The market witnessed a brilliant rebound session after Trump’s tariff policies towards Canada and Mexico, which had a positive response. The two countries were granted a tariff delay, preventing a devastating trade war in North America.

Domestic investor sentiment has been dominated by external factors lately, so once the pressure-relieving information was released, the market broke through. Meanwhile, the recently released Q4 financial results recorded a growth of over 20%, continuing the upward trend of Q3/2024. The VN-Index closed at 1,264 points, a gain of 11.33 points or 0.90%. The market breadth was overwhelmingly positive with 361 gainers and only 106 losers.

Most sectors witnessed strong growth, led by banking, thanks to explosive profit reports from some banks. Specifically, the banking group rose by an impressive 1.22%, with CTG up 3.55%, VPB by 1.35%, TCB by 1.65%, and STB by 2.05%. Securities followed suit, with VND hitting the ceiling price, SHS up 6.98%, and numerous stocks rising by over 2-3% such as SSI, HCM, MBS, and VIX. The materials, telecommunications, transportation, and energy sectors also witnessed substantial gains.

Notably, FPT reversed its losses from the previous session, climbing 0.48%, and CMG rose 1.34% after a sharp decline due to the DeepSeek shock that threatened technology stocks globally.

Liquidity on the three exchanges continued to increase, with matched orders reaching VND15,700 billion. The weakness came from foreign investors, who net sold VND985.6 billion, with a net sell of VND632.9 billion in matched orders.

The main net buy by foreigners in matched orders was in the Basic Resources, Construction, and Materials sectors. The top net bought stocks by foreigners in matched orders included HPG, MSN, CTG, GEX, FUESSVFL, TPB, VGC, EIB, VCG, and NKG.

On the selling side, foreigners net sold Food & Beverage stocks in matched orders. The top net sold stocks by foreigners in matched orders were VNM, FPT, SSI, VHM, FRT, STB, VCI, DGC, TCB, and MSN.

