Regal Legend Project

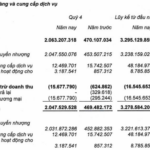

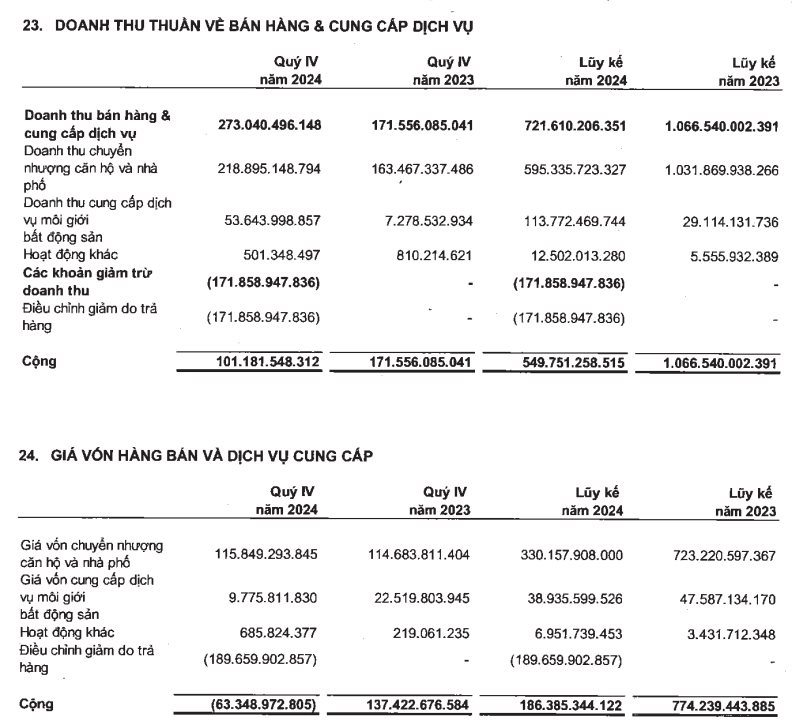

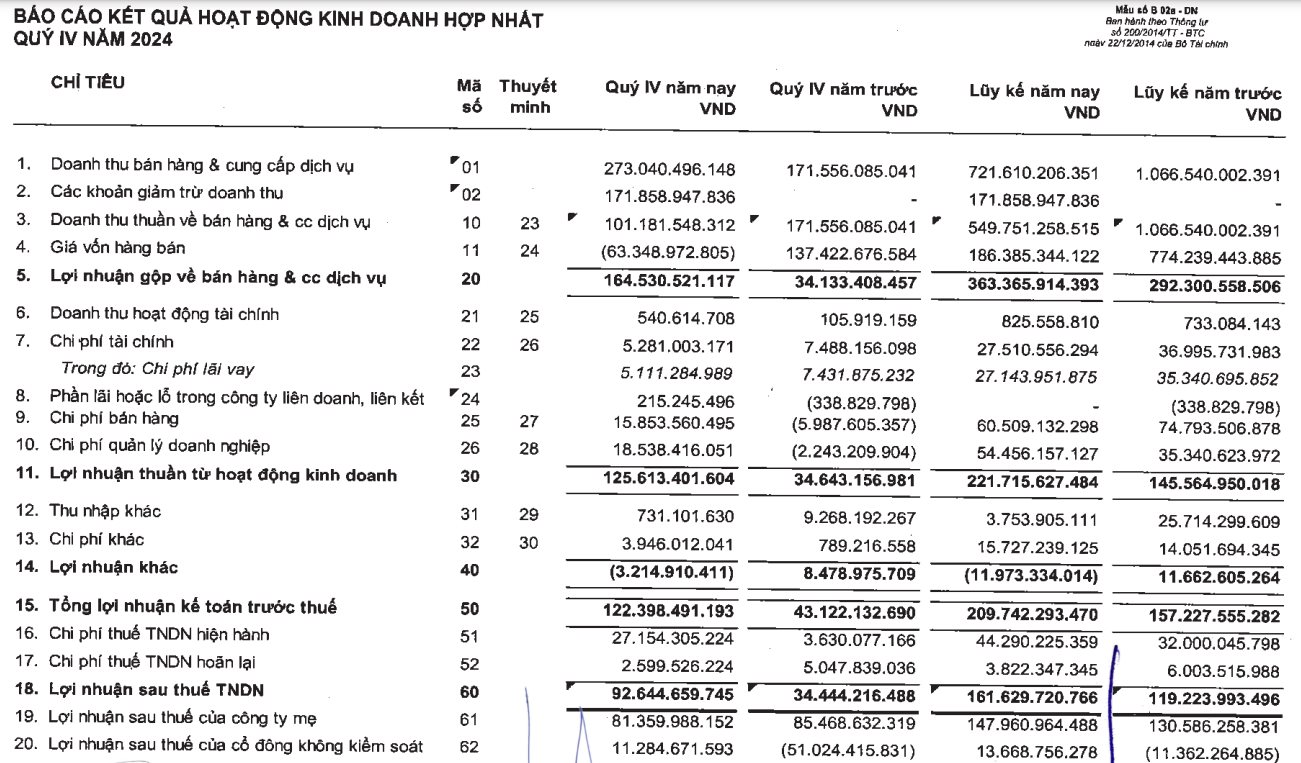

CTCP Regal Group has just announced its consolidated financial statements for Q4 2024 with sales revenue and service provision reaching VND 273 billion. However, due to adjustments for returned goods of nearly VND 172 billion, the company’s net revenue was over VND 101 billion, a 41% decrease compared to the same period last year.

Also due to adjustments for returned goods, the cost of goods sold decreased by nearly VND 190 billion. The company’s gross profit was nearly VND 165 billion, 4.8 times higher than the previous year.

Regal Group’s Financial Highlights for Q4 2024

After deducting expenses, the company’s net profit for Q4 was nearly VND 93 billion, an increase of 2.7 times compared to Q4 2023. The company attributed the high net profit growth to improvements in its core business, including the handover of products from projects to customers, such as the Regal Legend project, as well as the recognition of revenue from multiple projects.

For the full year 2024, Regal Group’s net revenue was VND 550 billion, a decrease of 48% from 2023, while net profit reached VND 162 billion, an increase of 36%.

