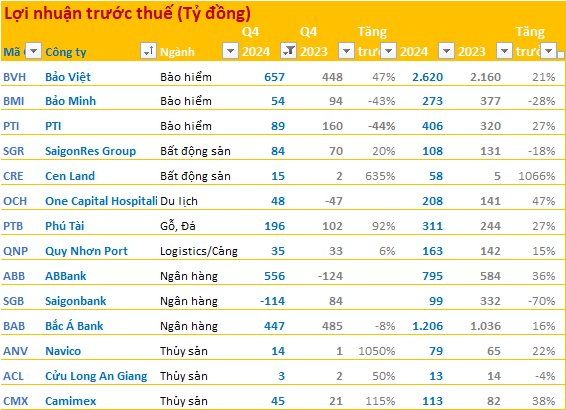

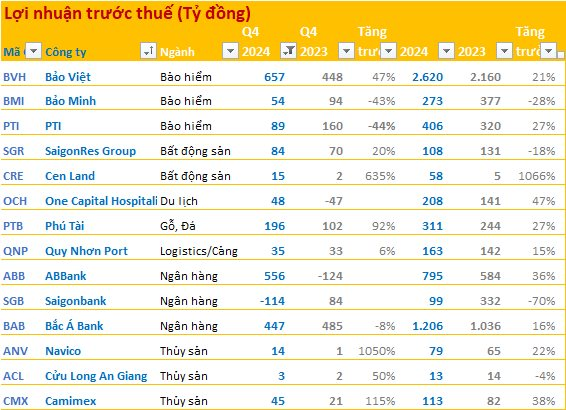

The latest financial reports for Q4 2024 were released on February 4, 2025, by several notable Vietnamese companies, providing insights into their performance and financial health.

Bao Viet Holdings (BVH): The group reported a 47% increase in profit, reaching VND 657 billion in Q4 2024. For the full year 2024, their pre-tax profit rose by 21% to VND 2,620 billion.

Cen Land (CRE): The company’s pre-tax profit for Q4 2024 was nearly VND 15 billion, a remarkable sevenfold increase compared to the same period last year.

ABBANK (ABB): The bank’s pre-tax profit for Q4 2024 increased by 58% year-on-year to VND 809 billion. As of December 31, 2024, ABBANK’s total assets reached VND 176,628 billion, a 9% increase from 2023.

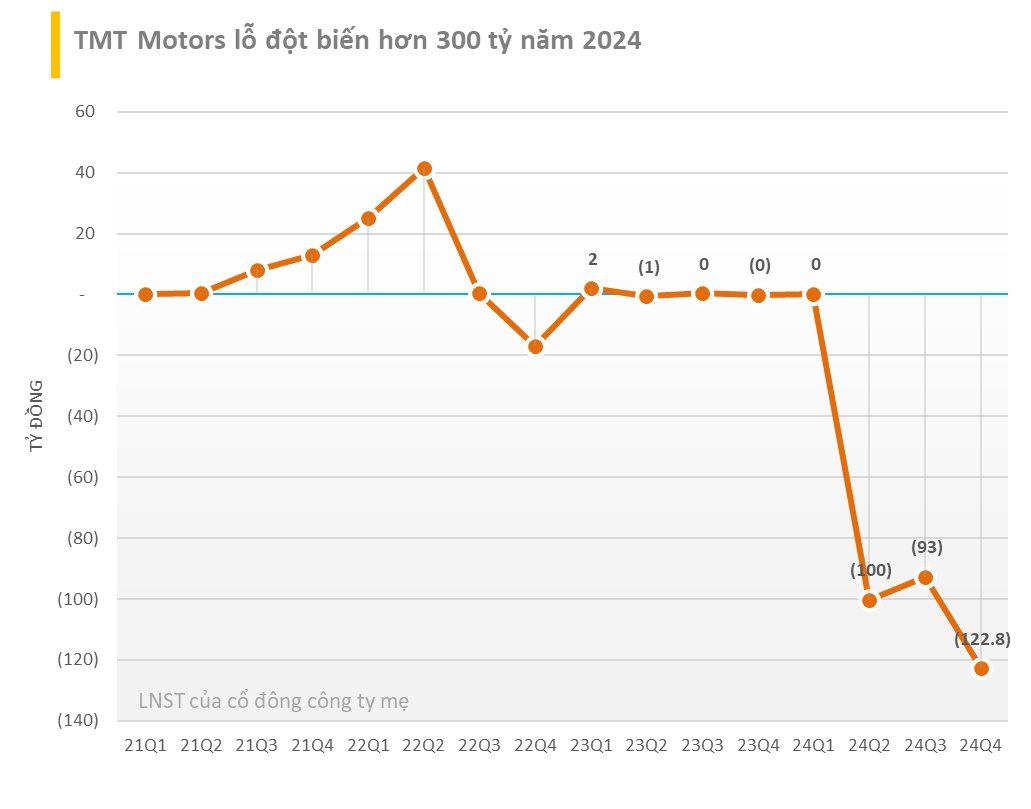

TMT Motors (TMT): TMT Motors’ Q4 2024 financial report showed flat revenue of VND 649.2 billion compared to the previous year. However, the company reported a post-tax loss of VND 120.8 billion, in contrast to a profit of VND 26.6 billion in Q4 2023, marking their third consecutive quarterly loss.

