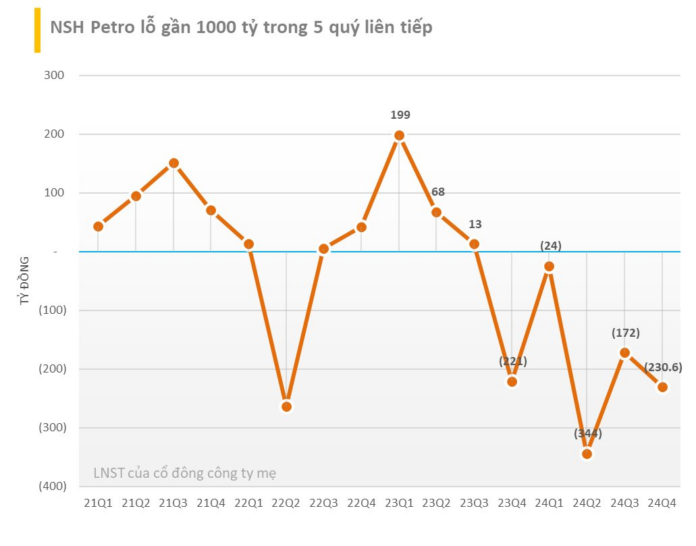

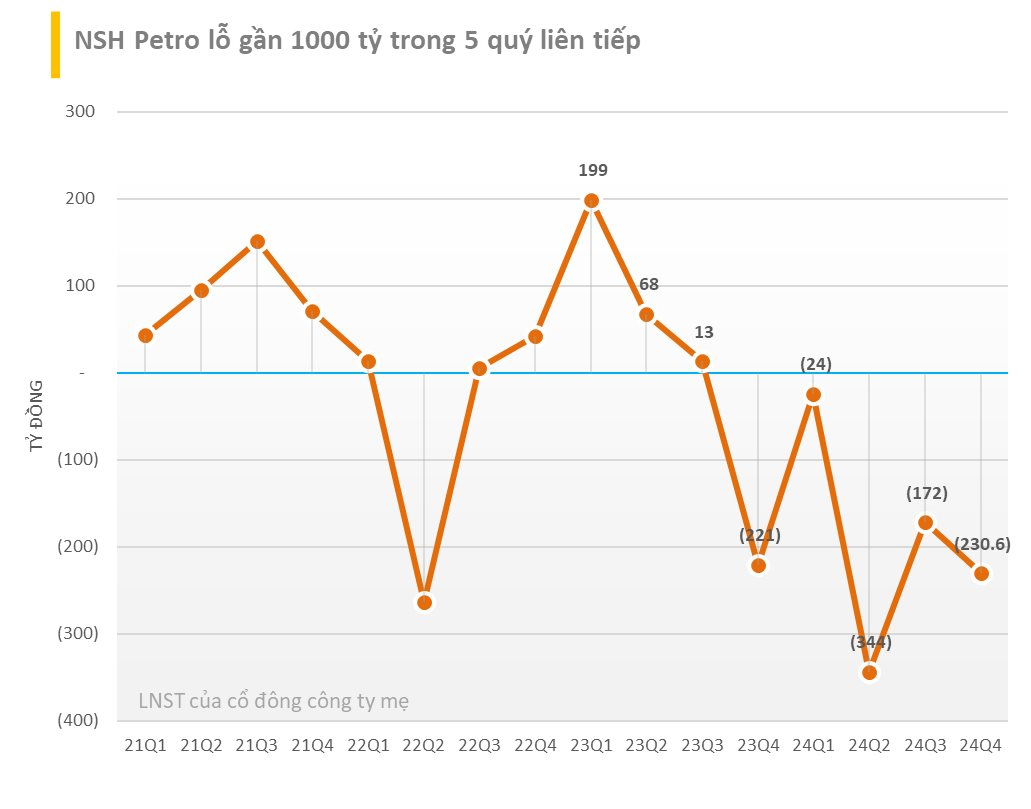

NSH Petro Reports Loss for 5th Consecutive Quarter

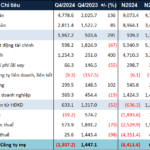

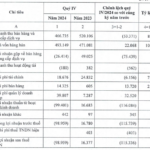

Petro Commercial Investment Joint Stock Company (NSH Petro – code PSH) has just announced its consolidated financial statements for Q4 2024 with net revenue reaching nearly VND 60 billion, down 92% over the same period in 2023. Due to higher cost of goods sold than revenue, NSH Petro reported a gross loss of VND 13 billion, while in the same period last year, it made a gross profit of VND 35 billion.