Regal Group’s Financial Performance for 2024

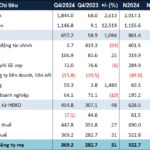

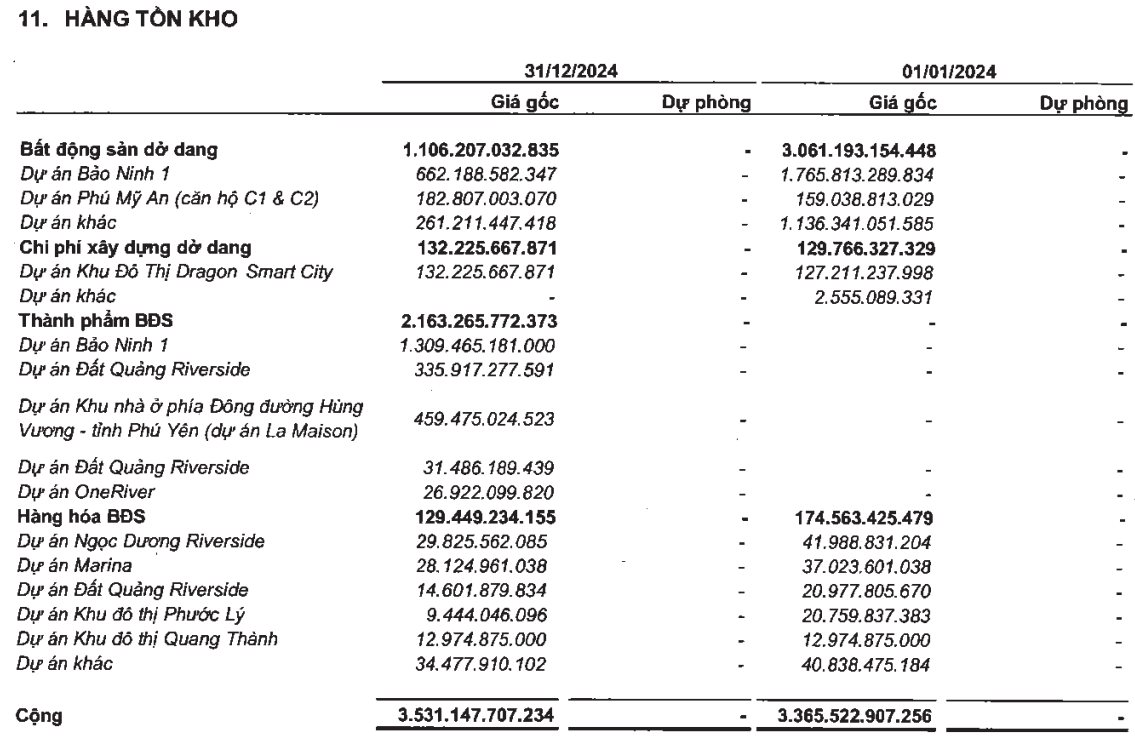

As of December 31, 2024, Regal Group’s total assets were VND 4,813 billion, a slight increase of VND 8 billion from the beginning of the year. The majority of the assets were inventories, amounting to VND 3,531 billion (73% of total assets).

Breakdown of Regal Group’s Total Assets

Real estate finished products accounted for the majority of the company’s inventories, with over VND 2,163 billion, of which the Bao Ninh 1 project accounted for VND 1,309 billion. The Bao Ninh 1 project, commercially known as Regal Legend in Quang Binh, spans 21 hectares and has a total investment of VND 10,000 billion. It offers a range of products, including a commercial center, apartments, shop villas, townhouses, and lakefront villas.

Regal Group, formerly known as Trung Land Shareholding Company, was established in March 2011. The company changed its name to CTCP Regal Group in March 2023.

Regal Group has a charter capital of VND 1,800 billion, of which CTCP Dich vu Bat dong san Dat Xanh holds 55% with a contribution of VND 990 billion, Mr. Tran Ngoc Thanh holds 15% with VND 270 billion, and Mr. Luong Tri Thin holds 5% with over VND 93 billion.

Notably, Regal Group has received the certificate of securities registration from the Vietnam Securities Depository and Settlement Corporation. Accordingly, the company’s shares are coded as RGG and took effect from January 10, 2025.

Prior to this, on December 5, 2024, the State Securities Commission confirmed the completion of the registration of Regal Group as a public company.

Some of Regal Group’s prominent projects include Regal Legend (Dong Hoi) with a scale of 21 hectares and a total investment of VND 10,000 billion; the Pavillon project with a scale of 2.1 hectares and a total investment of VND 1,000 billion; the Castia Dragon project with a scale of 78 hectares and a total investment of VND 4,000 billion, in which Regal Group is a development partner; the high-rise complex project Regal Complex Danang with a construction scale of 8,874 m2 and a total investment of VND 1,000 billion; and the Regal Maison project with a scale of 4.1 hectares and a total investment of VND 1,000 billion.

