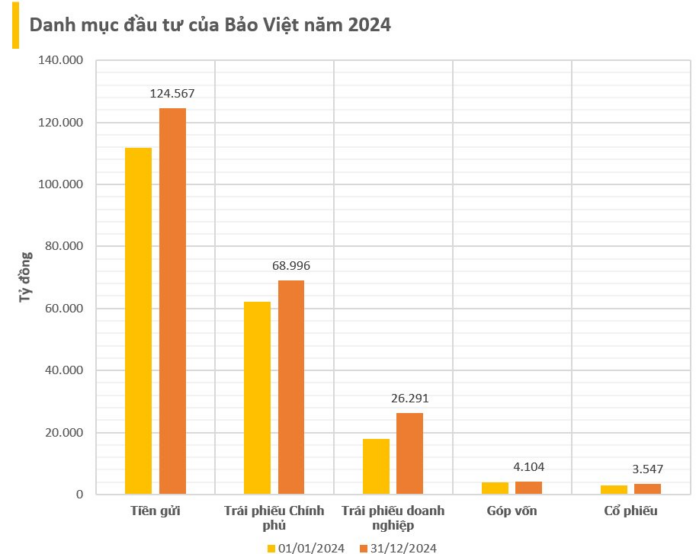

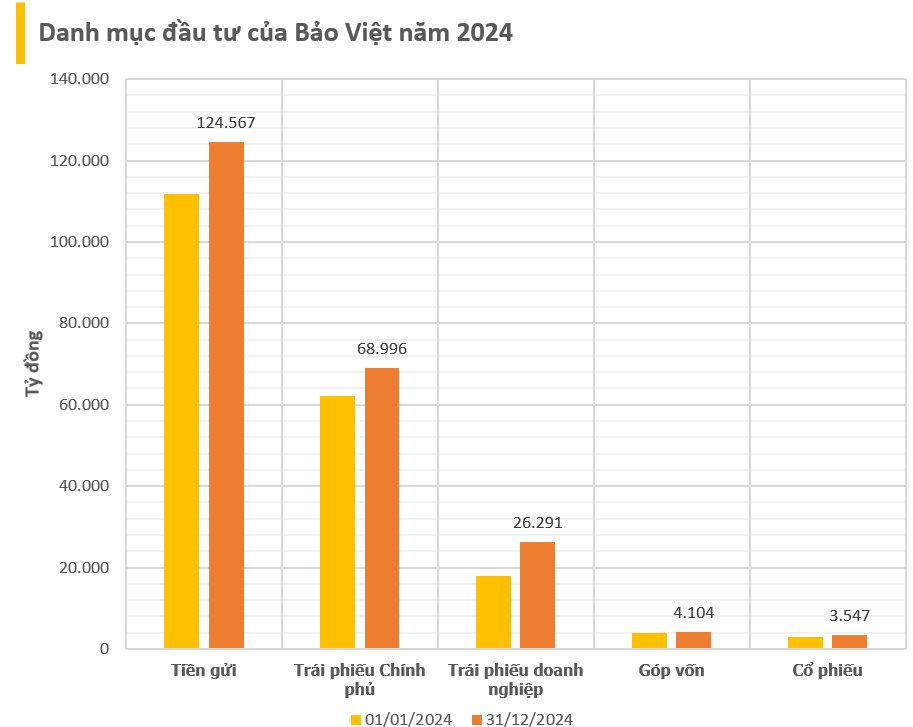

According to the financial statements for Q4 2024, the Bao Viet Group (stock code: BVH) had 231,546 billion VND (approximately 9.8 billion USD) in investments. Of this, over 4,100 billion VND was invested in joint ventures and associated companies, with deferred prepayments totaling 4,129 billion VND.

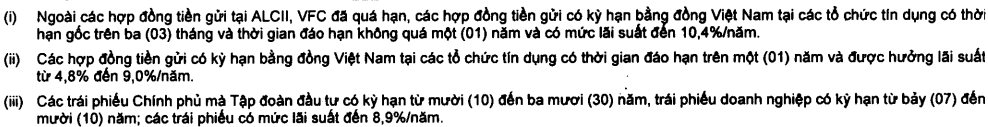

The remaining funds were deposited in banks, invested in bonds, or channeled into securities. As of December 31, 2024, Bao Viet had over 124,567 billion VND (nearly 54% of its portfolio) in bank deposits, an increase of nearly 12,800 billion VND from the beginning of the year. While this is a low-yield investment strategy, it is also the safest option, offering consistent returns with minimal risk. The highest interest rate secured by Bao Viet was 10.4%/year for short-term deposits, with rates ranging from 4.8% to 9%/year for long-term deposits.