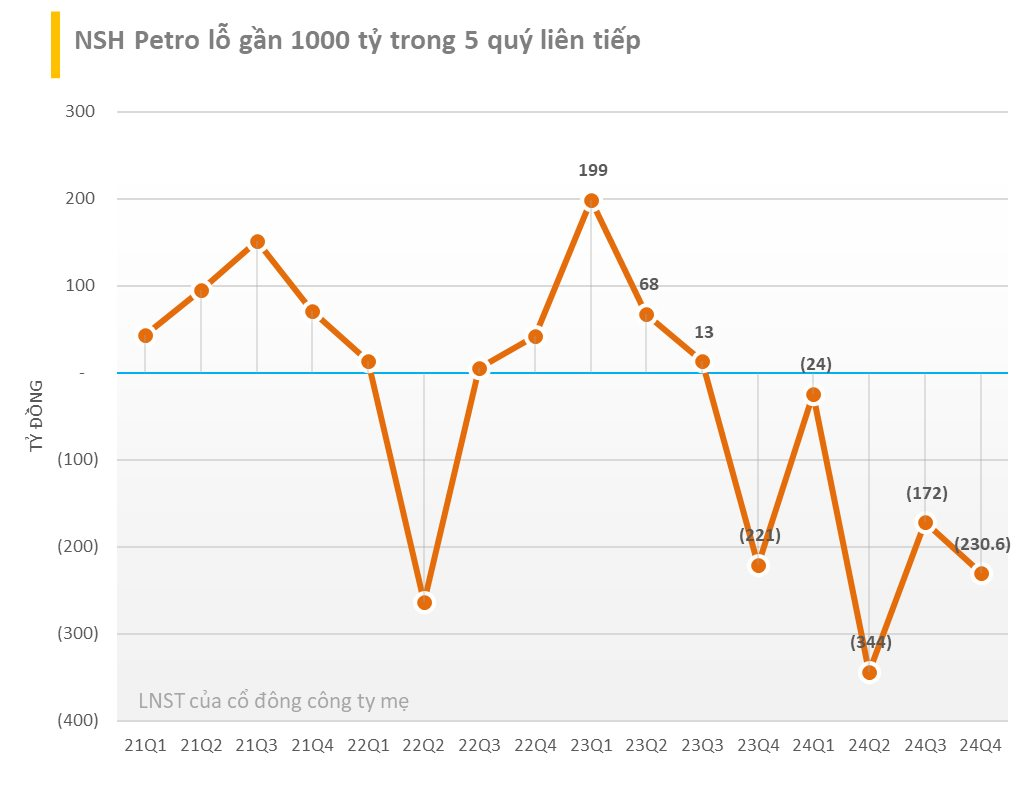

NSH Petro (PSH): The company incurred a significant loss of over VND 233 billion in Q4 2024, with a full-year 2024 loss of VND 790 billion.

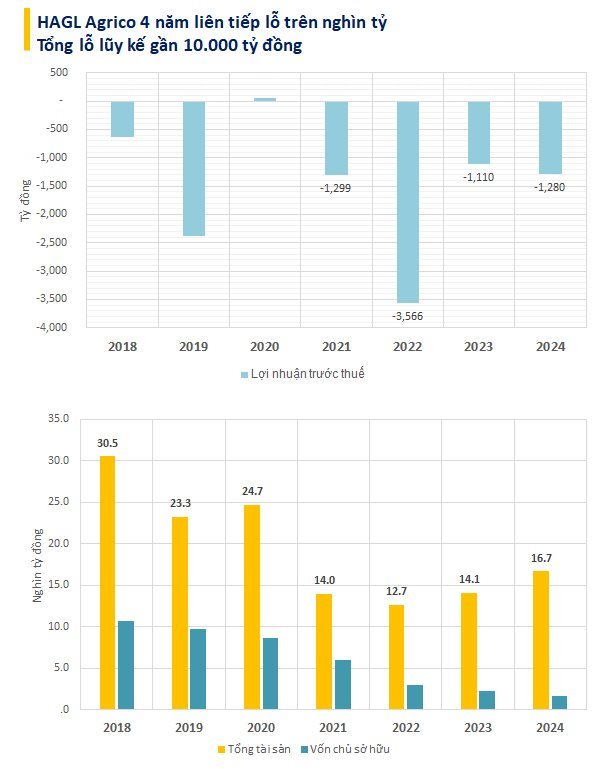

HAGL Agrico (HNG): HNG’s Q4 2024 financial report showed an 11% increase in revenue to VND 204 billion, mainly from rubber and fruit sales. However, the company reported a net loss of nearly VND 731 billion in Q4 2024, compared to a loss of over VND 652 billion in Q4 2023.

