The first trading session of the Year of the Snake (3/2) ended with the interbank exchange rate closing at 25,300 VND/USD, a significant increase of 200 VND from the previous session on 24/1. Meanwhile, interbank lending rates for VND rose by 0.04 – 0.13 percentage points compared to the pre-Tet session (24/1) for most tenors of one month and below.

STATE BANK INJECTS 11,052 BILLION DONG ON FIRST TRADING DAY OF THE YEAR

On 3/2, the State Bank offered a bid of 15,000 billion VND each for 7-day and 14-day terms at an interest rate of 4% on the collateral channel. Six members won the bid for the 7-day term with a value of 15,000 billion VND, while another six members won the bid for the 14-day term, valued at 13,902 billion VND.

The State Bank also offered a 7-day term bill, with an interest rate of 4%. Three members won the bid, with a value of 1,400 billion VND.

On the same day, 20,000 billion VND in collateral matured, along with 3,550 billion VND in bills. This resulted in a net injection of 11,052 billion VND by the State Bank through the open market operations on the first trading day of the new year.

On 3/2, the average interbank lending rates for VND increased by 0.04 – 0.13 percentage points for most tenors of one month and below, except for the one-month tenor, which decreased by 0.04 percentage points. Specifically: overnight 4.86%; one-week 4.98%; two-week 5.06%; and one-month 5.06%.

The average interbank lending rates for USD on 3/2 increased by 0.02 percentage points (compared to 24/1) for the overnight tenor, while decreasing by 0.03 – 0.04 percentage points for the other tenors. Transactions were made at the following rates: overnight 4.4%; one-week 4.44%; two-week 4.51%; and one-month 4.56%.

At the end of the 3/2 session, the yield on government bonds in the secondary market remained unchanged for the three-year tenor but increased for longer tenors, closing at: 3-year 2.1%; 5-year 2.34%; 7-year 2.57%; 10-year 3.02%; and 15-year 3.2%.

EXCHANGE RATE “HINTS” AT OUTSIDE FACTORS

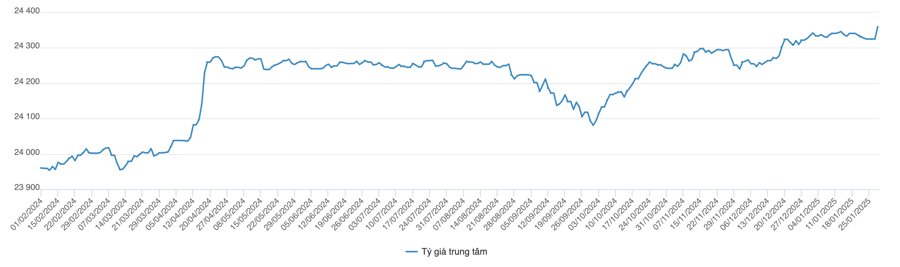

On 4/2, the State Bank adjusted the mid-rate by 35 VND compared to 3/2, setting it at 24,360 VND/USD – the highest level in the past year (since 1/1/2024). With a +/-5% margin, today’s ceiling rate is 25,578 VND/USD, and the floor rate is 23,142 VND/USD. The reference rate at the State Bank’s Trading Center remains unchanged at 23,400 – 25,450 VND/USD (buy-sell).

As of 9:30 am on 4/2, Vietcombank listed the USD exchange rate at 25,120 – 25,480 VND/USD (buy-sell), an increase of 180 VND in both buying and selling rates compared to the previous session’s close. Similarly, BIDV also raised its USD exchange rate by 175 VND in both buying and selling rates, reaching 25,085 – 25,445 VND/USD (buy-sell).

The USD/VND exchange rate is facing pressure from the strengthening of the USD in the global market due to escalating trade tensions between the US and its neighboring countries.

On the evening of 3/2 (Vietnam time), US President Donald Trump announced a temporary hold on trade tariffs on goods from Canada and Mexico for 30 days, following negotiations that yielded a commitment to tighten border controls. The Canadian dollar strengthened after hitting a two-decade low due to trade tensions with the US. With the negotiations helping to ease tensions, experts predict that the USD/VND exchange rate will stabilize around 25,200 – 25,300 today, awaiting further market reactions when China reopens after the Lunar New Year holiday tomorrow (5/2 Vietnam time).

The additional US tariffs on Chinese goods took effect this morning (4/2), as the leaders of the world’s two largest economies are expected to communicate by the end of this week. The European Union, consisting of 27 members, and China are the next targets of the US government in addressing trade deficit issues.

Speaking last night (Vietnam time), two members of the US Federal Reserve (FED) in Boston and Atlanta stated that the Trump administration’s trade tariff plans carry inflation risks, and they see no need for an early additional rate cut.

According to data from CME FED Watch, the market has lowered expectations, with less than a 50% chance of the FED cutting rates twice this year, and the earliest cut expected in July 2025.

“Standard Chartered: Robust USD and Vietnam’s Economic Growth Trajectory Towards 6.7% in 2025”

In its latest economic update on Vietnam, released on December 12, 2024, Standard Chartered Bank forecasts a strong USD in 2025, with a weakening bias in the early part of the year. The bank predicts a 6.7% GDP growth for Vietnam in 2025, with a 7.5% year-on-year expansion in the first half and a 6.1% growth in the latter half.

The Greenback Recovers Gracefully

After a sharp decline, the US dollar rebounded slightly in the international market last week (December 2-6, 2024), as robust US jobs data indicated a strong recovery in the labor market.