The group also invested nearly 1 billion USD in corporate bonds, with interest rates starting at 8.9%/year. This demonstrates a conservative and secure investment approach.

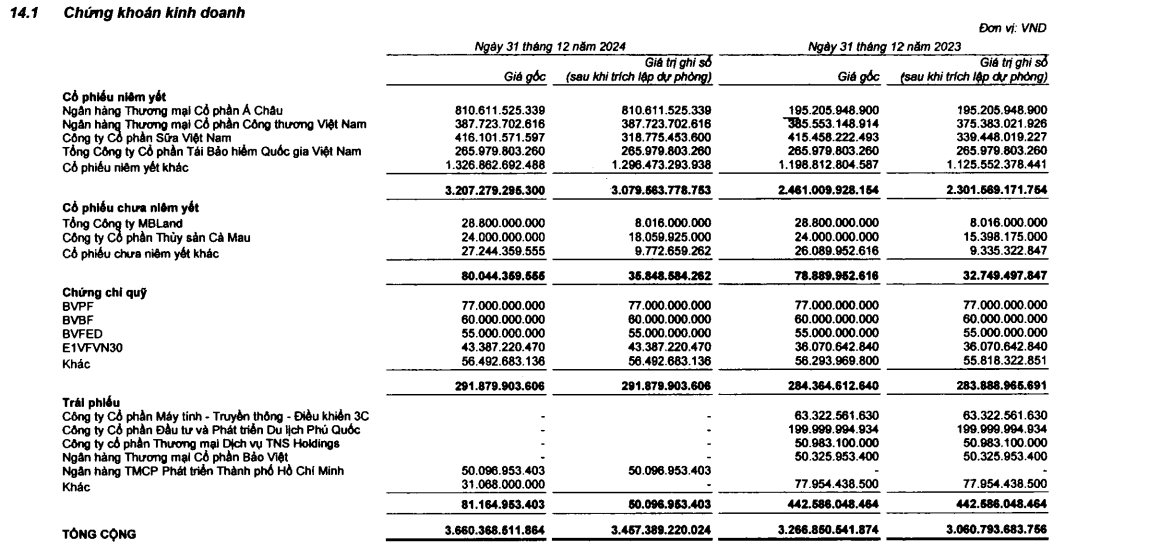

Bao Viet has also been actively investing in stocks and fund certificates on the Vietnamese stock market, with a portfolio that includes blue-chip companies like ACB, VNM, and VCB. However, the original investment value of 3,207 billion VND has slightly decreased, with a current market value of 3,079 billion VND. As a result, the company has had to make provisions of over 200 billion VND for this securities investment, indicating potential temporary losses in this area.

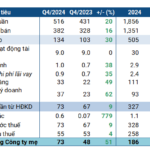

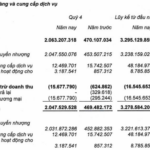

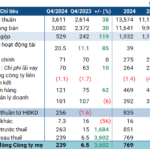

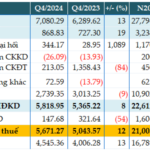

In terms of business performance, Bao Viet reported impressive results for Q4 2024, with total revenue reaching 56,899 billion VND. This included 43,525 billion VND from insurance activities, 12,865 billion VND from financial activities, 655 billion VND from other activities, and 34 billion VND from miscellaneous sources. After expenses, the group posted a post-tax profit of over 539 billion VND for the quarter, reflecting a 24.8% increase year-on-year.

For the full year 2024, Bao Viet recorded a net profit of over 2,157 billion VND, a 16% increase compared to 2023. The company attributed this improvement to a recovery in insurance business operations compared to the previous year. This was achieved through a significant reduction in gross losses from insurance activities, which decreased from 1,558 billion VND to nearly 981 billion VND. Additionally, profits from financial activities remained stable at 10,600 billion VND, on par with the previous year.

Delivering The Privia, KDH Achieves 2024 Profit Goals

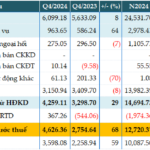

Thanks to a surge in Q4 results, Khang Dien House Trading and Investment Joint Stock Company (HOSE: KDH) reported a 13% increase in consolidated net profit for 2024.

Sacombank Achieves Record-Breaking Profits, Surpassing Targets by 20%

Sacombank (HOSE: STB) has announced impressive results, with a 33% year-on-year increase in pre-tax profits, totaling over VND 12,720 billion. This remarkable achievement marks a record-high for the bank, surpassing its annual target by 20%.