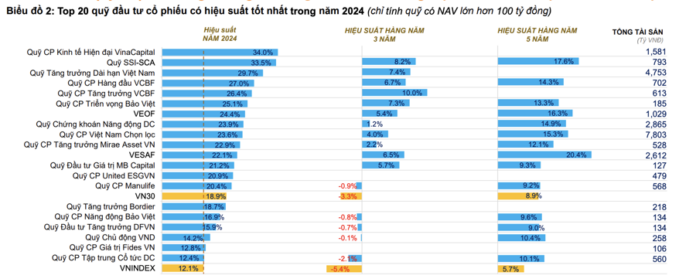

## Equity Funds Outperform in 2024, but Long-Term Performance Remains Unstable

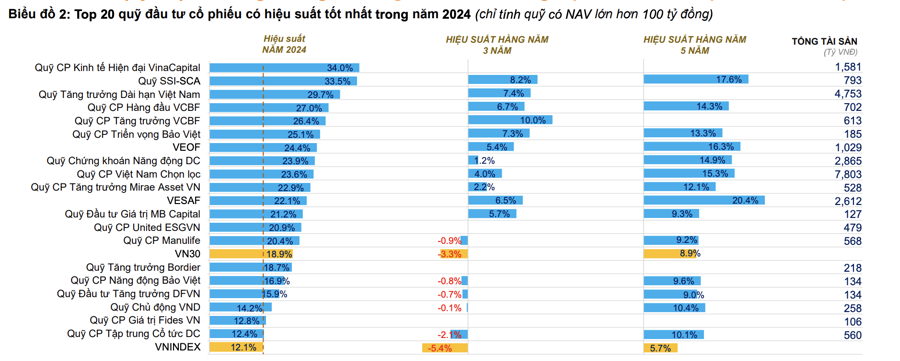

Equity funds outperformed in 2024, with an average growth rate of 20%, surpassing the VN-Index’s 12.1% rise, according to statistics by FiinTrade. This exceptional performance can be attributed to positive profits in the first half of the year.

However, the five-year average return was lower at 10.3%, and the three-year return was negative at -0.8%, mainly due to significant losses in 2022. This indicates the long-term instability of these funds, but a five-year average return of 10.3% is relatively solid.

Many Equity Funds Double or Triple the VN-Index’s Performance

Out of the 66 equity funds, 41 achieved exceptional growth compared to the VN-Index’s 12.1% rise in 2024, thanks to strong performance in the first half. However, the majority of these funds underperformed in the latter half as the market stagnated with reduced liquidity and continued net selling pressure from foreign investors.

The Modern Economy Equity Fund (VMEEF) from VinaCapital, established in 2023, led the pack with a 34% growth rate by allocating a large proportion of its portfolio to bank and technology stocks (FPT, FOX). Following closely was the Vietnam Long-Term Growth Fund (VFMVSF) with a 29.7% increase, the highest since its inception in 2021, and an impressive five-year compound annual growth rate of 15.3%.

The VinaCapital Market Access Equity Fund (VESAF) and the SSI Sustainable Competitive Advantage Investment Fund (SSI-SCA) maintained stable compound annual growth rates over both short and long-term periods. Their growth rates for the past year were 22.1% and 33.5%, respectively. Several other funds also outperformed the VN-Index, including the Vietnam Long-Term Growth Fund (29.7%), VCBF Leading Equity Fund (27%), VCBF Equity Growth Fund (26.4%), and the Bao Viet Prospect Equity Fund (25.1%).

While not achieving the high growth rates of equity funds, the bond funds displayed consistent performance over the years.

Bond funds continued their stable performance in 2024, with 19 out of 23 funds offering higher returns than the 12-month savings deposit rate of 4.6% at Vietcombank. The TCBF fund stood out with a superior performance compared to its peers (+13.7%), although it fell short of its 2023 performance (+32.16%).

In second place was the MB Bond Fund (MBBOND) with an 8.3% return. Conversely, the HD High-Yield Bond Fund (HDBond) was the only bond fund with a negative performance (-0.3%). Its portfolio allocation consisted of 44.4% bonds, 13.7% stocks, and mostly fixed deposits. Notably, VietCredit bonds and stocks of the Vingroup conglomerate made up a significant portion of HDBond’s portfolio.

Over the long term, the bond funds displayed positive performance, with returns outpacing the 36-month (5.3%) and 60-month (6.8%) savings deposit rates at Vietcombank.