Thuduc House (TDH), Danh Khoi (NRC), First Real (FIR), and Vinahud (VHD): These real estate companies reported significant losses in Q4 2024.

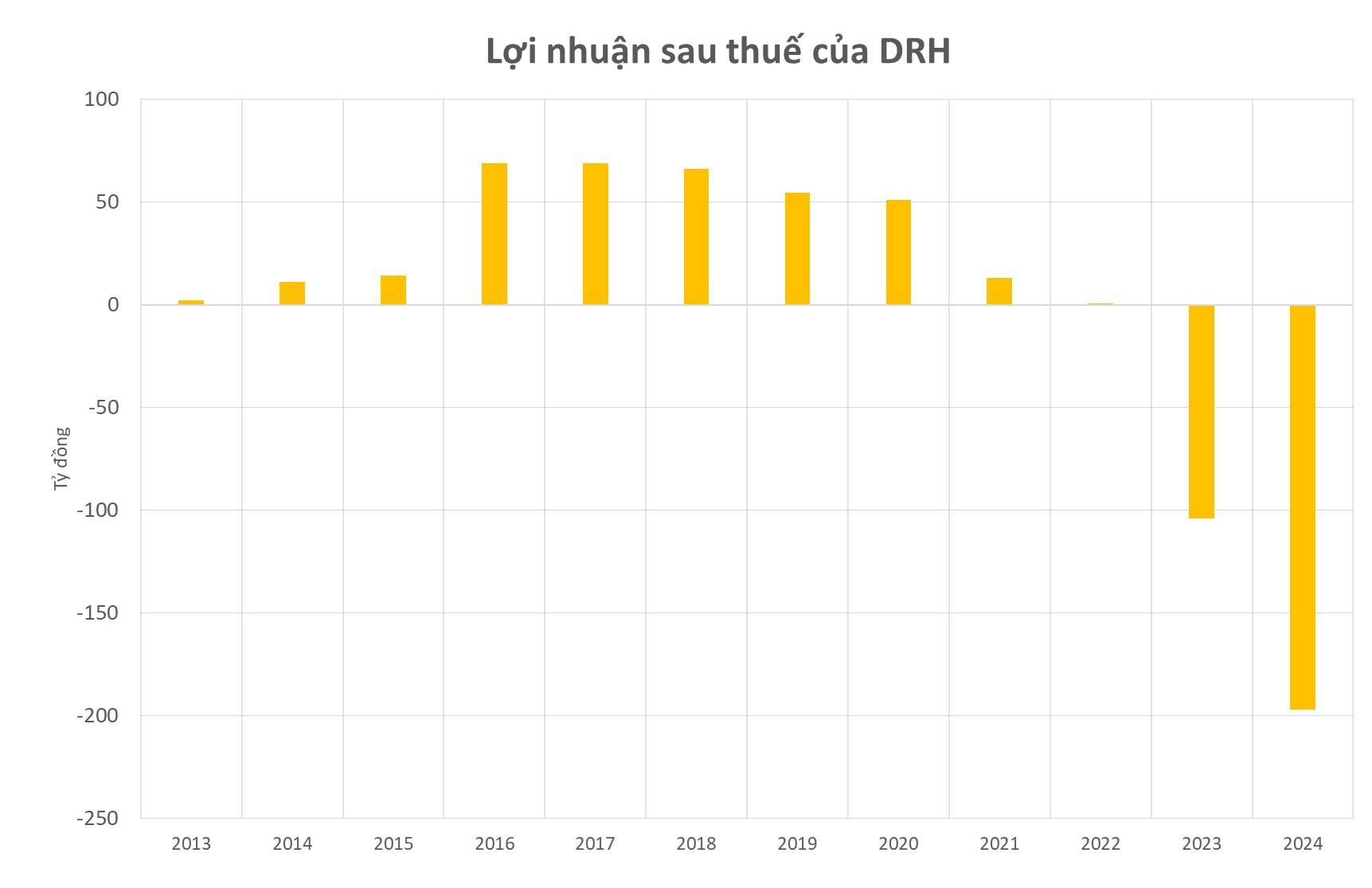

DRH Holdings (DRH): DRH’s Q4 2024 financial report showed a sharp decline in revenue to just over VND 500 million, half of the previous year’s figure. High financial expenses and losses from investment and securities transactions led to a post-tax loss of nearly VND 118 billion in Q4 2024, compared to a loss of VND 38 billion in the same period last year.

CTS Approves Limit Loan of 800 Billion VND

On November 25th, the Board of Directors of Vietnam Industrial and Commercial Bank Securities Joint Stock Company (HOSE: CTS) approved a resolution to sign a loan agreement for a limit of VND 800 billion at ABBank Hanoi Branch.