On December 26, 2024, Regal Group’s Board of Directors approved the transfer of 10.2 million shares, equivalent to 51% of the charter capital of Viet Nam Smart City Joint Stock Company, to DXS.

Subsequently, on December 27, 2024, the Board of Directors of Regal Group approved the transfer of more than 3.1 million shares of Central Real Estate Joint Stock Company (51% charter capital) and more than 1 million shares of Emerald Real Estate Development Joint Stock Company (51% charter capital) to Viet Nam Smart City Joint Stock Company.

The Cash Flows into Mid and Small-Cap Stocks

Although the VN-Index closed today with a modest gain of 0.39%, nearly a hundred stocks outperformed, rising over 1% compared to their reference prices. Notably, only six of these were from the VN30 basket, with the majority being small- and mid-cap stocks. Among these, several high-liquidity stocks stood out, leading the market’s gains.

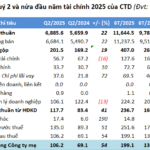

Coteccons Profits Soar to $85 Million in H1 of 2025 Fiscal Year

The first half of the 2025 financial year (July 1st to December 31st, 2024) saw the Construction Joint Stock Company Coteccons (HOSE: CTD) achieve impressive financial results. The company recorded a net profit of nearly VND 200 billion, a remarkable 47% increase compared to the same period last year, and successfully fulfilled 46% of its annual plan. Additionally, new contract wins amounted to VND 16.8 trillion, showcasing the company’s strong performance and promising future prospects.

Delivering The Privia, KDH Achieves 2024 Profit Goals

Thanks to a surge in Q4 results, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) reported a 13% increase in consolidated net profit for 2024.