Balanced funds witnessed high growth rates in 2024, with larger-scale funds (NAV > 100 billion VND) outperforming their smaller counterparts. Leading the pack was the VCBF Strategic Balanced Fund with a 20.2% growth rate. This fund allocated 61.6% to stocks and 23.1% to bonds, with significant holdings in FPT, MEATLife (MML), and Coteccons (CTD) corporate bonds.

Over a five-year period, the VCBF Strategic Balanced Fund maintained its impressive performance, achieving an average compound annual growth rate of 11%.

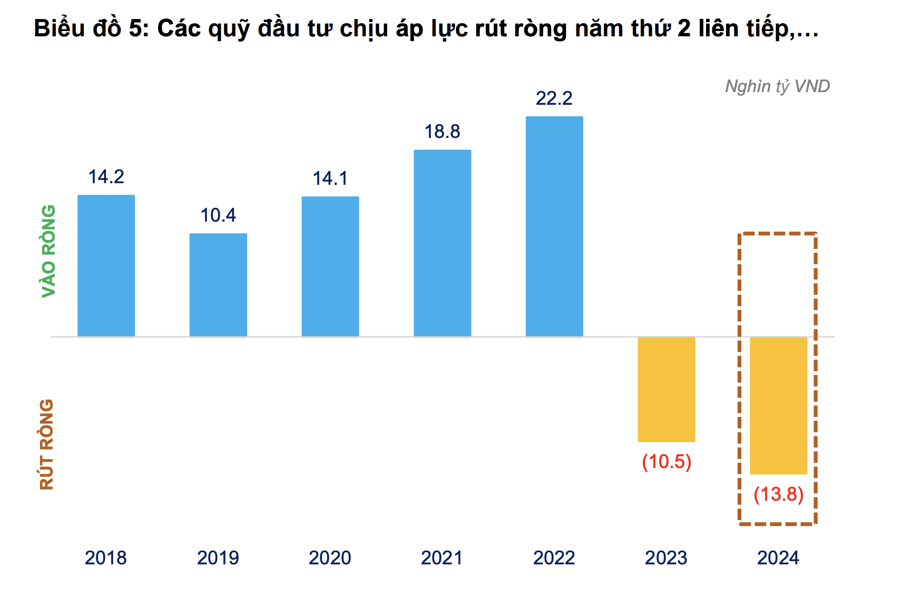

Equity Funds Continue to Experience Record Outflows

In terms of capital flows, equity funds experienced outflows for the second consecutive year. In 2024, funds investing in Vietnamese stocks and bonds faced outflows for the second year in a row, totaling approximately 13.8 trillion VND, higher than the 10.5 trillion VND outflows in 2023.

When considering fund types, passive funds witnessed outflows of around 30.6 trillion VND, while active funds saw inflows of 23.6 trillion VND.

Analyzing investment strategies, there was a significant shift towards bond funds, with net inflows of nearly 12.9 trillion VND, mostly attributed to the Techcom Bond Investment Fund (TCBF). Conversely, equity funds experienced record outflows of 27.5 trillion VND, primarily driven by passive ETFs such as DCVFMVN DIAMOND and Fubon FTSE Vietnam ETF. Meanwhile, balanced funds exhibited negligible changes in capital flows.

The VFMVSF and VMEEF open-ended funds, with their superior performance in 2024 due to their holdings in bank stocks, attracted positive capital inflows. Specifically, VMEEF has seen continuous net inflows since November 2023, totaling over 1.4 trillion VND. On the other hand, VFMVSF experienced sudden net inflows during months when the fund’s performance was negative.

Large-scale funds, such as VEIL, Fubon FTSE Vietnam ETF, and ETF DCVFMVN DIAMOND, faced significant redemption pressure from investors, particularly in the initial months of the year.

In 2024, a broad shift towards bond funds was observed, with 14 out of 23 funds experiencing net inflows, notably the Techcom Bond Investment Fund (TCBF) and the Vietnam Bond Fund (DCBF) managed by Dragon Capital.

The year marked a turnaround for bond funds, with positive net inflows and stable performance, although a few funds continued to experience mild redemption pressure. This shift reflects investors’ preference for safer and less volatile investment options.

The Foreign Block Continues to Dump Tech Stocks, with Particularly Strong Sell-Offs in FPT

Liquidity across all three exchanges surged today, with a massive 15.7 trillion VND in matched orders. The foreign bloc remained a weak link, offloading another 985.6 billion VND, with 632.9 billion VND in matched orders alone.

The First Month of 2025: VN-Index Slips, Liquidity Hits 3-Year Low, Foreigners Keep Selling

The first month of the year witnessed a significant 23.4% decline in average trading values, bringing the figure to a meager 11.406 trillion VND. This places the monthly liquidity at a three-year low, a concerning development for the market.