Global gold prices have surged to a new record, firmly holding above the $2,500/oz mark as investors’ risk aversion sentiment persists amid uncertainties surrounding President Donald Trump’s tariff plans. The U.S. dollar’s reversal and decline have further bolstered the value of the precious metal.

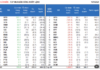

As of nearly 10 a.m. today (Feb 4), spot gold prices in the Asian market rose by $1.7/oz compared to the previous session’s close in New York, equivalent to a 0.06% increase, trading at $2,817.9/oz, according to Kitco exchange data. Converted at Vietcombank’s selling rate, this price is equivalent to VND 86.4 million/lotte, up VND 1.6 million/lotte from yesterday morning.

On Feb 3, in New York, spot gold prices climbed $15/oz, or 0.53%, to close at $2,816.2/oz. During the session, spot gold prices touched a historic peak of $2,830.5/oz.

In a surprising move, President Trump delayed tariffs on Mexican and Canadian goods just hours before they were set to take effect, averting a devastating trade war in North America. The one-month postponement of tariffs on the U.S.’s two largest trading partners followed bilateral calls between Trump and Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau. The decision marked a reversal from Trump’s earlier move to impose 25% tariffs on Mexican and Canadian goods and 10% on Chinese products, which had rattled allies and investors.

While tariffs on Canada and Mexico are on hold, Trump maintains his plans to impose tariffs on Chinese goods. David Meger, director of metals trading at High Ridge Futures, noted that the uncertainties surrounding Trump’s tariff plans are driving safe-haven demand for gold. As Trump’s decisions are highly unpredictable, the tariff delay does not necessarily ease these uncertainties.

Bart Melek, head of commodity strategy at TD Securities, added that the market has yet to fully price in the potential for a prolonged trade war. “We have not seen a full reaction from the gold market to this risk, and if the trade conflict persists for a significant period, gold prices are poised to climb higher,” Melek stated.

A JPMorgan Chase report suggested that stock market pressures could lead to short-term gold price declines as investors may liquidate gold positions to cover stock losses. However, the report anticipated that tariffs would benefit gold prices in the medium term.

Analysts believe that tariffs could spark a global trade war, hindering economic growth across the board and driving up inflation, creating an ideal environment for gold to flourish.

According to Reuters, gold-trading banks are shifting gold from Asian hubs like Dubai and Hong Kong to the U.S. to capitalize on the significant price differential between U.S. gold futures and spot gold. On Feb 3, gold futures on the COMEX exchange in the U.S. rose 0.8% to settle at $2,857.1/oz.

This week, in addition to tariff news, investors are closely monitoring the U.S. jobs report due Friday, a crucial indicator of the economy’s health.

Gold Slides After Powell Says No Rush to Cut Rates

The Fed’s meeting spurred a rise in Treasury yields and the dollar, exerting downward pressure on precious metals.

The Golden Opportunity: “Gold Prices Surge as Risk-Averse Investors Seek Safe Haven”

The mounting uncertainty surrounding President Donald Trump’s tariff plans continues to fuel demand for gold as a safe-haven asset.