Large-cap stocks, notably FPT and bank stocks, had a significant impact on the indices today. However, there were many green spots in the sea of red. Moreover, cash flow provided effective support for many stocks, suggesting that internal strength could make a difference in the coming sessions.

During the two-week break for the Lunar New Year holiday, global markets were quite turbulent, with two main events being the shock to tech stocks and the “opening shot” of a new round of trade tensions. With US inflation remaining high and the expected impact of new tariffs, the chance of a Fed rate cut in 2025 is quite faint.

Nevertheless, Vietnam has not yet been drawn into the trade conflict vortex, and some countries facing higher tariffs could even provide an advantage for Vietnam’s exports. Today’s stock market reaction, with some stocks being dumped, does not represent the trend for the future but rather a form of “compensatory” reaction to the volatility during the two-week trading halt.

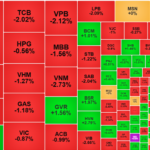

During the holiday break, the flow of information about fourth-quarter 2024 financial results also paused. The focus will be on these reports in the coming days. For stocks with good profit prospects, internal factors will soon be of interest. In fact, bottom-fishing cash flow started to operate today, providing some support, even if it just pulled prices up within the red zone. With the whole market under selling pressure, observing the cash flow support will be more advantageous. Today’s matching liquidity on the HSX and HNX increased by 16% compared to the previous session, reaching approximately VND 13.5 trillion. FPT’s large trading volume contributed mainly to this increase. If we exclude FPT’s transactions, today’s volume increased by about 5% to more than VND 11.6 trillion. The selling pressure was mainly in the VN30 blue-chip stocks, with 15 out of the 20 most liquid stocks in the market belonging to this group. Therefore, observing the cash flow into blue chips and the opposite price reaction in small-cap stocks will make it easier to assess the market. Today, mid- and small-cap stocks showed significantly better strength.

Currently, external information is still “dominating,” so external influences will continue to prevail. If the market starts to show more differentiation, buying opportunities will emerge early for stocks with good earnings results. The US stock market last year was not “in phase” with Vietnam, and the same is true now.

There was strong net selling by foreign investors in the derivatives market today. This is also consistent with the heavy selling pressure in the VN30 basket. This is also a form of hedging because when a large number of underlying stocks are dumped, the underlying index will surely fall, and short derivatives can offset the price slide in stocks when selling.

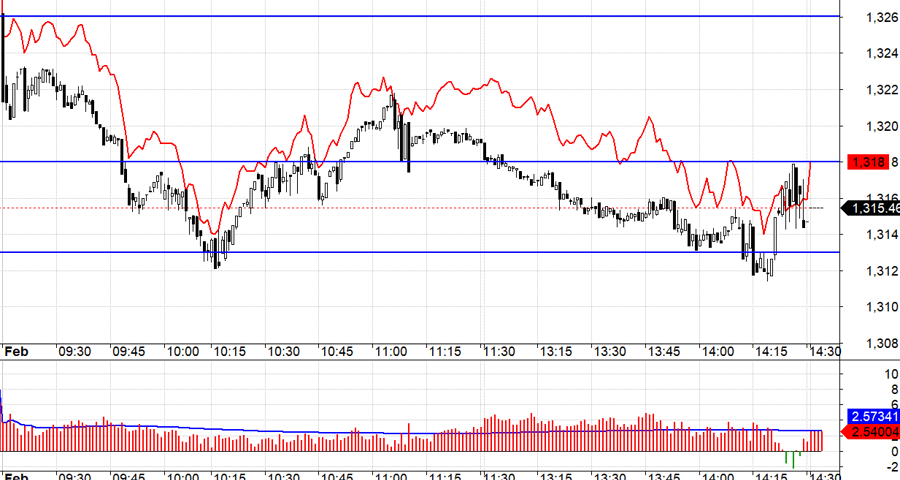

The basis of F1 has narrowed significantly throughout the session but has maintained a positive spread. The pressure on the VN30 is still very high, especially as bank stocks have joined the group of decliners, along with FPT and some other pillars. However, if the phenomenon of differentiation appears, the basis is likely to widen again. The strategy should be to wait for a long position.

VN30 closed today at 1315.46. Tomorrow’s nearest resistance levels are 1318, 1326, 1331, 1338, and 1348. Supports are at 1313, 1307, 1301, 1297, 1292, 1286, and 1279.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views and investment advice expressed are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment opinions and recommendations presented in this blog.

The Foreign Sell-Off: A $1.4 Billion Rout Sends Blue-Chip Stocks Tumbling

The VN-Index remained lackluster in the afternoon session, but many resilient stocks gained strength. The index was heavily impacted by the drag of large-cap stocks, with the VN30-Index plunging to a 16-session low as foreign selling pressure weighed down on these stocks. FPT took a significant hit, evaporating 5.15% in value.

The Red-Hot Market: FPT in the Eye of the Storm, Foreign Outflows Galore

The investor community reacted rather negatively on the first trading session of the Year of the Wood Snake, as Vietnamese markets reopened after a two-week Lunar New Year holiday amidst a volatile international backdrop. The tech-heavy NASDAQ composite index fell sharply, and this was reflected in the performance of FPT Corporation, which faced the brunt of the selling pressure. The stock tumbled as global tech stocks experienced a broad-based decline, with the impact of this trend finally catching up to the Vietnamese market.

The Market Beat – 02/01: VN-Index Starts the Year on a Positive Note Despite Lackluster Liquidity

The market witnessed a rebound in the afternoon session, with the VN-Index recovering from 1,264 to 1,269.71. Meanwhile, the HNX-Index also gained 0.26 points to reach 227.69, while the UPCoM-Index dipped slightly by 0.01 points to 95.05. Overall, the liquidity of the three exchanges was relatively low, slightly exceeding 12 trillion VND.

The Market Beat: Transport Sector Shines Amid Dull Liquidity

The market closed with the VN-Index up 2.83 points (0.23%) at 1,257.5, while the HNX-Index fell 0.47 points (-0.21%) to 227.07. The market breadth tilted towards gainers with 452 advancing stocks against 284 declining stocks. The VN30 basket saw a slight dominance of green with 14 gainers, 12 losers, and 4 stocks unchanged.