnam’s unique potential, prominent opportunities, competitive advantages, and strategic direction.”

The World Sells 1 Trillion Chips a Year: What’s in It for Vietnam?

The global semiconductor industry took 66 years to reach the $500 billion mark, but it needed just nine more to sprint to the $1 trillion milestone. Meanwhile, foreign-invested enterprises dominate the chip design and packaging industry in Vietnam, leaving us with near-zero ownership of chip products.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)