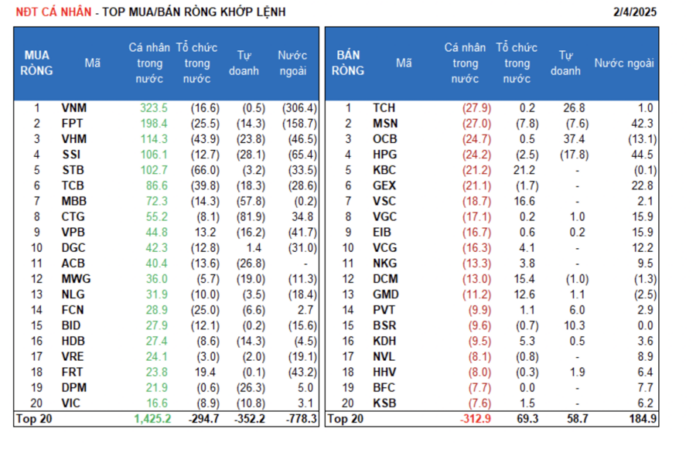

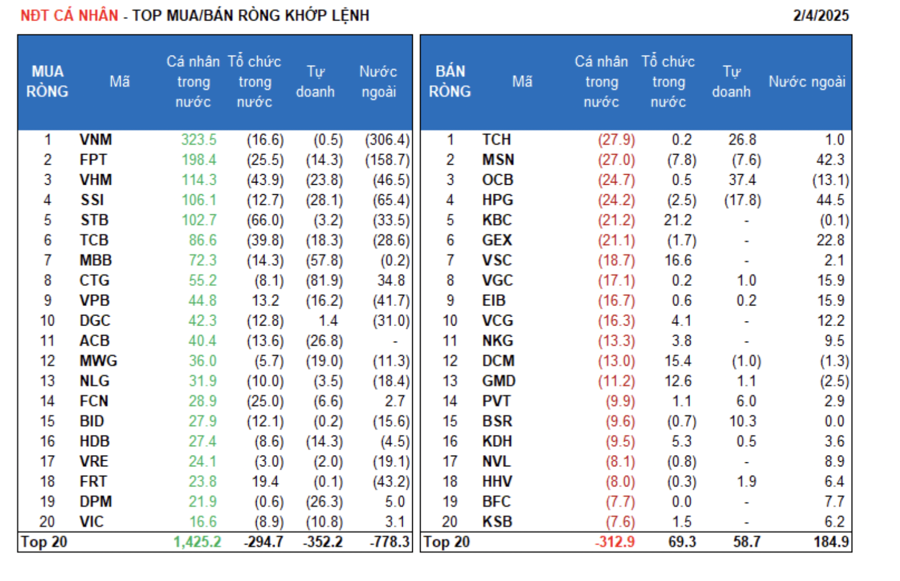

Individual investors net bought VND1,392.2 billion, of which VND1,232.0 billion was in matched orders.

In terms of matched orders, they net bought 10/18 sectors, mainly in the Banking sector. The top net bought stocks by individual investors included VNM, FPT, VHM, SSI, STB, TCB, MBB, CTG, VPB, and DGC.

On the net selling side in matched orders, they sold 8/18 sectors, mainly in the Industrials & Business Services and Basic Resources sectors. The top net sold stocks included TCH, MSN, OCB, HPG, KBC, GEX, VGC, EIB, and VCG.

Proprietary trading net sold VND949.0 billion, with a net sell of VND356.4 billion in matched orders.

In terms of matched orders, proprietary trading net bought 4/18 sectors. The biggest net bought sector was Oil & Gas, followed by Travel & Leisure. The top net bought stocks by proprietary trading in today’s session included OCB, TCH, VCI, SCS, VCB, BSR, PVT, ANV, CSM, and HHV. The top net sold sector was Banking. The top net sold stocks included CTG, MBB, SSI, ACB, DPM, VHM, FUESSVFL, MWG, TCB, and HPG.

Domestic institutions net bought VND511.7 billion, but in terms of matched orders, they net sold VND242.7 billion.

Looking at matched orders, domestic institutions net sold 11/18 sectors, with the highest value in the Banking sector. The top net sold stocks included STB, VHM, TCB, FPT, FCN, VNM, MBB, ACB, DGC, and SSI. The highest net bought sector was Industrials & Business Services. The top net bought stocks included KBC, FRT, VSC, DCM, VPB, GMD, LPB, POW, KDH, and PNJ.

Today’s matched orders reached VND2,339.7 billion, up 97.4% from the previous session and contributing 13.8% of the total trading value.

Notable transactions today included LPB, with over 11.6 million units worth VND417.2 billion traded by domestic institutions, who bought from proprietary trading and foreign investors. Additionally, there was a transaction where domestic institutions sold nearly 5.5 million units of GEE (valued at VND194 billion) to an individual investor.

Individual investors continued to trade in the Banking sector (STB, TCB, EIB, HDB, VPB) and large-cap stocks (FPT, MWG, HPG).

The allocation of money flow increased in Real Estate, Banking, Securities, Construction, Steel, Chemicals, Agricultural & Seafood, and Food & Beverage, while it decreased in Retail, Electrical Equipment, Oil & Gas Equipment & Services, Software, Warehousing, Logistics & Maintenance, and Plastics, Rubber & Fibers.

In terms of matched orders, the allocation of money flow increased in the mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in the large-cap (VN30) stocks.

The Great Capital Shift: Will Frontier and Emerging Markets Trump the US by 2025?

The global investment landscape may be shifting its gaze away from the traditional allure of the US stock market in 2025. There is a potential shift towards frontier and emerging markets, with Vietnam being a key player in this narrative.

“Steady Growth and Effective Risk Management: Nam A Bank’s Path to Success in 2024”

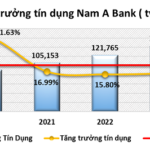

As of the end of 2024, Nam A Bank (HOSE: NAB) reported impressive growth in its business performance. The bank witnessed a significant expansion in its scale of operations, coupled with enhanced asset quality. Notably, the bank’s indicators for mobilization and credit outstanding balances demonstrated remarkable effectiveness, reflecting the bank’s strong performance and strategic success.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)