After deducting expenses, NSH Petro reported a net loss of nearly VND 234 billion, marking the fifth consecutive quarter of losses for the company.

For the full year 2024, NSH Petro recorded net revenue of over VND 678 billion, down 89% from 2023. The company reported a net loss of nearly VND 790 billion in 2024, while it made a profit of VND 47 billion in the previous year.

With five consecutive quarters of losses, NSH Petro’s accumulated loss as of the end of 2024 exceeded VND 513 billion.

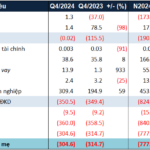

As of December 31, 2024, NSH Petro’s total assets stood at VND 10,504 billion, a decrease of VND 489 billion from the beginning of the year. Notably, the majority of NSH Petro’s assets are funded by debt. Total liabilities at the end of the year exceeded VND 9,700 billion, 12 times the equity. Of this, financial loan debt alone amounted to nearly VND 6,900 billion, an increase of VND 801 billion from the beginning of the year and accounting for about 65% of total capital sources.

Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) – Branch 2 is NSH Petro’s largest creditor, with outstanding loans of nearly VND 4,270 billion. The Vietnam Bank for Agriculture and Rural Development (Agribank) – Saigon Branch provided loans of over VND 1,502 billion. Agribank – Soc Trang Branch lent VND 200 million. Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) – Tien Giang Branch provided a loan of VND 50 million.

Hau Giang Urban and Agricultural Development Investment Joint Stock Company lent VND 74 million. Personal loan of VND 30 million. Bond debt of over VND 758.5 million.

Still owes taxes of more than VND 1,000 billion

NSH Petro is known as one of the largest gasoline distributors in the Mekong Delta region of Vietnam. The company was established on February 14, 2012, and is headquartered in Hau Giang province, with Mr. Mai Van Huy as its Chairman.

According to its website, the company currently owns 67 retail outlets and has 550 agents in the Mekong Delta region. In addition, the company also has a system of 9 warehouses and ports with a total capacity of more than 500,000 cubic meters.

According to its disclosure of information, in its explanation of the measures and roadmap to remedy the situation of its warned securities in Q3 2024 on November 4, 2024, NSH Petro stated that the roadmap to remedy the debt situation as of December 31, 2023, included VND 1,140 billion, which was enforced by the Hau Giang Tax Department, and nearly VND 93 billion, which was enforced by the Can Tho Tax Department, with a resolution deadline of December 2024.

However, according to the list of taxpayers who owe taxes and other budgetary amounts of the Hau Giang Tax Department, as of December 31, 2024, NSH Petro’s tax debt amounted to more than VND 1,191 billion. Its Chairman, Mr. Mai Van Huy, and CEO, Mr. Ranjit Prithviraj Thambyrajah, have also been temporarily banned from exiting Vietnam.

On December 24, 2024, the Can Tho Tax Department issued Decision 2408/QD-CTCTH on the enforcement of administrative decisions on tax management by suspending the use of invoices for the company’s branch in Can Tho, as the branch had tax debts of nearly VND 104.7 billion that were overdue by more than 90 days from the due date.

PSH shares are currently restricted from trading due to the company’s late submission of its reviewed financial statements for the first six months of 2024. As of February 3, PSH shares closed at VND 2,770 per share, a decrease of more than 60% within a year.

The Unforeseen Loss: Novaland’s Unexpected First-Year Report

Novaland (HOSE: NVL) ended 2024 with a net loss of over VND 6.4 trillion, marking the first time the real estate giant has reported a loss since its listing.

How Much Tax Arrears Will Result in a Departure Postponement?

The proposed threshold debt amount that would trigger a travel ban for individuals and legal representatives of businesses has sparked a flurry of diverse opinions. This controversial topic has led to a heated debate, with strong arguments being presented from all sides. As the discussion unfolds, the implementation of this policy is temporarily put on hold, allowing room for further consideration and refinement.